Section 12: Real Estate and Lending 171

File name: HP 12c Pt Converted_user's guide_English_HDP0F123E02_080207 Page: 170 of 281

Printed Date: { 2007/8/2Dimension: 14.8 cm x 21 cm

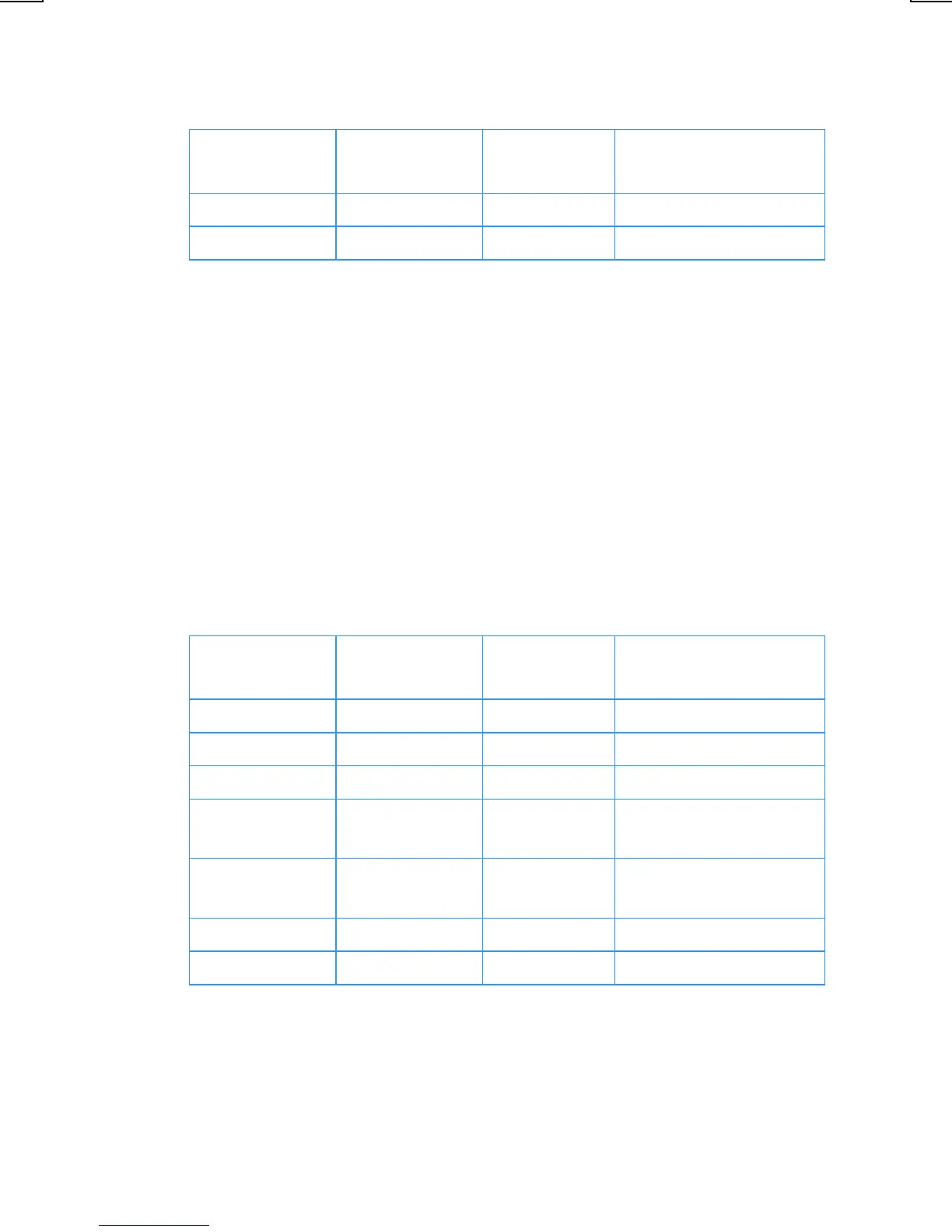

Keystrokes

(RPN mode)

Keystrokes

(ALG mode)

Display

t

t

8.57

Yield.

t

t

46,048.61

Balance in savings.

By purchasing a house, you would gain $7,047.04 (53,095.65 – 46,048.61)

over an alternate investment at 3% interest.

Deferred Annuities

Sometimes transactions are established where payments do not begin for a

specified number of periods; the payments are deferred. The technique for

calculating NPV may be applied assuming zero for the first cash flow. Refer to

pages 73 through 77.

