QuickBooks for Mac 2014 User’s Guide 194

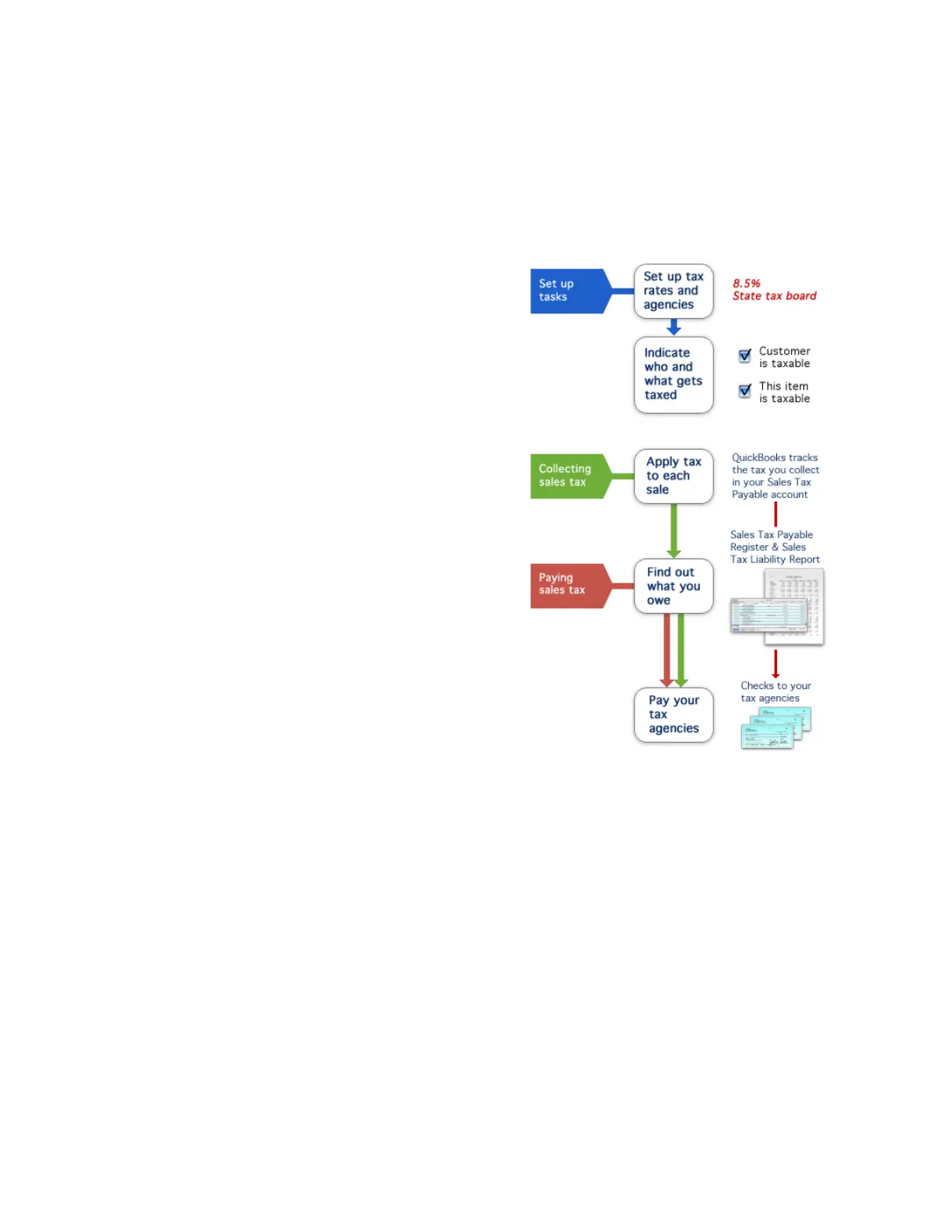

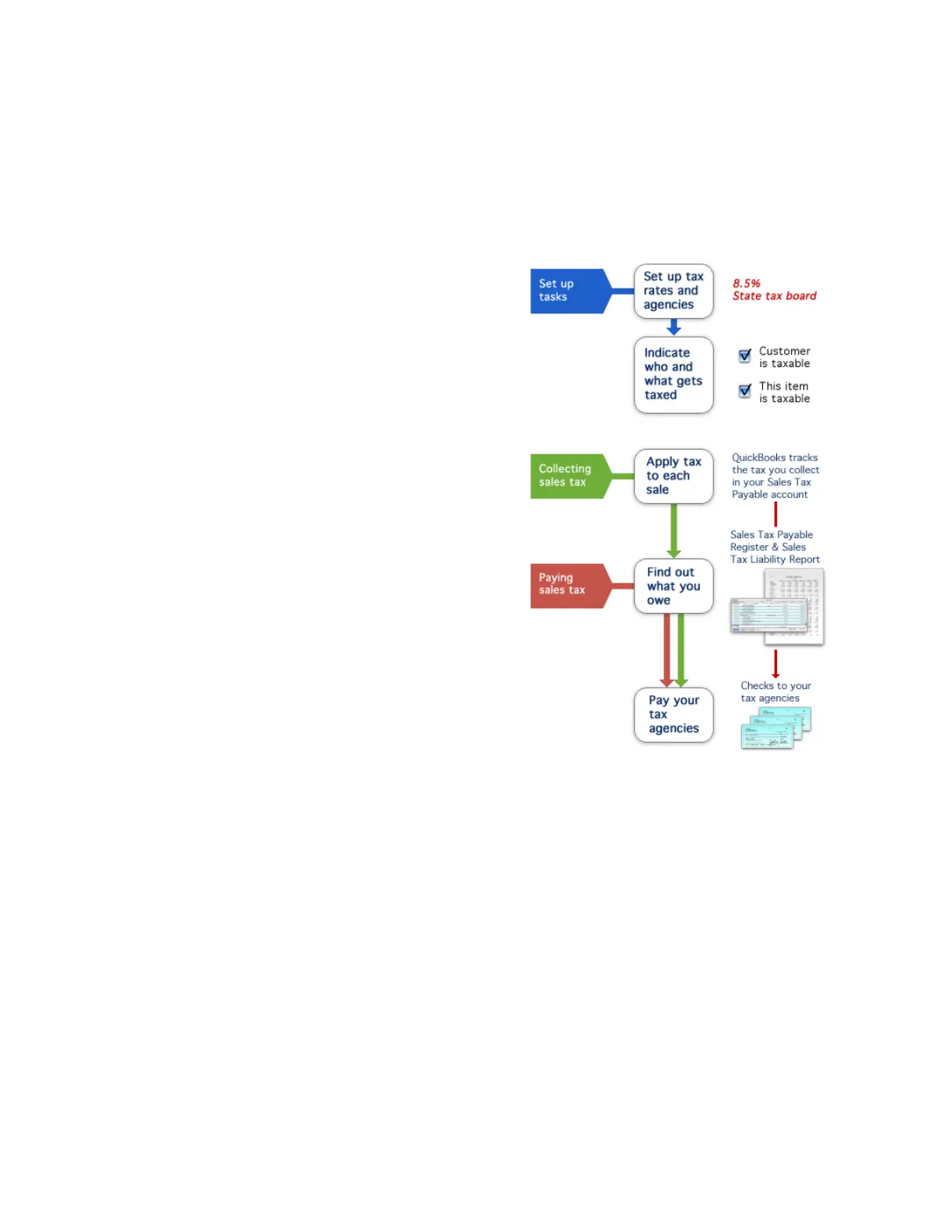

Sales tax

If you sell stuff, sales tax is part of your life. Ugh. Oh, I mean, lucky you! OK, I tried to be upbeat, but there’s really

no way around the fact that sales tax takes a bite out of your donut. But QuickBooks can make it easier for you,

even if you have to deal with many tax rates in multiple

jurisdictions.

Before I go on, here are a couple of things you should

know:

• It’s important you understand the sales tax rules for

your area. You can learn what these are by contacting

the sales tax agencies that will collect sales tax from

you. Not sure who the agencies are? Your state’s web

site is a good place to start searching for information.

• When you set up a company that charges sales tax, or

when you enter your first sale, QuickBooks

automatically creates a current liability account called

Sales Tax Payable. The Sales Tax Payable account

keeps track of as many tax agencies as you need.

So, working with sales tax in QuickBooks…here we go.

Set up tax rates and agencies

Before you can charge and track sales tax, you must let

QuickBooks know which agencies you collect tax for, and

at what rates. You do this by creating tax items. A tax item

represents a single tax rate payable to a single agency. In

your Items list, add an item and for the type, choose Sales

Tax Item. (If you need help with adding items, check the

Help in QuickBooks.)

If you collect for more than one agency, create a separate tax item for each agency. You can then group the items

together so that your customers will only see a single tax rate on your sales forms.

Indicate who and what gets taxed

After you set up your tax rates and agencies, QuickBooks still needs to know which customers you collect tax from,

and which items you charge tax for when you make a sale. Once you enter this information, QuickBooks

automatically calculates sales tax whenever you sell a taxable item to a taxable customer.

For each item and customer, there’s a Taxable checkbox. It’s up to you to know if you need to use it or not. If

your customer is purchasing items from you for resale, they may not be taxable. Also, the items you sell—products

and services—may or may not be taxable. You may sell services that are not taxed and products that are. Again,

this is where knowing the rules for the tax agencies is important. That will guide you as to whether something is

taxable. Either way, if an item or a customer is taxable, be sure you use that Taxable checkbox.

Loading...

Loading...