Often borrower would want to re-finance long term loan. Using CMPD and AMRT in

combination, we can easily compare the cost of re-financing with the savings due to

decide whether the re-financing exercise would be profitable.

Example 5 ►>> A borrower has an $8,000 loan with QED Finance which is to be

repaid over 4 years at %18

12

=j . In case of early repayment, the borrower is to pay

a penalty of 3 months’ payments. Right after the 20

th

payment, the borrower

determines that his banker would lend him the money at %5.13

12

=j . Should he re-

finance?

Operation

First let’s find the monthly payment of the loan.

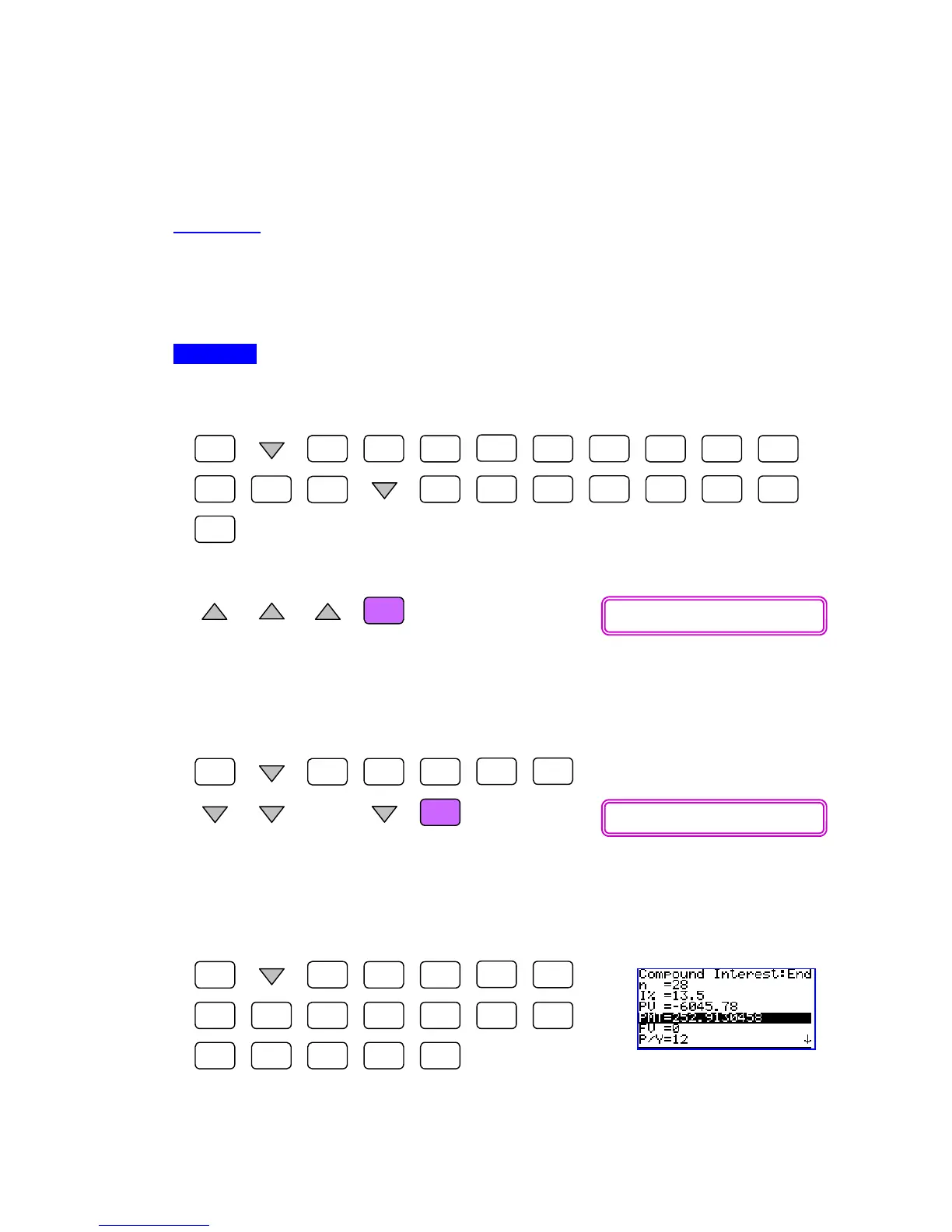

Enter CMPD mode, make sure calculator displays [Set:End]. Then scroll down

and enter 48 for [n], 18 for [I%], (-)8000 for [PV], 0 for [FV], 12 for [P/Y] and [C/Y].

