BONDVALUATION

ColinCSmith2010

10

*seegettingstarted

16. Valueofanannualpaymentbondwithasingleannualpayment

Acompanypurchasesbondson1Januaryofthis

year.Thenominal/face/couponvalueisR1,000and

theannualnominal/couponinterestrateis10%.The

bondisredeemableon31December6yearslater.

Themarketinterestrateforsimilarbondsis15%.

Assumethatthebondpaymentsaremadeannually

inarrears.Whatpricewouldthecompanypayfor

thebond?(i.e.whatshouldthevaluebeon1

Januaryofthisyear?

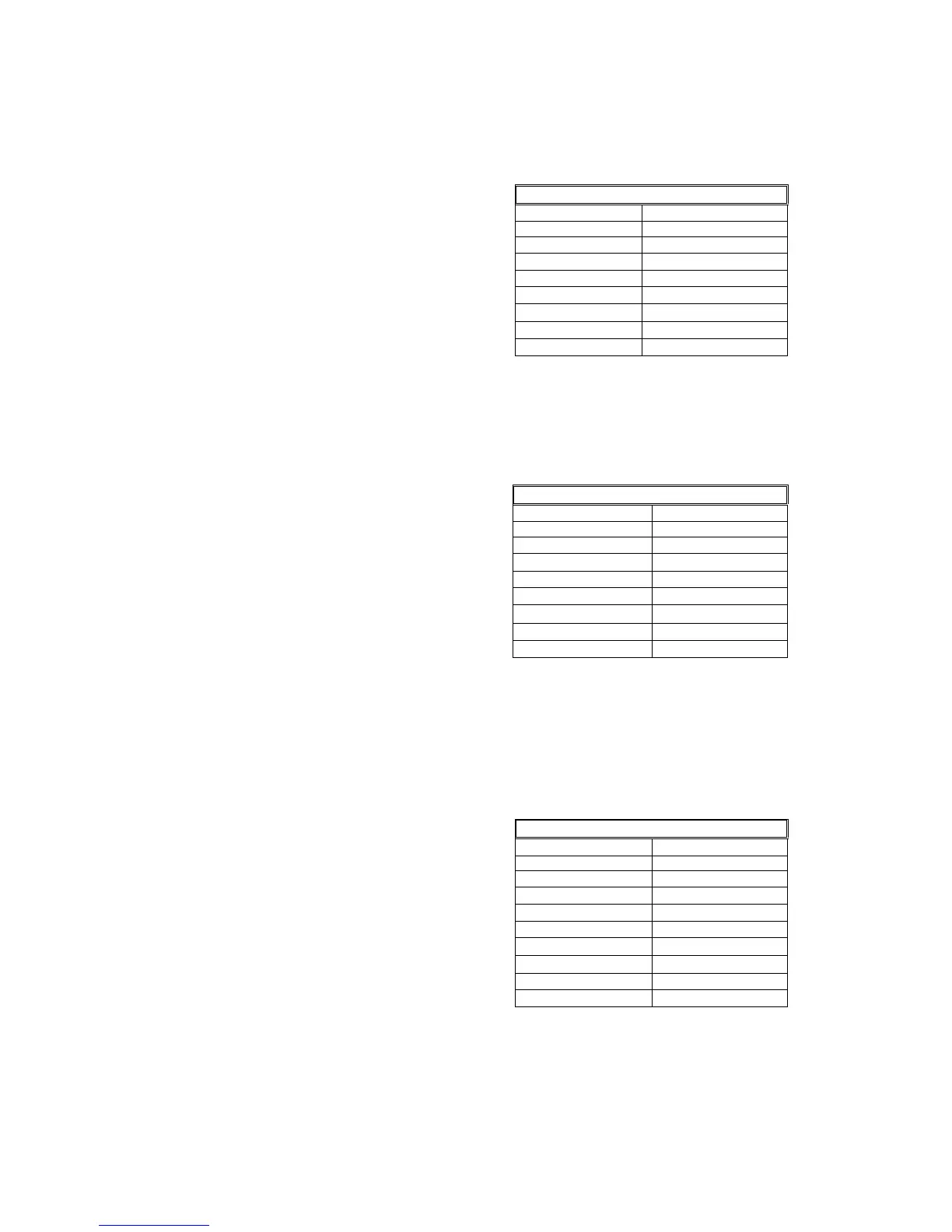

HP10BIIfinancialcalculator

KEYS DISPLAY

*MustnotdisplayBEGIN

CLEARALL 0.00

15I/YR 15.00

6N 6.00

1,000FV 1,000.00

100PMT 100.00

1P/YR 1.00

PV ‐810.78

17. Valueofatypicalgovernmentbondwithsemi‐annualpayments

Assumesameinformationasfor16aboveexcept

thatthebondisatypicalgovernmentbondthat

payssemi‐annuallyinarrears.Whatpricewouldthe

companypayforthebond?

