QuickBooks for Mac 2014 User’s Guide 146

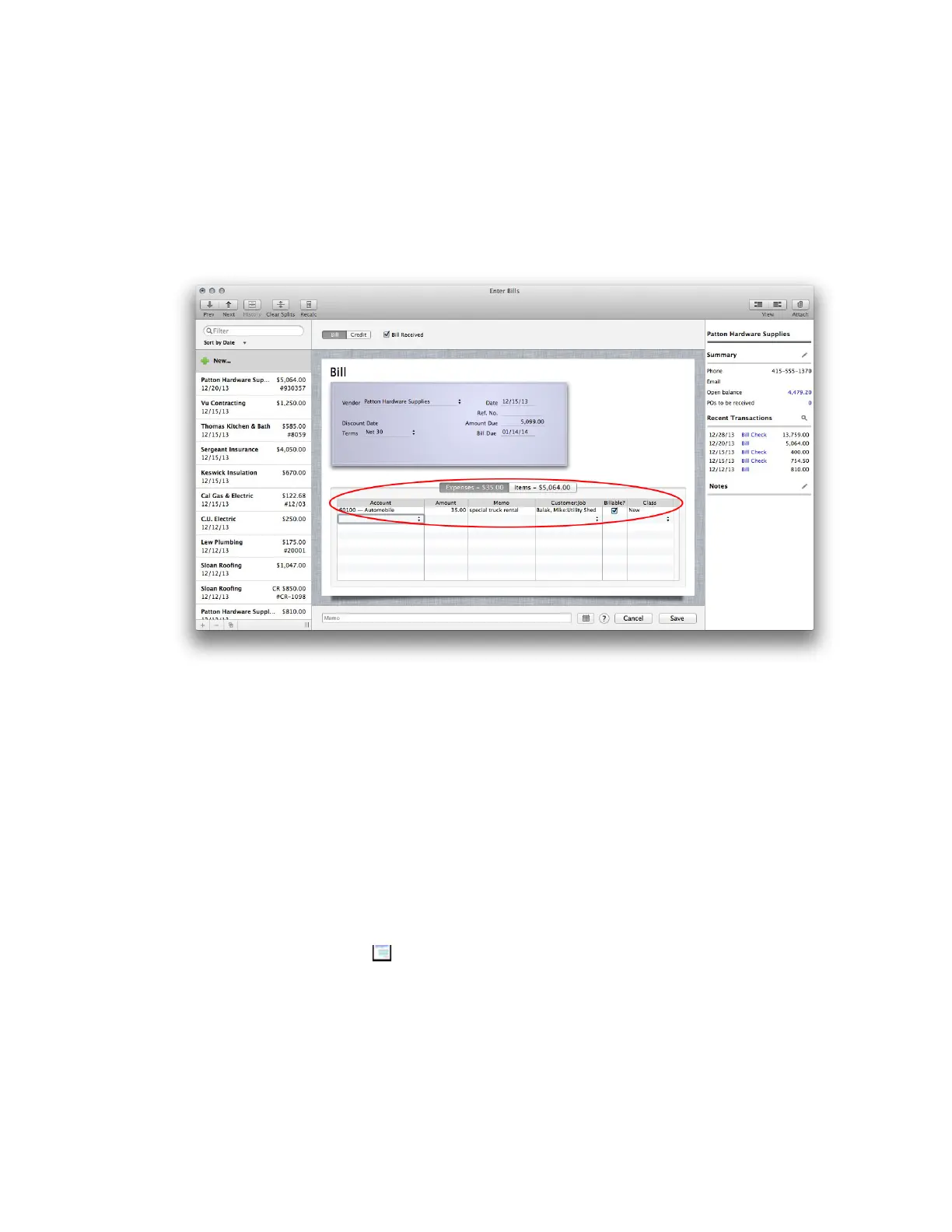

Tracking expenses related to a bill

On the Enter Bills window, use the Expenses pane at the bottom of the window to enter non-item expenses, like

electricity expenses for a bill from the utility company or postage expenses that are part of inventory items you've

received.

Tip: If you assign the amount of the bill to various expense accounts, customers, jobs, or classes, your reports will

show you how much you spend within each of these areas.

• Account. Choose the account that you use to track that type of expense. Usually, this will be an expense

account.

• Amount. QuickBooks enters the amount you entered for Amount Due or Credit Due. To assign only part of the

amount to the expense, you can edit this number. Note: For inventory item purchases, you may want to

associate expenses such as tax or freight charges with your Cost of Goods Sold (COGS) account instead of an

expense account.

• Memo. Enter a memo about the expense.

• Customer: Job. To pass on the amount as an expense to be reimbursed by a customer, enter the customer in

the Customer:Job column.

• Billable Time. An icon appears ( ) indicating this is billable time. If it's not, click the icon so that an X appears

over it.

• Class. To assign the amount to one of your QuickBooks classes, enter it in the Class column. Note: This column

only appears when you have selected the “Use Class Tracking” preference (choose QuickBooks > Preferences >

Transactions).

!

Loading...

Loading...