35

Cost-Sell-Margin Calculation

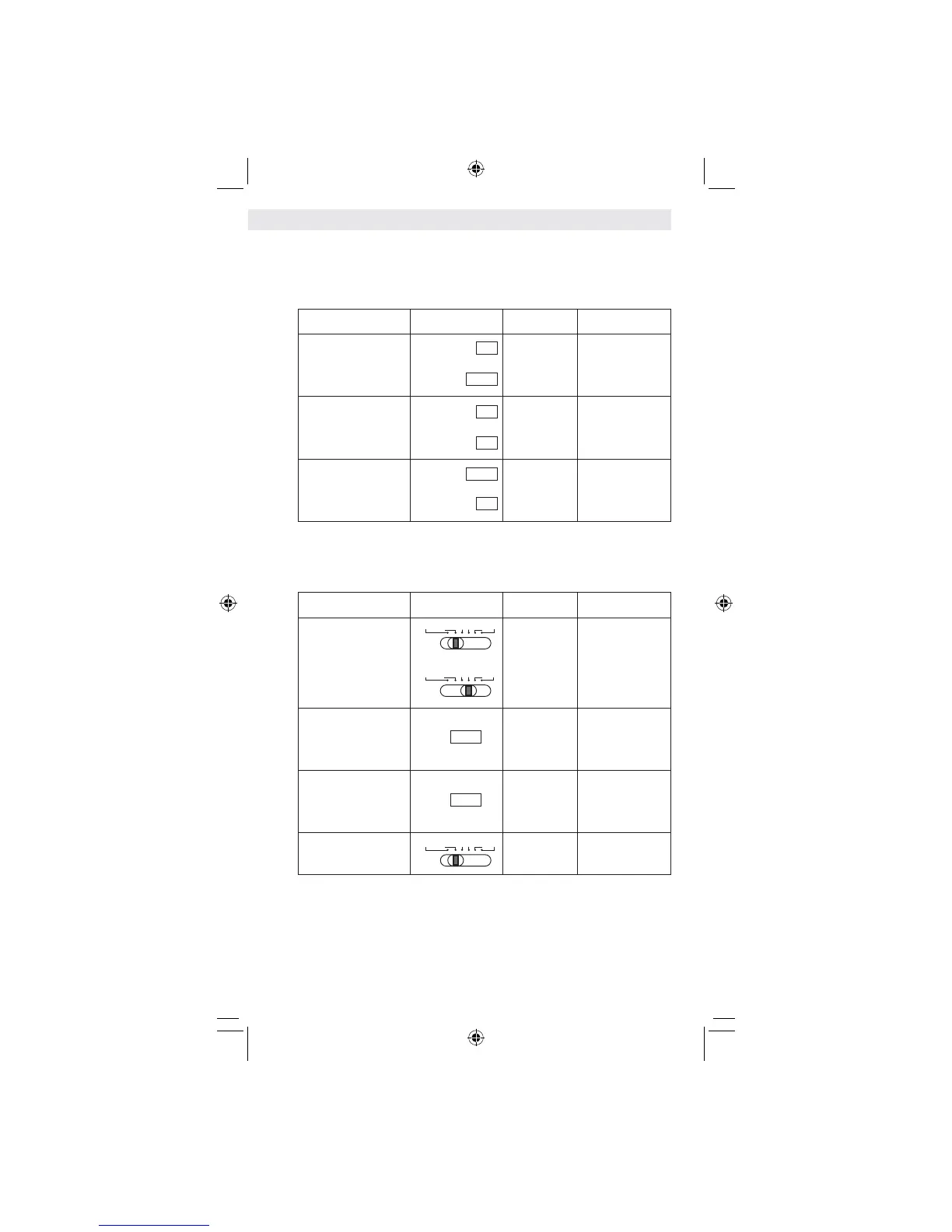

Calculation Operation Display Print Out

Calculating Cost

Selling Price: $ 200

Profit Margin: 12 %

Cost = ? ($ 176)

200

SELL

12

MARGIN

SELL

200.

COST

176.00

200. **

12. M %

176.00 C *

Calculating Profit Margin

Cost: $ 60

Selling Price: $ 100

Profit Margin = ? (40 %)

60

COST

100

SELL

COST

60.

MARGIN%

40.00

60. C *

100. **

40.00 M %

Calculating Selling Price

Profit Margin: 20 %

Cost: $ 120

Selling price: ? ($ 150)

20

MARGIN

120

COST

MARGIN%

20.

