ANNUITIES–ORDINARY,DUE,FUTUREVALUE,PRESENTVALUE

ColinCSmith2010

6

12. Calculatingthepayment(PMT)foranormalfinancialtransaction‐AnnuityDue

You buy a new car today for R120 000 and

obtainfinancefor80%ofthepurchaseprice

(R96,000) overfour years.Thebank quotes

you a finance rate of 12% per annum

(nominal rate).Instalments are payable

monthly in advance.Calculate the monthly

instalment.

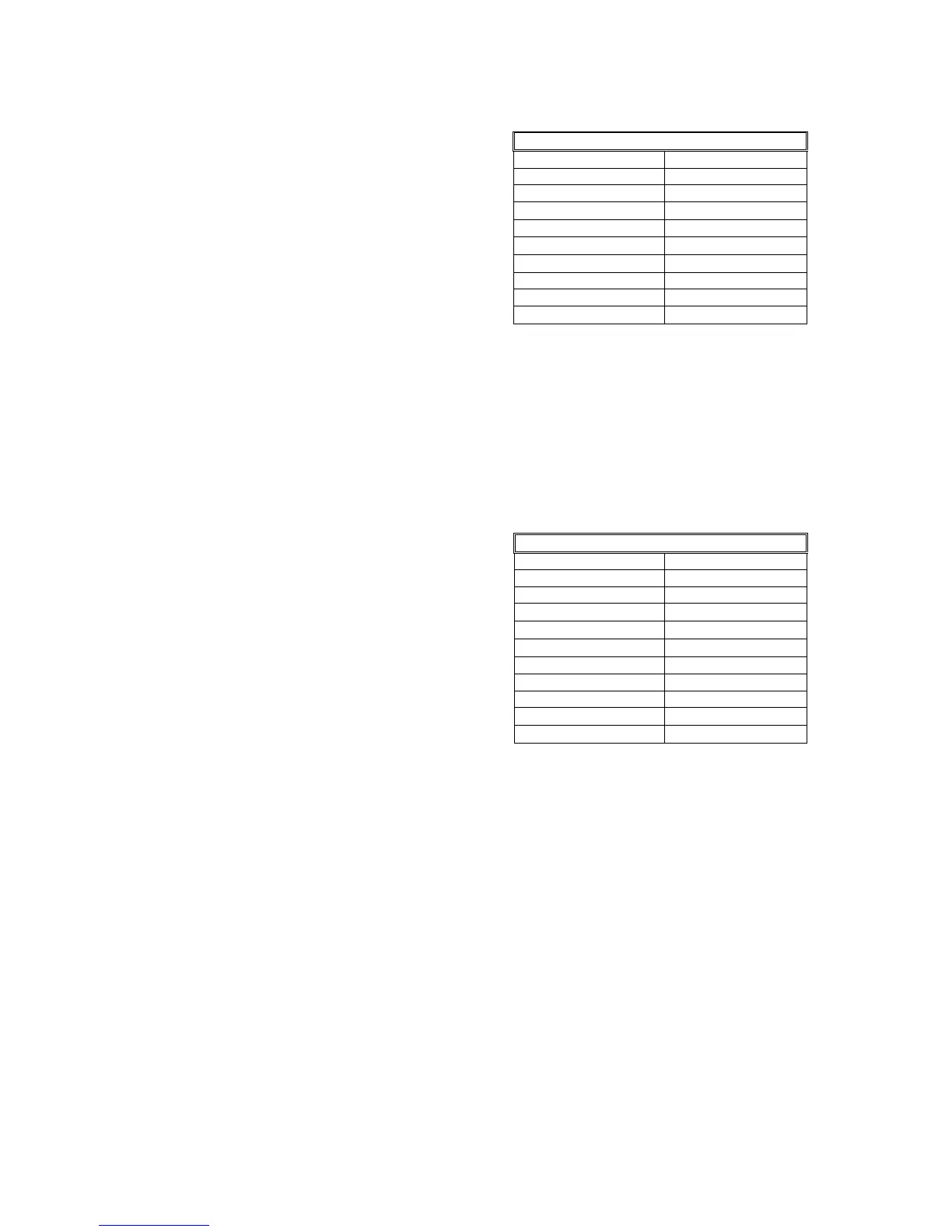

HP10BIIfinancialcalculator

KEYS DISPLAY

*MustdisplayBEGIN

CALL 0.00

BEG/END

BEGIN0.00

1 P/YR 1.00

96,000PV

96,0000.00

0FV

0.00

12÷12I/YR 1.00

4x12N 48.00

PMT

‐2503.02

Youcanalsosolvefortheinterestrateandforthenumberofperiodsusingthesamefunctions.

