E-15

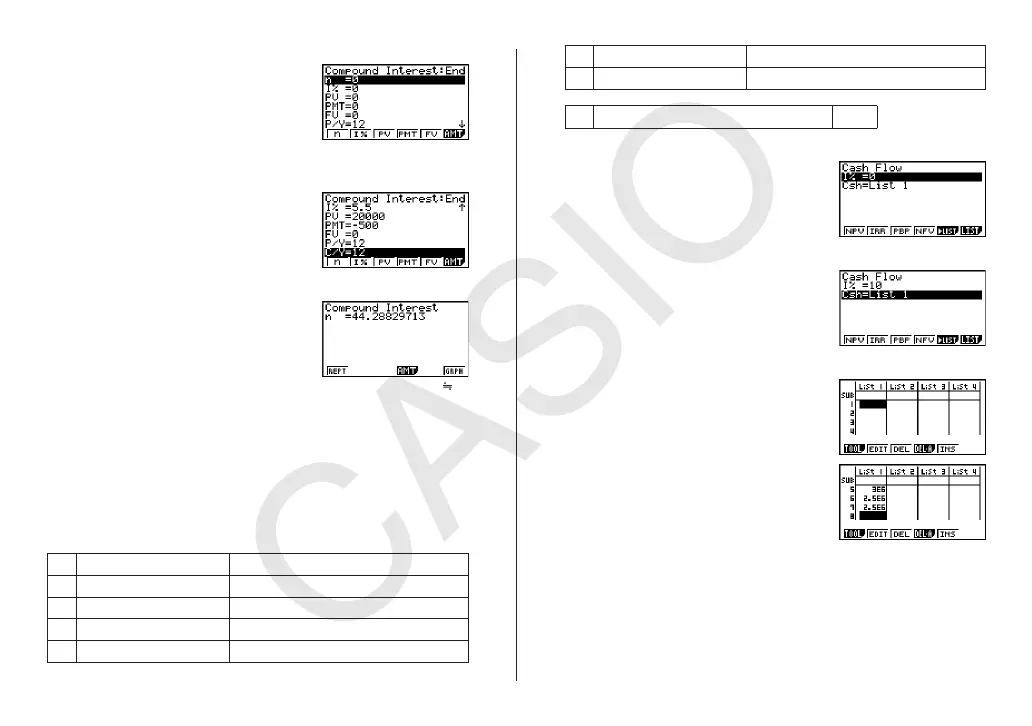

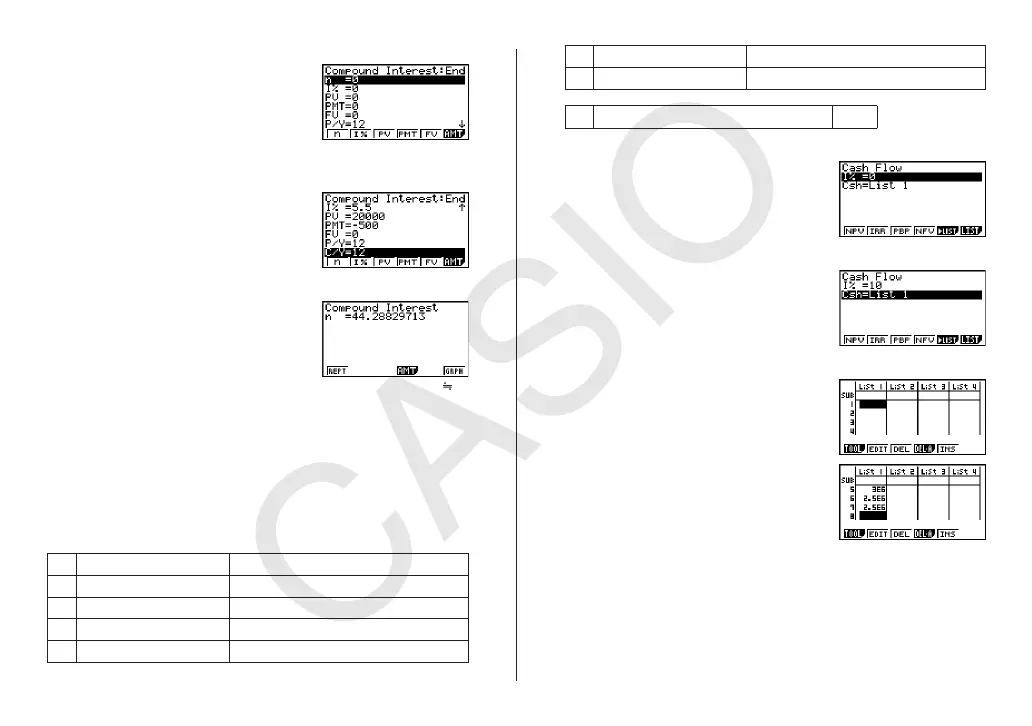

Select Compound Interest.

K((TVM)

(CMPD)

Configure settings for the various conditions.

I% = 5.5, PV = 20,000, PMT = –500, FV =0,P/Y = 12, C/Y =12

ADDUA????U

D??U?U@AU

@AU

Determine the number of payments

n.

(

n)

Result:

n = 44.28829713 45

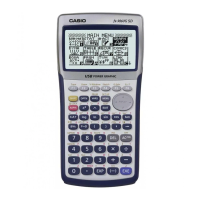

Example 2: Net Present Value (NPV) Method

By investing $10 million in a piece of machinery, a company expects

to earn annual profits as shown in the table below (all profit values

calculated at the end of each fiscal year).

If the machine has a useful life of six years, a trade-in value of $1

million, and expected capital costs of 10%, how much is the net

present value (the total profit or loss of this investment)?

Cash Data

x1 – $10,000,000 Initial investment (One machine, $10 million)

x2 – $1,000,000

x3 $5,000,000

x4 $4,500,000

x5 $3,000,000

x6 $2,500,000

x7 $1,500,000 + $1,000,000 To add trade-in value of machine.

I%

Investment cost (annual interest) 10%

Select Cash Flow.

K((TVM)

(CASH)

Configure settings for the various conditions.

@?U

Input the condition values into List 1.

(LIST)

@???????U

@??????U

D??????U

CD?????U

B??????U

AD?????U

@D?????

@??????U

Loading...

Loading...