182 Section 13: Investment Analysis

File name: HP 12c Pt Converted_user's guide_English_HDP0F123E02_080207 Page: 200 of 281

Printed Date: { 2007/8/2Dimension: 14.8 cm x 21 cm

RPN Mode:

7. Key in the year desired then press \.

8. Key in the number of months in first year

*

and press t.

†

The display

will show the amount of depreciation for the desired year. Press ~ to see

the remaining depreciable value. If desired, press

:$:3=~-:M- to find the total depreciation through

the current year.

ALG Mode:

7. Key in the year desired then press ³.

8. Key in the number of months in first year* and press t.† The display will

show the amount of depreciation for the desired year. Press ~ to see the

remaining depreciable value. If desired, press

:$=:3-~-:M³ to find the total depreciation

through the current year.

9. Press t for the amount of depreciation then, if desired, press ~ for the

remaining depreciable value for the next year. Repeat this step for the

following years.

10. For a new case press gi000 and return to step 2.

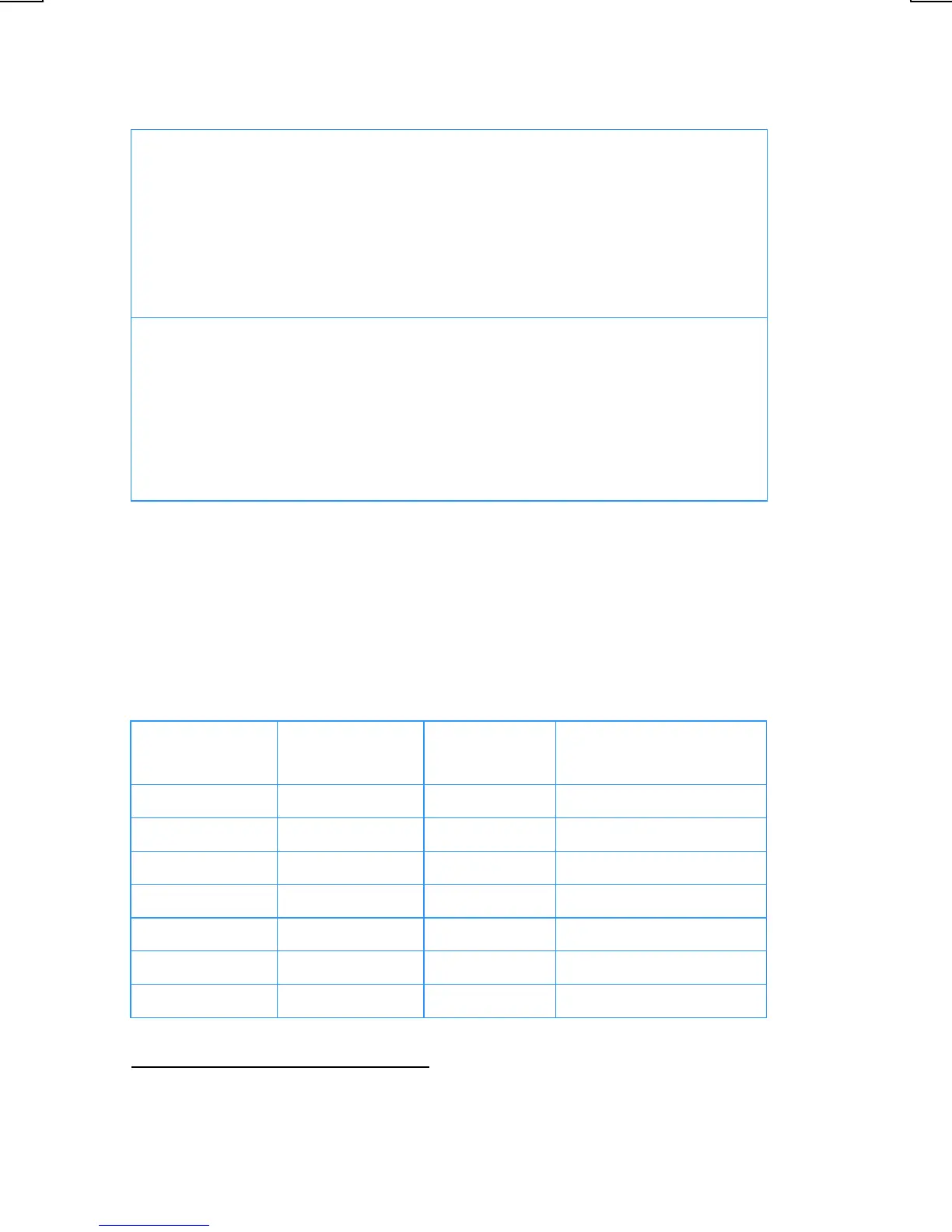

Example:

An electron beam welder which costs $50,000 is purchased 4 months

before the end of the accounting year. What will the depreciation be during the

first full accounting year (year 2) if the welder has a 6-year depreciable life, a

salvage value of $8,000 and is depreciated using the declining-balance

depreciation method

?

The declining-balance factor is 150%.

Keystrokes

(RPN mode)

Keystrokes

(ALG mode)

Display

f]

f[

f

CLEAR

G

f

CLEAR

G

50000

$

50000

$

50,000.00

Book value.

8000

M

8000

M

8,000.00

Salvage value.

150

¼

150

¼

150.00

Declining-balance factor.

6

n

6

n

6.00

Life.

2

\

2

³

2.00

Year desired.

*

Refer to straight-line depreciation instruction note, page 177.

†

The display will pause showing the year number before showing the amount of depreciation

for that year.

Loading...

Loading...