Example 1:

You have just inherited $20,000 and wish to put some of it aside for

your daughter’s college education. You estimate that when she is of college age, 9

years from now, she will need $7,000 at the beginning of each year for 4 years

for college tuition and expenses. You wish to establish a fund which earns 6%

annually. How much do you need to deposit in the fund today to meet your

daughter’s educational expenses

?

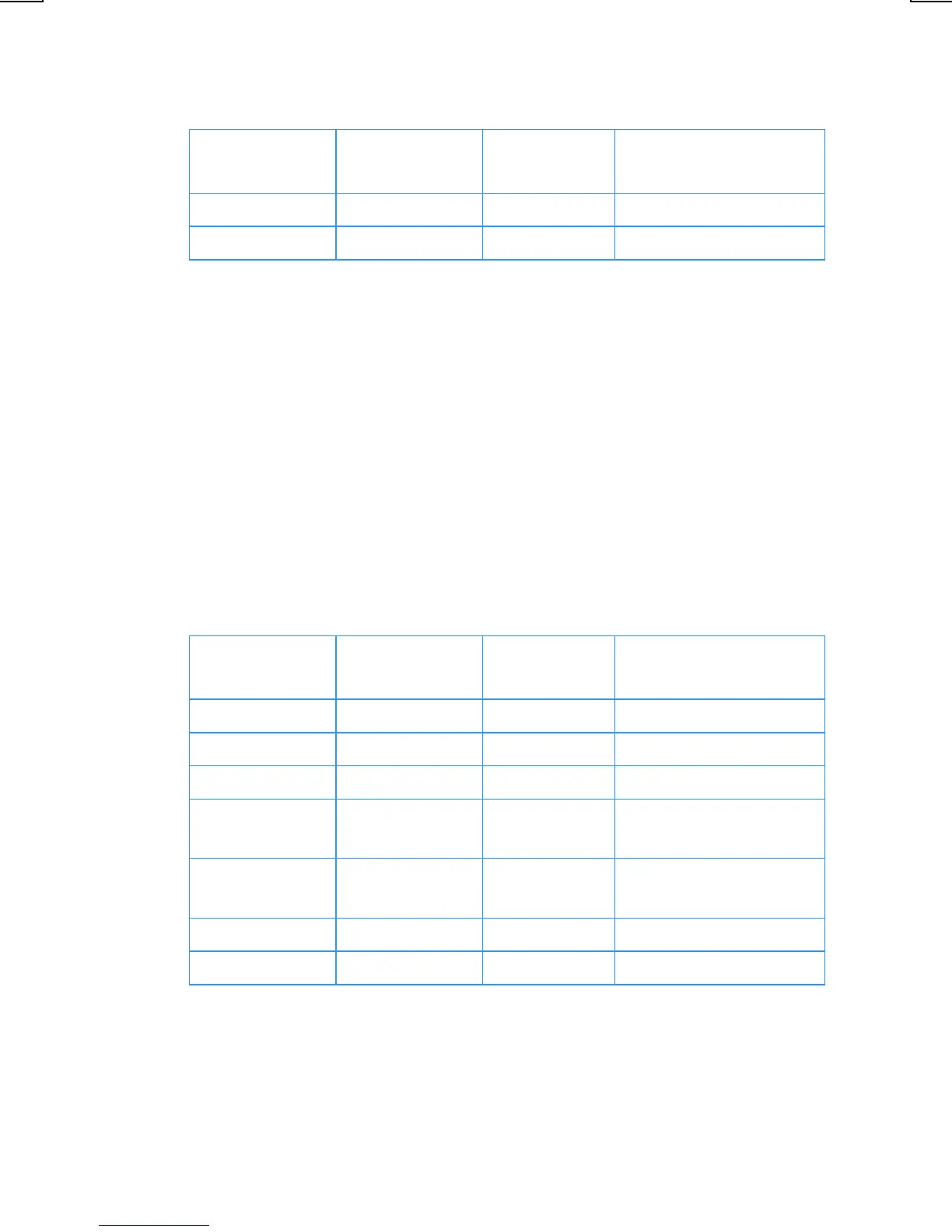

Keystrokes

(RPN mode)

Keystrokes

(ALG mode)

Display

f]

f[

f

CLEAR

H

f

CLEAR

H

0.00

Initialize.

0

gJ

0

gJ

0.00

First cash flow.

0

gK

8

ga

0

gK

8

ga

0.00

8.00

Second through ninth

cash flows.

7000

gK

4

ga

7000

gK

4

ga

7,000.00

4.00

Tenth through thirteenth

cash flows.

6

¼

6

¼

6.00

Interest.

fl

fl

15,218.35

NPV.

Loading...

Loading...