QuickBooks for Mac 2014 User’s Guide 14

Why enter my historical transactions?

Entering historical transactions gives you an accurate look at how your company is doing in the present and over

time. After you enter your transactions from your start date up to today, you'll have:

• Accurate balances in your bank accounts and all other accounts

• The ability to reconcile your bank and credit card statements with your QuickBooks bank and credit card

accounts

• Up-to-date records of what customers owe you and what you owe vendors

• Accurate year-to-date profit and loss statements

• Accurate sales tax reports for any period after your start date

Do I wait to enter current transactions until I get the historical data

in?

No. Just because you starting to use QuickBooks doesn't mean your business has stopped running. You probably

have current transactions happening right now that you need to record, as well as get your historical data into

QuickBooks. So this is important to know: You can enter historical transactions at any time. You don’t have to enter

all your past transactions before you start using QuickBooks.

Go ahead and start entering current transactions as they occur so you don’t get behind. Then catch up with

historical transactions when you can. Try breaking them into digestible chunks, like a week or month's worth at a

time. Remember, though, that your account balances may be off until you’ve entered all the transactions back to

your start date.

Order matters

There are two important guidelines to keep in mind as you enter historical transactions:

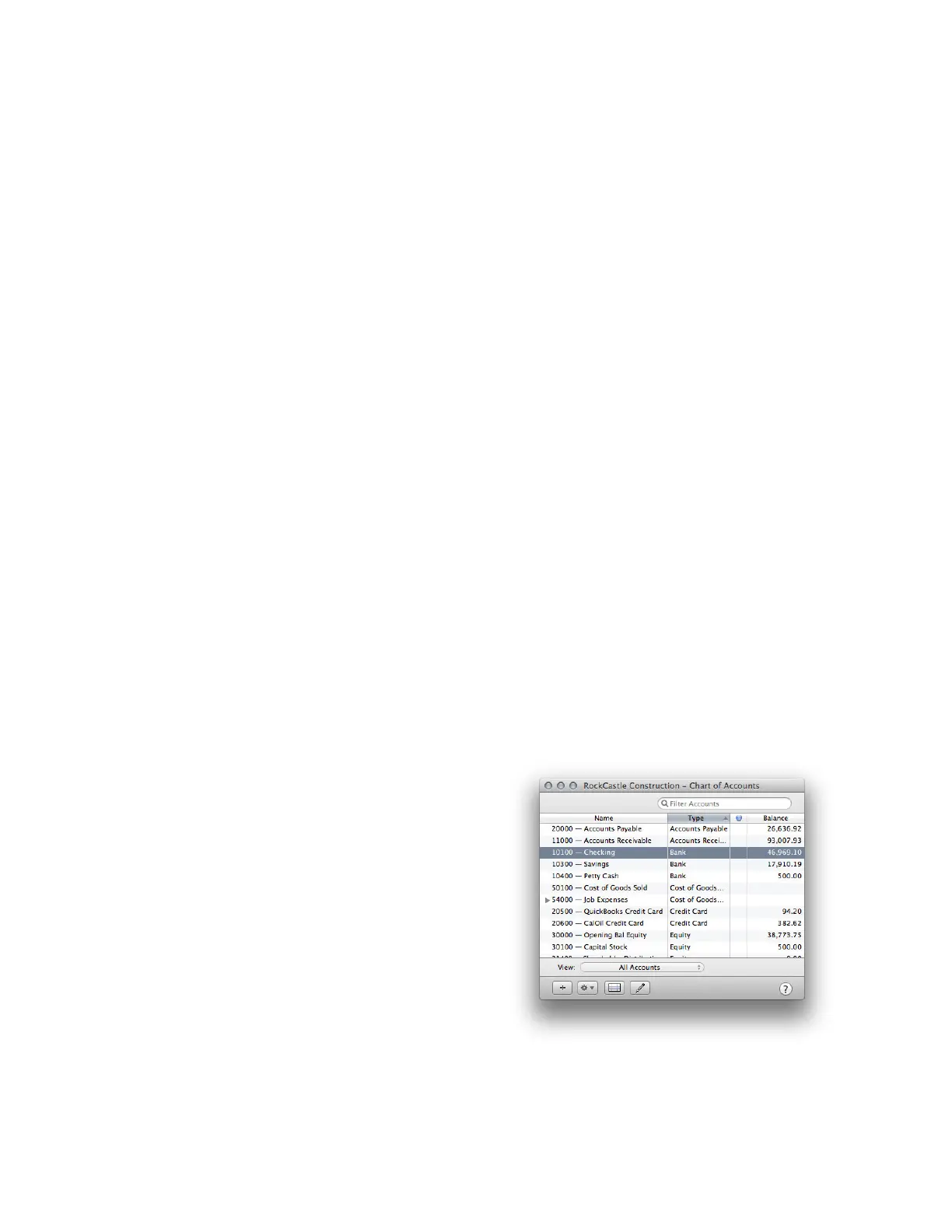

Enter transactions in your bank accounts last. This may

seem counterintuitive, but stay with me here. You

want to do this because your Accounts Payable and

Accounts Receivable accounts affect your QuickBooks

bank accounts (but not the actual account at your

bank). So the only bank transactions you’ll have to

enter in your bank account are those that are still

missing after you finish entering transactions for

accounts payable, accounts receivable, and payroll.

You must enter bills and invoices first before you enter

payments. If you tell QuickBooks you've made a

payment, QuickBooks needs to know what bill that

payment is for. Likewise, if a customer has sent you

their payment, then QuickBooks needs to know what

invoice the payment is for. That way QuickBooks knows which bills you've paid and what invoices your customers

have paid.

Loading...

Loading...