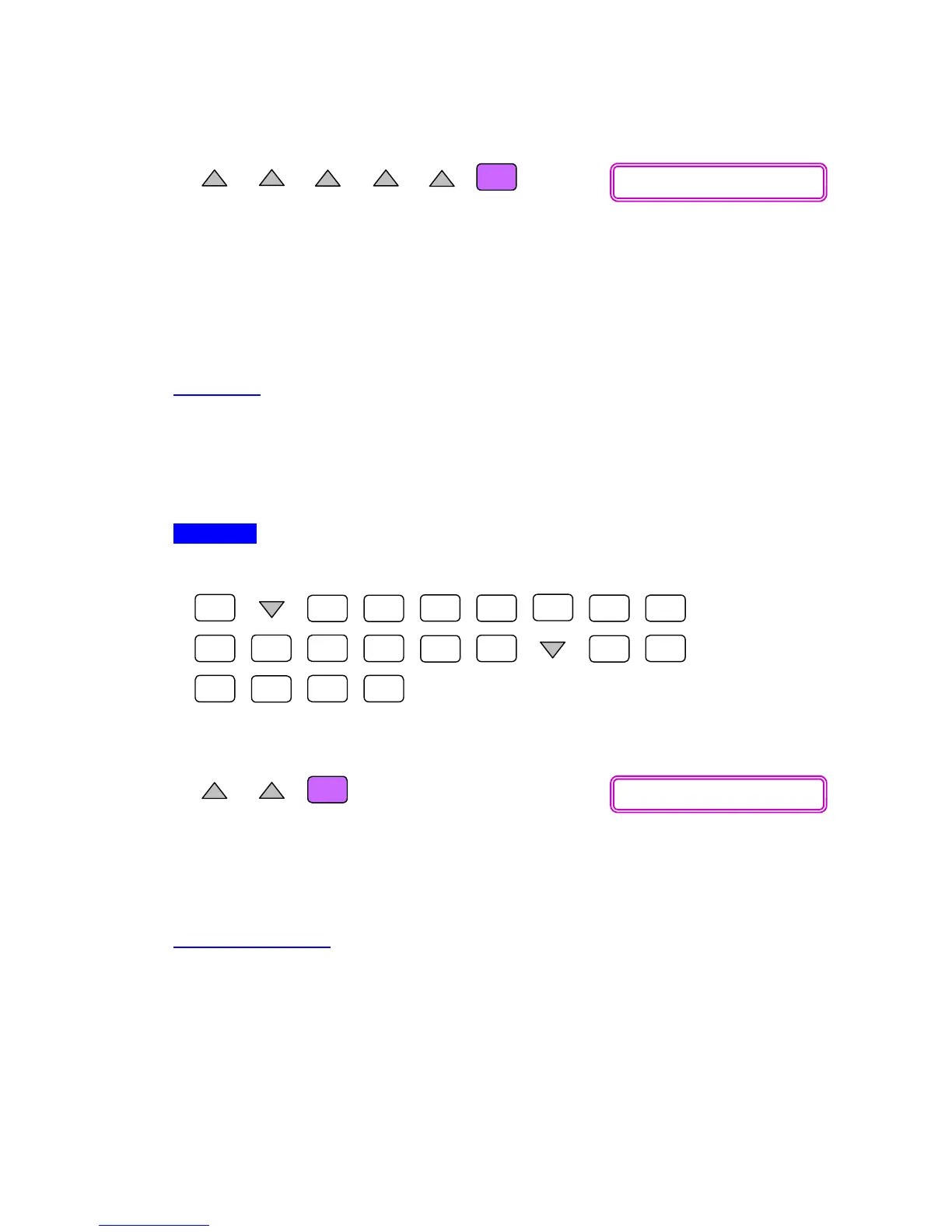

Now scroll up to select [I%] and solve it.

Therefore the compounded annual increase rate of this stock for the last 5 years is

about 13.46%. █

The previous example shows that when sufficient information is provided, we could

calculate for most parameters available in CMPD mode. The next example is simple

annuity calculation made possible with the CMPD mode of FC-100V/FC-200V.

Example 5 ►>> My friend JT was repaying a debt with payments of $250 a

month. He misses his payments for November, December, January and February.

What payment will be required in March to put him back on schedule, if interest is at

%4.14

12

=j ?

In this example, Set = End, n = 5 (months), I% = 14.4, PMT = 250, P/Y = C/Y = 12. Other parameters

= 0.