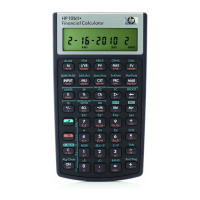

HP10BIIfinancialcalculator

KEYS DISPLAY

*MustnotdisplayBEGIN

CLEARALL 0.00

15÷2I/YR

7.50

6x2N 12.00

1,000FV 1,000.00

100

2PMT

50.00

1P/YR 1.00

PV ‐806.62

18. Calculatingtheyieldtomaturity

Thisisextremelydifficulttocalculatewhenusingaformulaapproachwithoutafinancialcalculator.

Thenominal/face/couponvalueisR1,000andthe

annualnominal/couponinterestrateis10%paid

semiannuallyinarrears.Youpurchasedthebondon

1Januaryofthisyearand

thebondisredeemableon

31December10yearslateratapremiumof10%.

ThebondispricedatR980on1Januaryofthisyear.

Whatistheyieldtomaturityon1Januaryofthis

year?

‡ Rememberthatthisistheratefor6months.

To

annualisetheconvention(frombond

tradingintheUnitedStates)hasbeento

multiplythisby2.

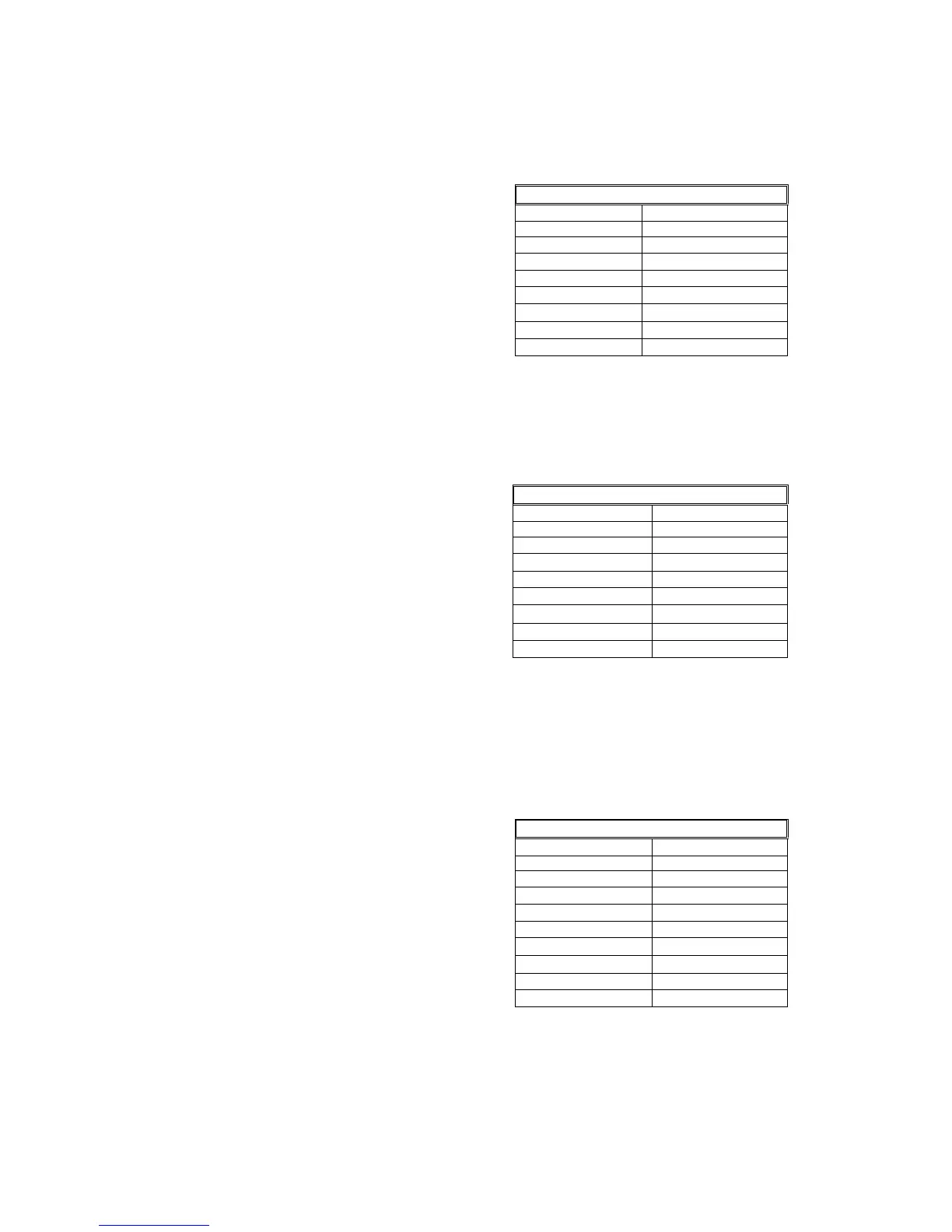

HP10BIIfinancialcalculator

KEYS DISPLAY

*MustnotdisplayBEGIN

CLEARALL 0.00

10x2N 20.00

1,000x1.10FV 1,100.00

980+/‐PV‐980.00

50PMT 50.00

1P/YR 1.00

I/YR 5.45

X2 10.91

‡

Loading...

Loading...