90

Appendix

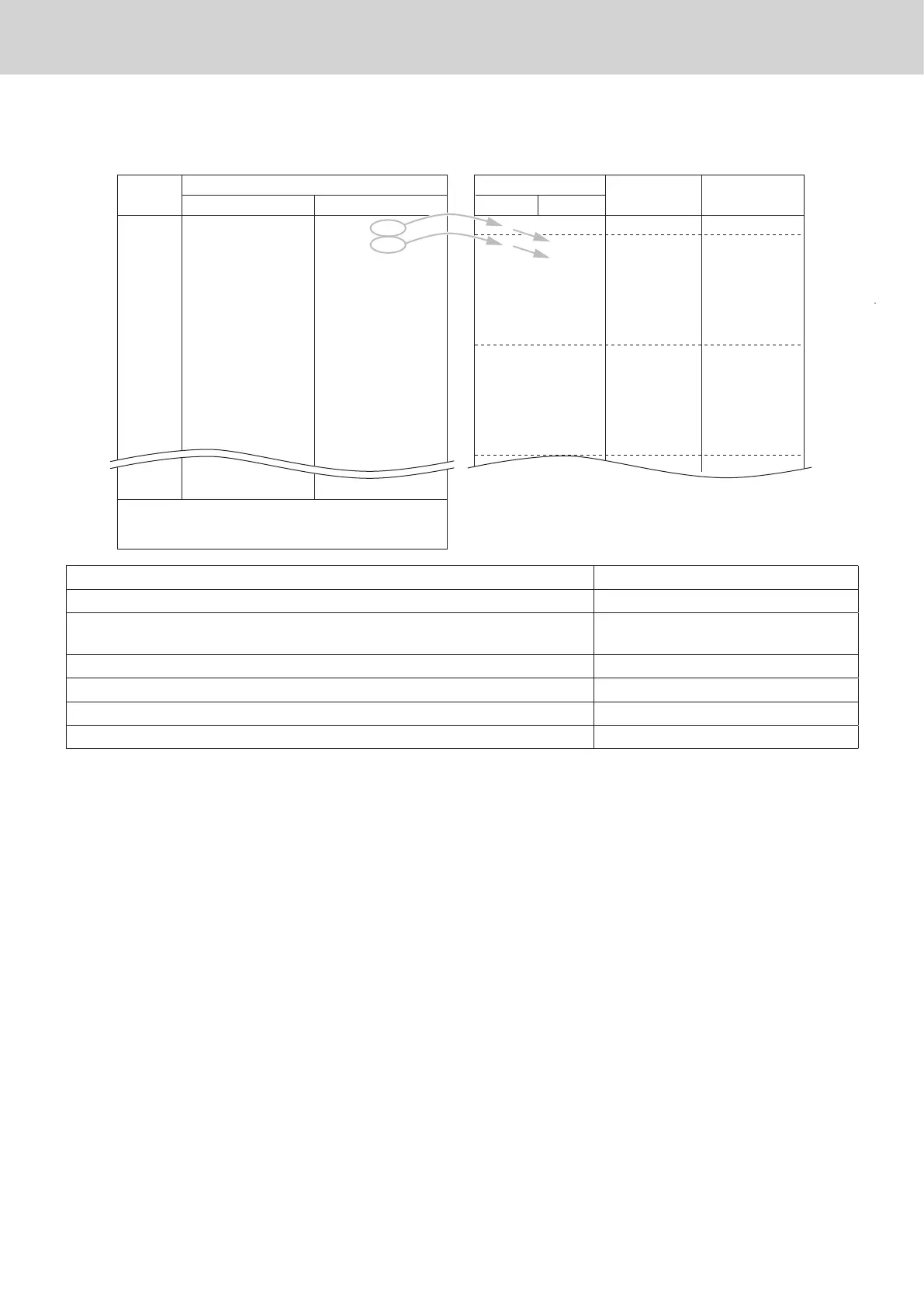

Example 3: With rate tax:

