Intel Corporation

17

Integrated Market and Credit Risk

Award-winning, real-time risk analysis

Banks want to make more risk-aware decisions,

and are running increasingly sophisticated risk

analytics on demand.

Achieving performance increases on

computationally intensive Monte Carlo risk

analysis can help financial institutions to reduce

their capital costs and operating expenses.

Performance

increase

of up to

1.7 X*

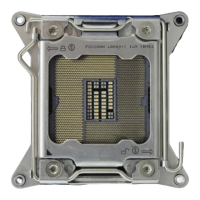

"Our latest benchmark results on the Intel® Xeon® processor E5-2600 product family

demonstrates Algorithmics’ continued commitment to improving our software

performance and reducing the total cost of ownership for our clients. With industry-

standard, low-cost hardware, global institutions can cost-effectively perform Monte Carlo

risk simulations for their largest trading counterparties in a few minutes, and execute

what-if risk profiles in milliseconds for pre-deal analysis on the trading room floor.“

Neil Bartlett, Chief Technology Officer, Algorithmics, an IBM Company

Source: Published/submitted/approved results as of March 6, 2012. Software and workloads used in performance tests may have been optimized for performance only on Intel microprocessors.

Performance tests, such as SYSmark and MobileMark, are measured using specific computer systems, components, software, operations and functions. Any change to any of those factors may cause the results to vary. You should

consult other information and performance tests to assist you in fully evaluating your contemplated purchases, including the performance of that product when combined with other products.

Configuration Details: Please reference back up slides.

For more information go to http://www.intel.com/performance

*Other names and brands may be claimed as the property of others

Loading...

Loading...