SELL

150.00

20. M %

120. C *

150.00 **

Tax Calculation

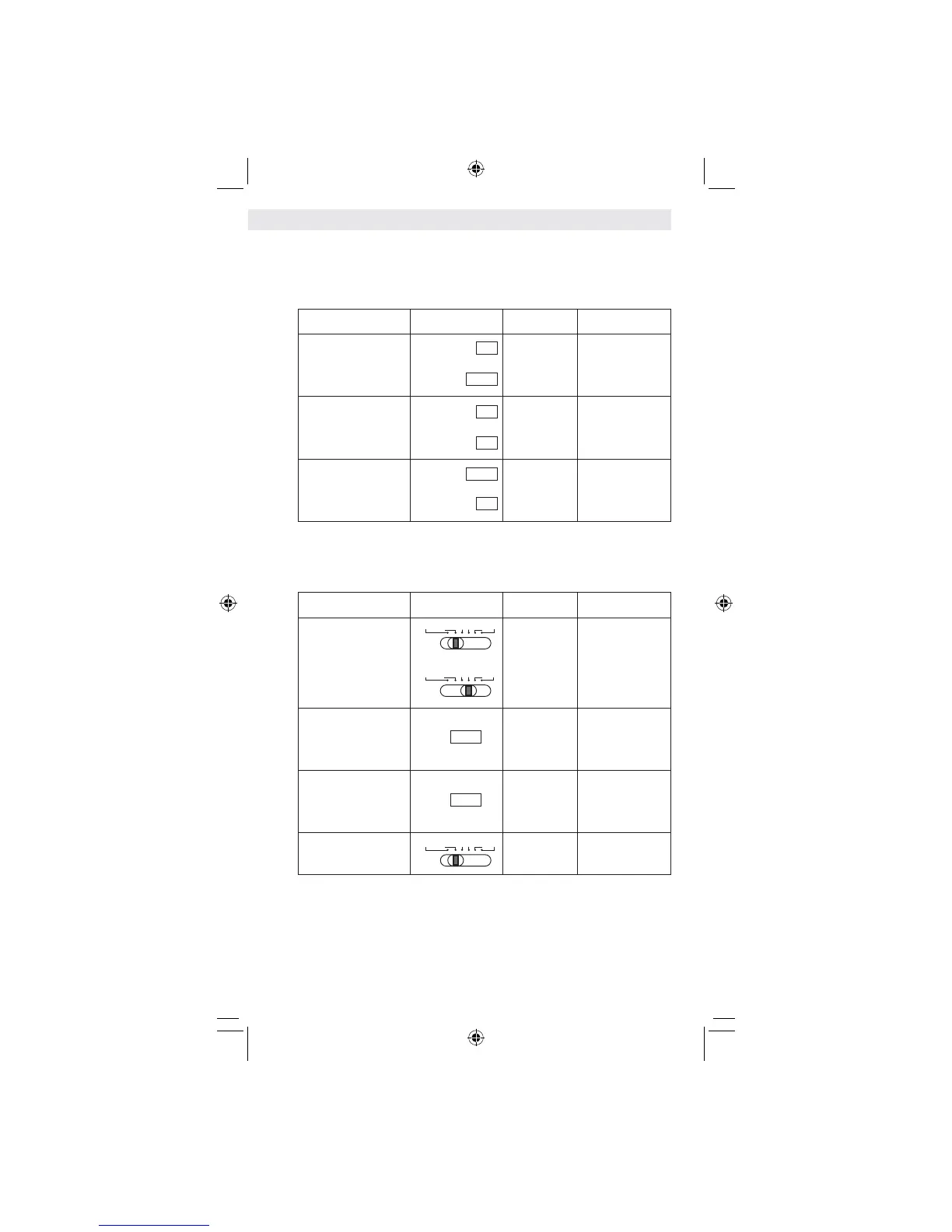

Calculation Operation Display Print Out

Set Tax Rate

Rate: 5 %

CURRENCY

RATE ITEM PRT ON OFF

5

CURRENCY

RATE ITEM PRT ON OFF

RATE

0.

RATE

5.

TAX %

5.

0. %

5. %

◊

To add Tax to $ 120.

Tax = ? (6)

Selling Price with Tax = ?

(126.00)

120

TAX +

+ TAX

126.00

120.

5. %

6.00 ∆

126.00 *

To subtract Tax from $

120. Tax = ? (-5.71)

Price without Tax = ?

(114.29)

120

TAX -

- TAX

114.29

120.

5. %

- 5.71 ∆

114.29 *

Recall Tax Rate

CURRENCY

RATE ITEM PRT ON OFF

RATE

5. 5. %

CPD_430.indd 35 13.11.2007 11:16:30

Loading...

Loading...