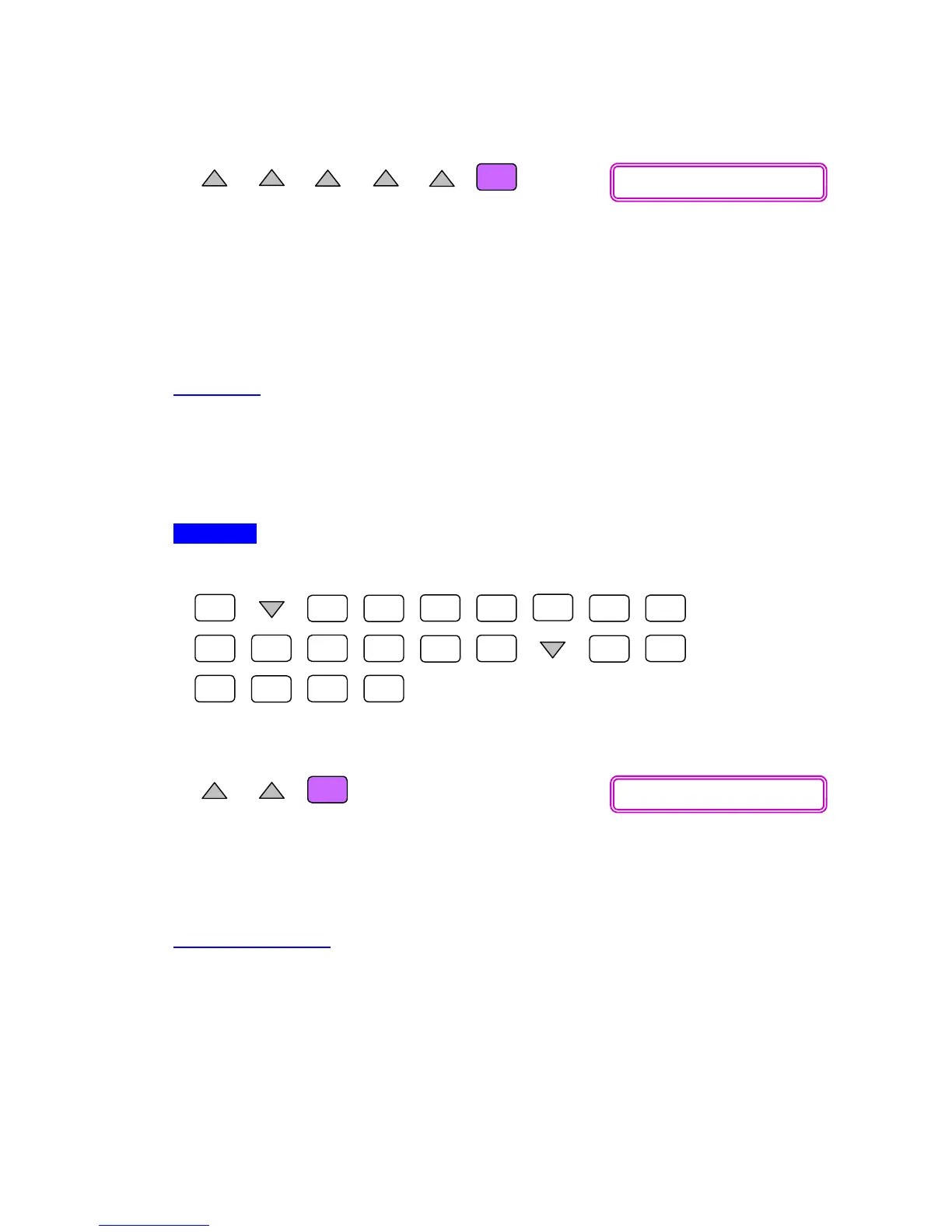

Operation

Once entered CMPD mode, make sure that [Set:End] is shown. Enter 5 for [n],

14.4 for [I%], 0 for [PV], 250 for [PMT], 12 for both [P/Y] and [C/Y].

Scroll up to select [FV] and solve it.

Hence JT needs to settle $1280.36 in March to get back on the loan repayment

schedule. █

For Understanding ►>> A company estimates that a machine will need to be

replaced 10 years from now at a cost of $350,000. How much must be set aside

each year to provide that money if the company’s savings earn interest at %8

2

=j ?

Answer: $23977.37

Loading...

Loading...