9–EN

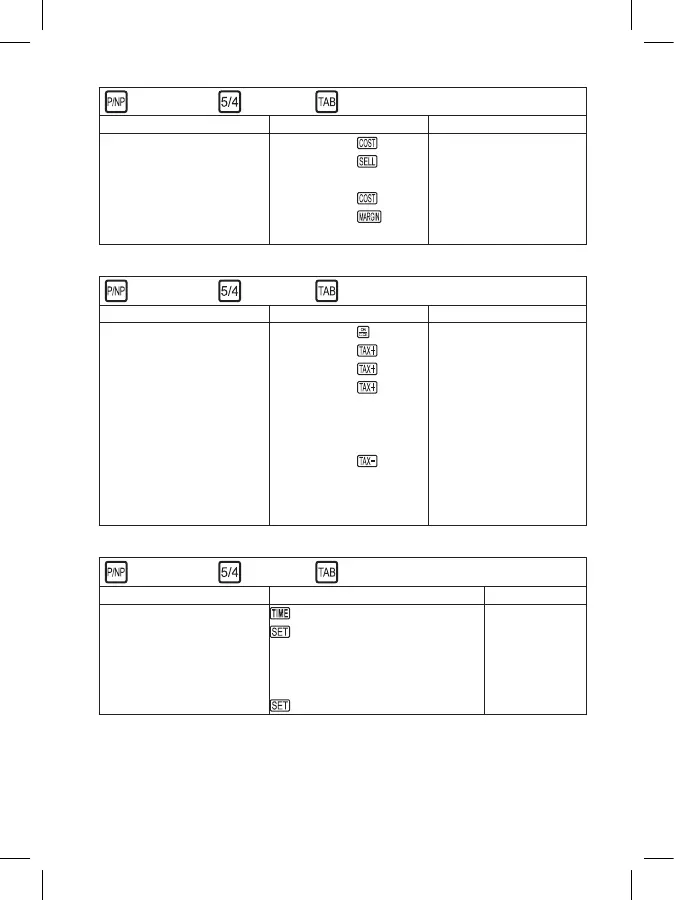

14. Cost, sell price, margin

PRINT

5/4

0 2 3 4 A

F

Example Entry Print out

COST = 100

SELL = 500

MARGIN = 80

100

100. C*

500

500. **

80. M%

100

100. C*

80

80. M%

500. **

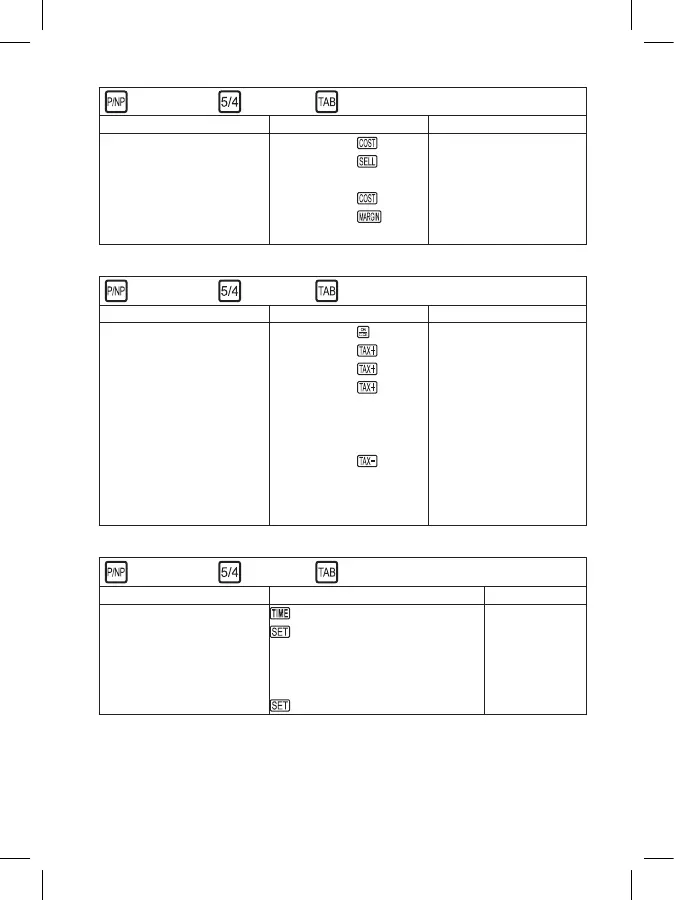

15. Tax vat calculation

PRINT

5/4

0 2 3 4 A

F

Example Entry Print out

Set tax rate

Enter rate (5%)

0. C

0. %

5

5. %

Add the tax amount

Price $2,000 without tax

Tax = ? ($100)

Selling price with tax = ?

($2,100)

2000

2,000.

5. %

100. ∆

2,100. *

Deduct the tax amount

Selling price $3,150 with tax

Tax = ? ($150)

Price without tax = ? ($3,000)

3150

3,150.

5. %

–150. ∆

3,000. *

16. Calendar and clock function

PRINT

5/4

0 2 3 4 A

F

Example Entry Print out

How to set date:

Oct.20.2001

01–01–2000 ...01–01–2000...

(Hold 2 seconds)

“0“1–01–2000

10 10–“0“1–200

29 10–29–“2“000

2001 “1“0–29–2001

10–29–2001

Loading...

Loading...