46

Calculating bond price and accrued interest

A $100, 20-year, 6.5% coupon bond is issued to mature on

August 15, 2023. It was sold on November 3, 2006 to yield the

purchaser 7.2% compounded semiannually until maturity. At

what price did the bond sell? Also calculate the accrued coupon

interest.

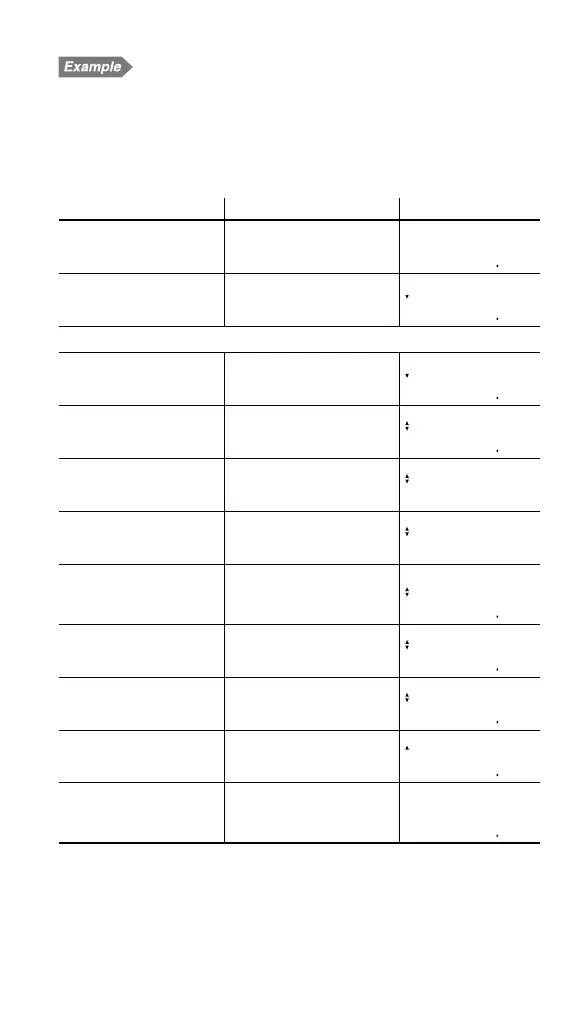

Procedure Key operation Display

Bring up the initial dis-

play in NORMAL mode.

s

000

Select bond calcula-

tions.

#

COUPON(PMT)=

000

Make sure the actual calendar is set (360 is not displayed).

Enter the coupon rate

(%).

6.5

Q

COUPON(PMT)=

650

Enter the redemption

value.

i

100

Q

REDEMPT(FV)=

10000

Enter the settlement

date.

i

11032006

Q

M-D-Y 1=[FR]

11- 3-2006

Enter the redemption

date.

i

08152023

Q

M-D-Y 2=[TU]

8-15-2023

Enter the number of

coupon payments per

year.

i

2

Q

CPN/Y(N)=

200

Enter the annual yield

(%).

i

7.2

Q

YIELD(I/Y)=

720

Calculate bond price.

i

@

PRICE(PV)=

9323

Calculate the accrued

interest.

i

ACCU INT=

141

Calculate bond price

including accrued

interest.

s

i

v

+

i

/

=

PV+ANS=

9464

Answer: The bond sold at $93.23 and the accrued coupon

interest was $1.41 (the bond price including accrued

interest would be $94.64).

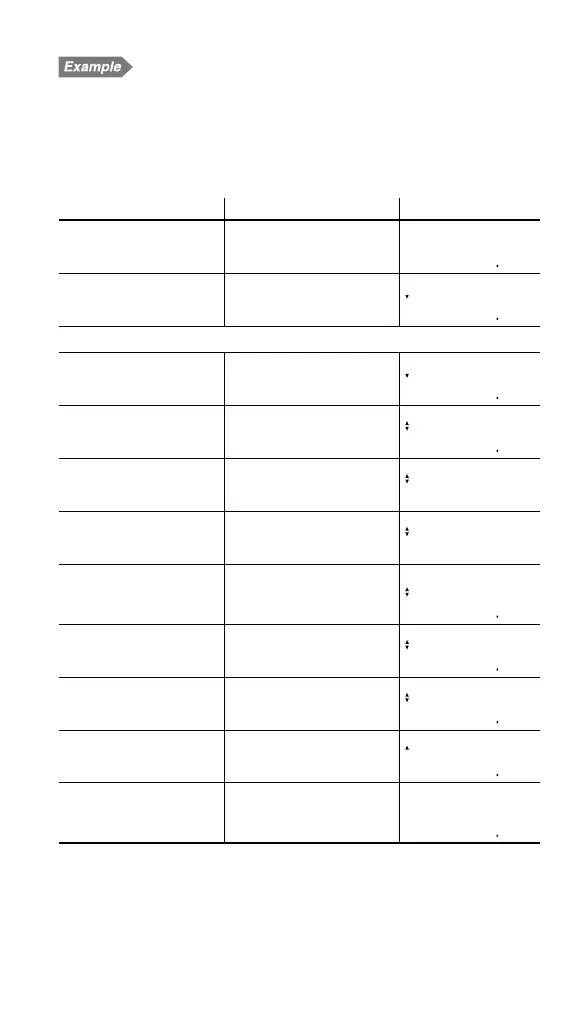

The asking price on the above bond is $92.50. What will your

yield be?

3FinancialFunctionsCurrent.indd463FinancialFunctionsCurrent.indd46 06.7.108:38:42PM06.7.108:38:42PM

Loading...

Loading...