Section 13: Investment Analysis 203

File name: HP 12c Pt Converted_user's guide_English_HDP0F123E02_080207 Page: 201 of 281

Printed Date: { 2007/8/2Dimension: 14.8 cm x 21 cm

Example 1:

An option has 6 months to run and a strike price of $45. Find

Call and Put values assuming a spot price of $52, return volatility of 20.54% per

month and a risk-free interest rate of 0.5% per month. Show how to change the

time scale of the inputs between monthly and annual values.

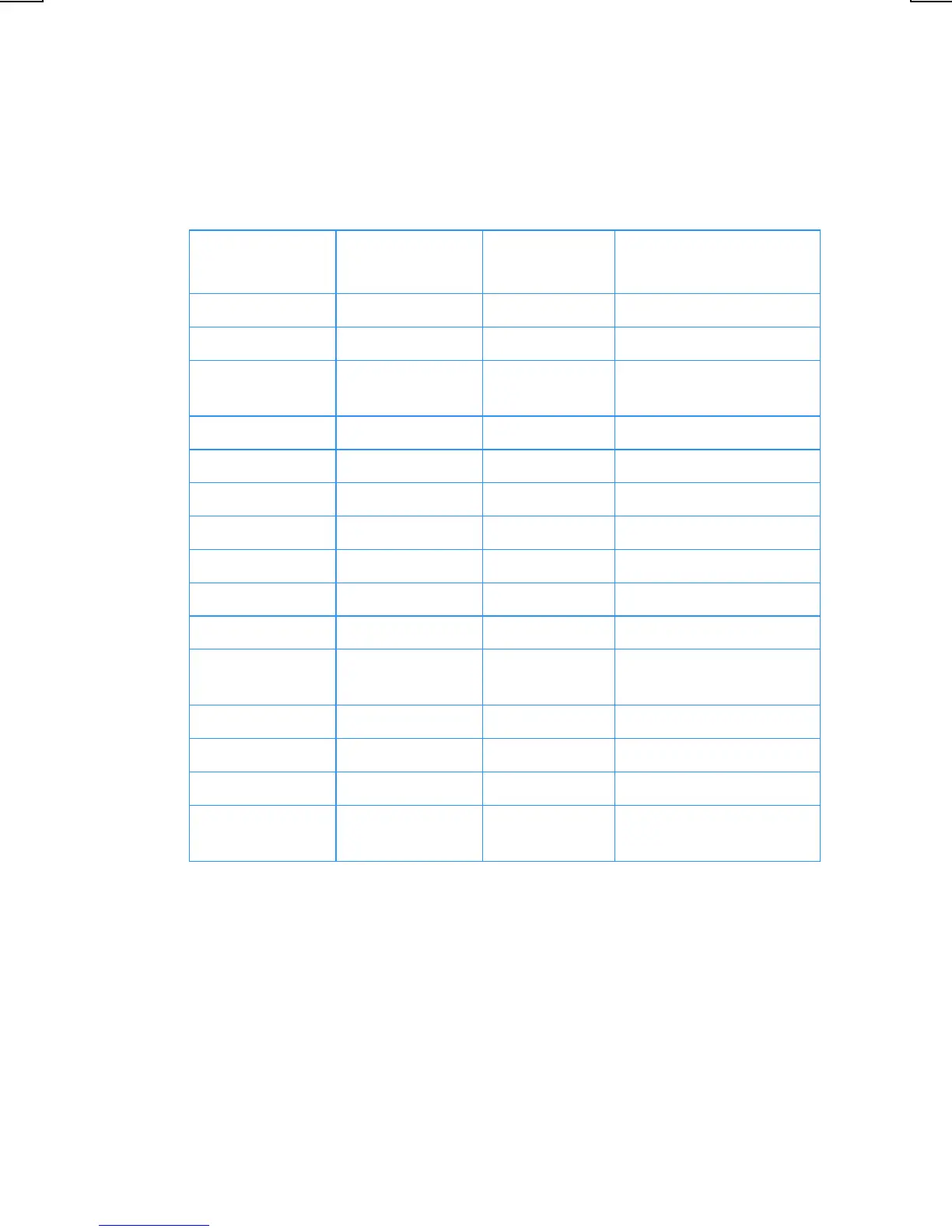

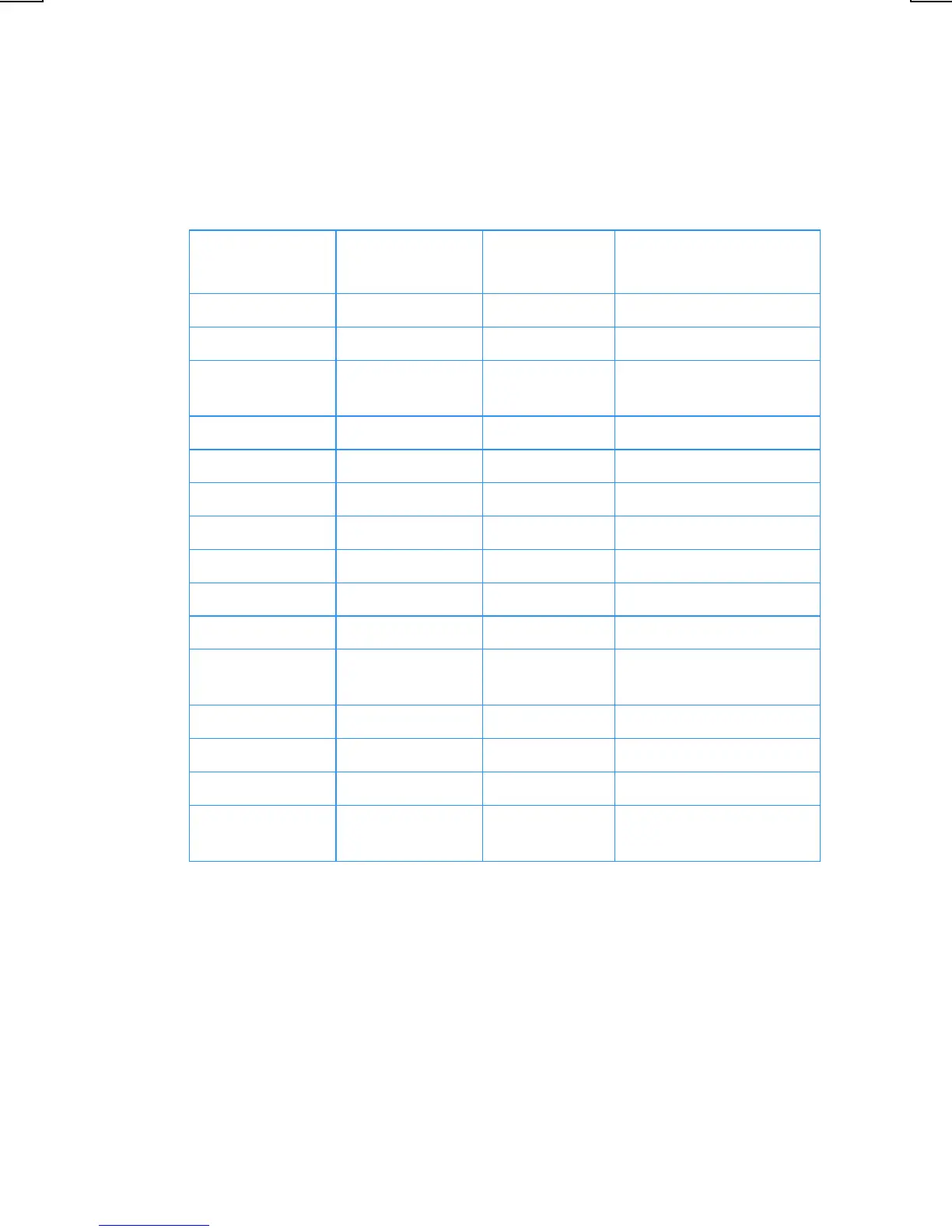

Keystrokes

(RPN mode)

Keystrokes

(ALG mode)

Display

f]

f[

6

n

6

n

6.00

Time to expiry (months).

.5

¼

.5

¼

0.50

Interest rate (% per

month).

52

$

52

$

52.00

Stock price.

20.54

P

20.54

P

20.54

Volatility (% per month).

45

M

45

M

45.00

Strike price.

t t

14.22

Call value.

~ ~

5.89

Put value.

:gAn :gAn

0.50

Years to expiry.

:gC¼ :gC¼

6.00

Yearly interest rate %.

:P

12

gr§P

:P§

12

grP

71.15

Yearly volatility %.

t t

14.22

Call value (unchanged).

:ngA :ngA

6.00

Months to expiry.

:¼gC :¼gC

0.50

Monthly interest rate %.

:P

12

grzP

:Pz

12

grP

20.54

Monthly volatility %.

The next example is Example 12.7 from Options, Futures, and Other Derivatives

(5th Edition) by John C. Hull (Prentice Hall, 2002).

Loading...

Loading...