Preparation

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

=

=

=

=

=

=

=

=

=

=

=

=

=

=

=

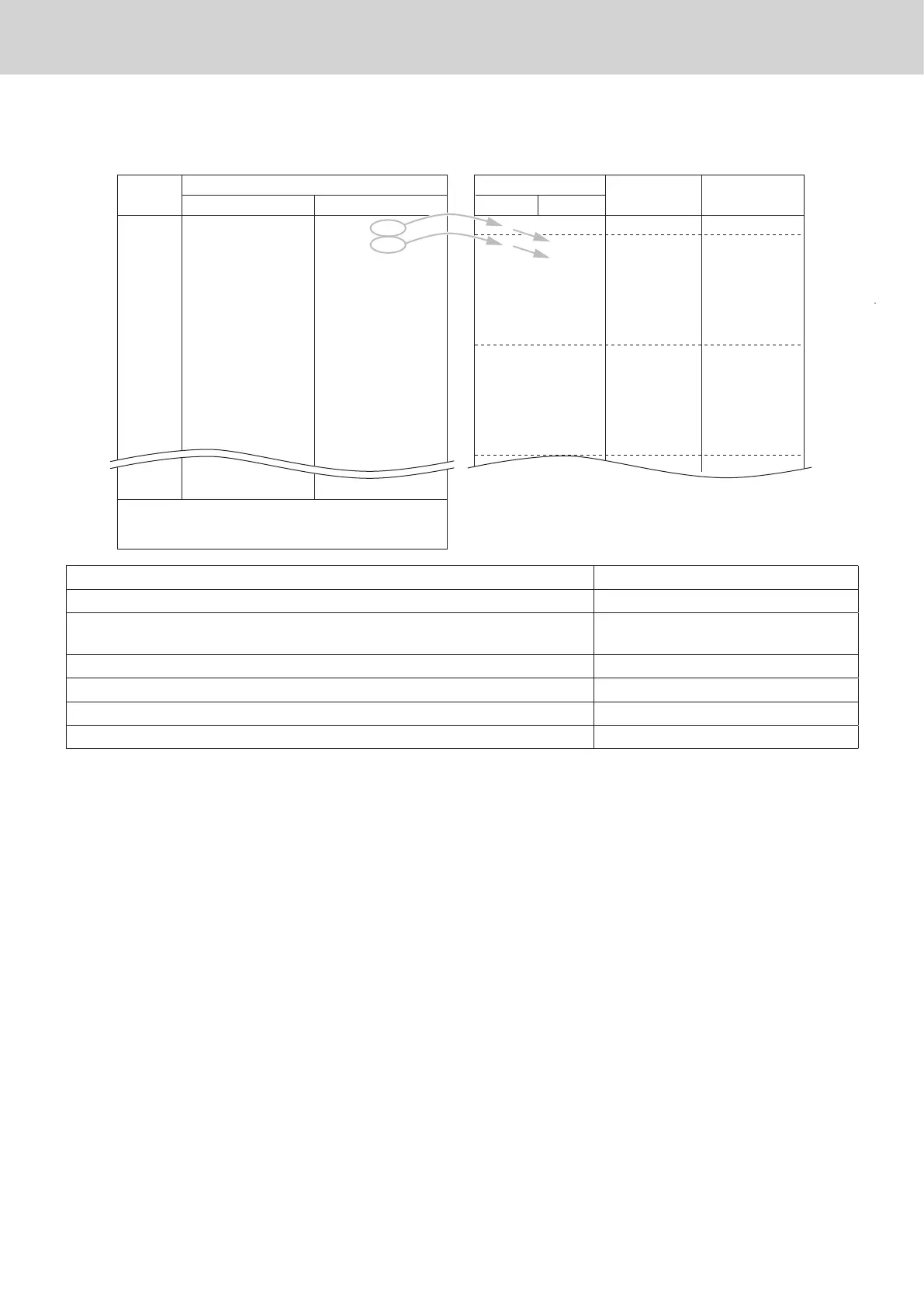

7

21

35

49

64

78

92

107

121

135

149

164

178

192

207

0

7

21

35

49

64

78

92

107

121

135

149

164

178

192

7

14

14

14

15

14

14

15

14

14

14

15

14

14

15

Max. break point

Upper

Difference

Pattern

Non-cyclic

Cyclic

Cyclic

Lower

$ .00

.01

.02

.03

.04

.05

.06

.07

.08

.09

.10

.11

.12

.13

.14

1.40

$ .01

.08

.22

.36

.50

.65

.79

.93

1.08

1.22

1.36

1.50

1.65

1.79

1.93

19.93

$ .07

.21

.35

.49

.64

.78

.92

1.07

1.21

1.35

1.49

1.64

1.78

1.92

2.07

20.07

TAX

(7%)

Price range

Min. break point Max. break point

On all sales above $20.07, compute the tax at

the rate of 7 %.

Tax rate (2-digit for integer + 4-digit for decimal) 7%

Maximum table amount 2007

Rounding system (A) and tax system of add-in or add-on (B) codes (see pages

60 and 61)

0002 (Cut off & table + rate)

Sum of a cyclic pattern 100 (14 + 14 + 14 + 15 + 14 + 14 + 15)

Number of values in each cyclic pattern 7

Sum of non-cyclic values 7

Actual value of difference of the non-cyclic and cyclic values 14, 14, 14, 15, 14, 14, 15

Loading...

Loading...