13. Calculatingtheinterestrateforanormalfinancialtransaction‐AnnuityDue

AbankoffersyouapersonalloanofR20,000

repayable in 24 easy instalments of R1,050

per month

starting immediately.What

nominalinterestrate(APR)isbeingcharged?

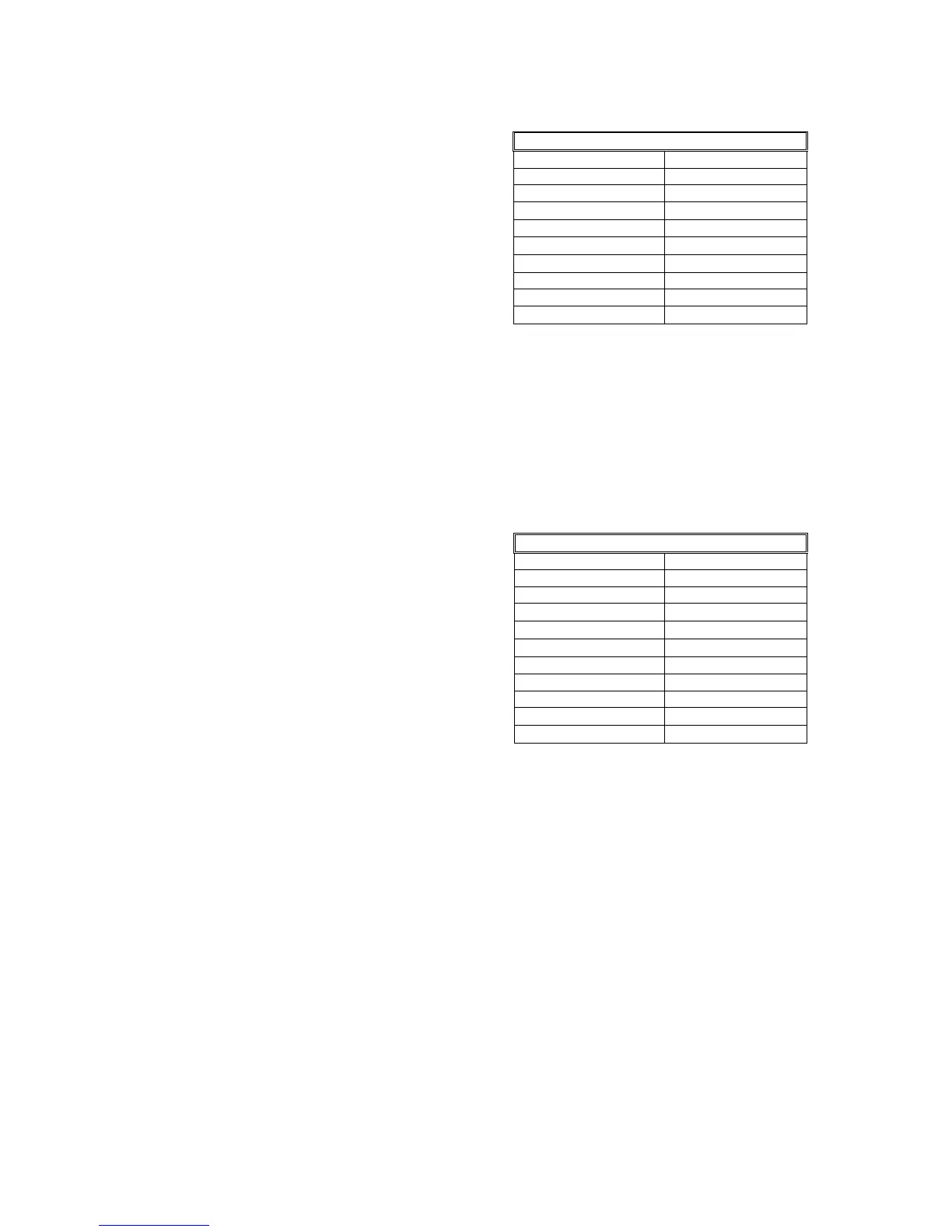

HP10BIIfinancialcalculator

KEYS DISPLAY

*MustdisplayBEGIN

CALL 0.00

BEG/END

BEGIN0.00

1 P/YR 1.00

20,000PV

20,0000.00

0FV

0.00

1,050+/‐PMT ‐1050.00

24N 24.00

I/YR

2.1237

X12

25.48

Additionalnotes:

PleasealsoseetheBondValuationsectionforsimilartransactions.

Wherewehaveirregularcashflowpayments,wecannotusetheannuityfunctionalityandinsteadcanusetheNET

PRESENTVALUEandINTERNALRATEOFRETURNfunctions.

Loading...

Loading...