Scroll up to select [PMT] and solve it.

So the monthly payment is about $235 and the outstanding principal after 20

payments would be about $5340.78, as calculated below.

Enter AMRT mode and scroll down to enter 1 for [PM1] and 20 for [PM2]. Then,

scroll to select [BAL:Solve] and solve it.

Thus the total to be refinanced is 5340.78 + 3(235) = $6045.78. Now we can obtain

the new monthly payment at CMPD mode for comparison.

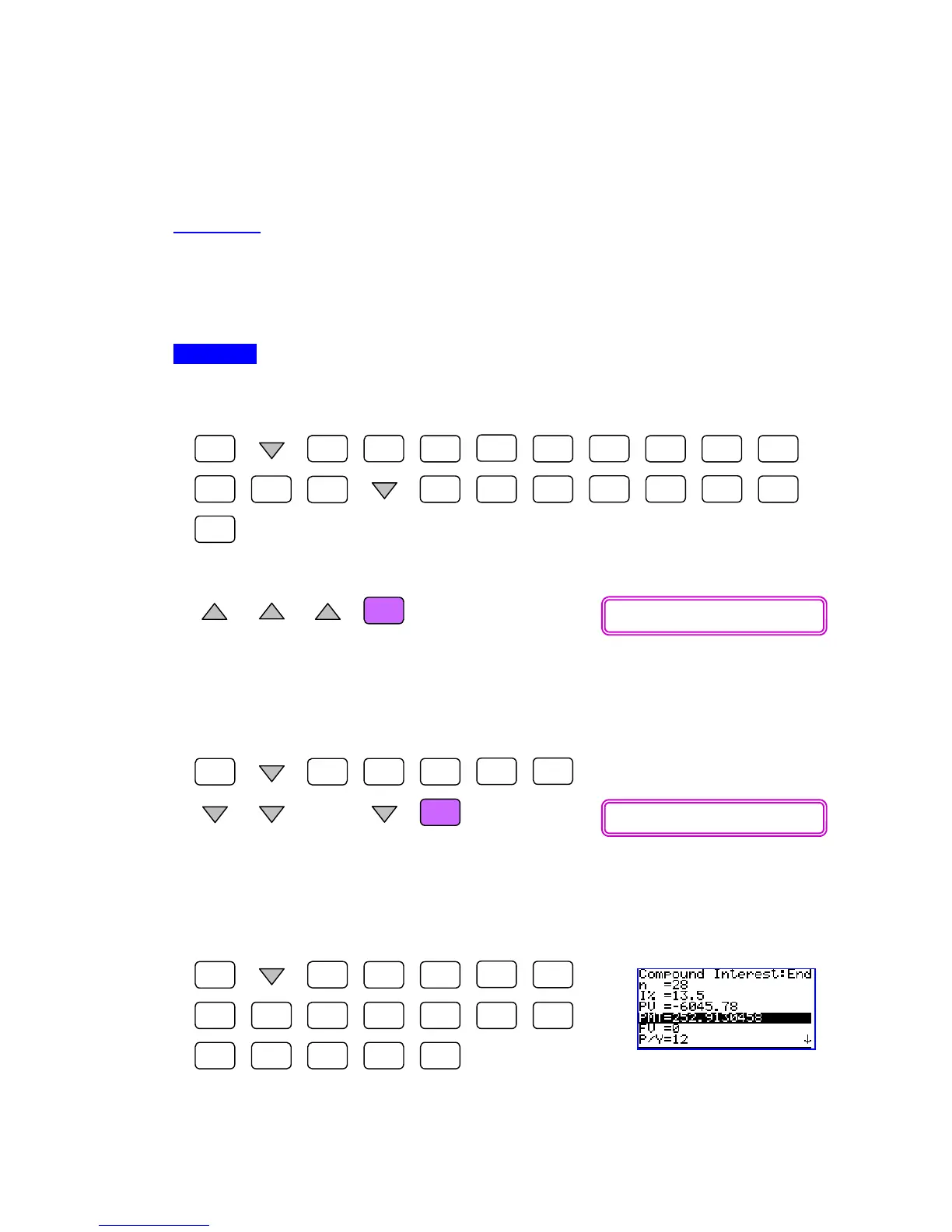

Enter CMPD mode, enter 28 (less 20 months) for [n], 13.5 for [I%], (-)6045.78 for

[PV]. Other parameters’ values are retained.

Loading...

Loading...