FINANCIAL MATHEMATICS

Annuities and Loan Repayments

Amortisation describes the process used to calculate the principal to interest portion

of an installment (for example monthly), the remaining principal and the amount of

principal and interest repaid up to any point to repay a debt.

Defined as: Amortise – gradually extinguish (debt) by money regularly put aside.

OPTIONS AVAILABLE IN F4 – AMORTISATION

BAL - balance of principal remaining after installment PM2

INT - interest portion of installment PM1

PRN - principal portion of installment PM1

Σ

ΣΣ

ΣINT - total interest from installment PM1 to payment of installment PM2

Σ

ΣΣ

ΣPRN - total principal from installment PM1 to payment of installment PM2

Loan schedule 1

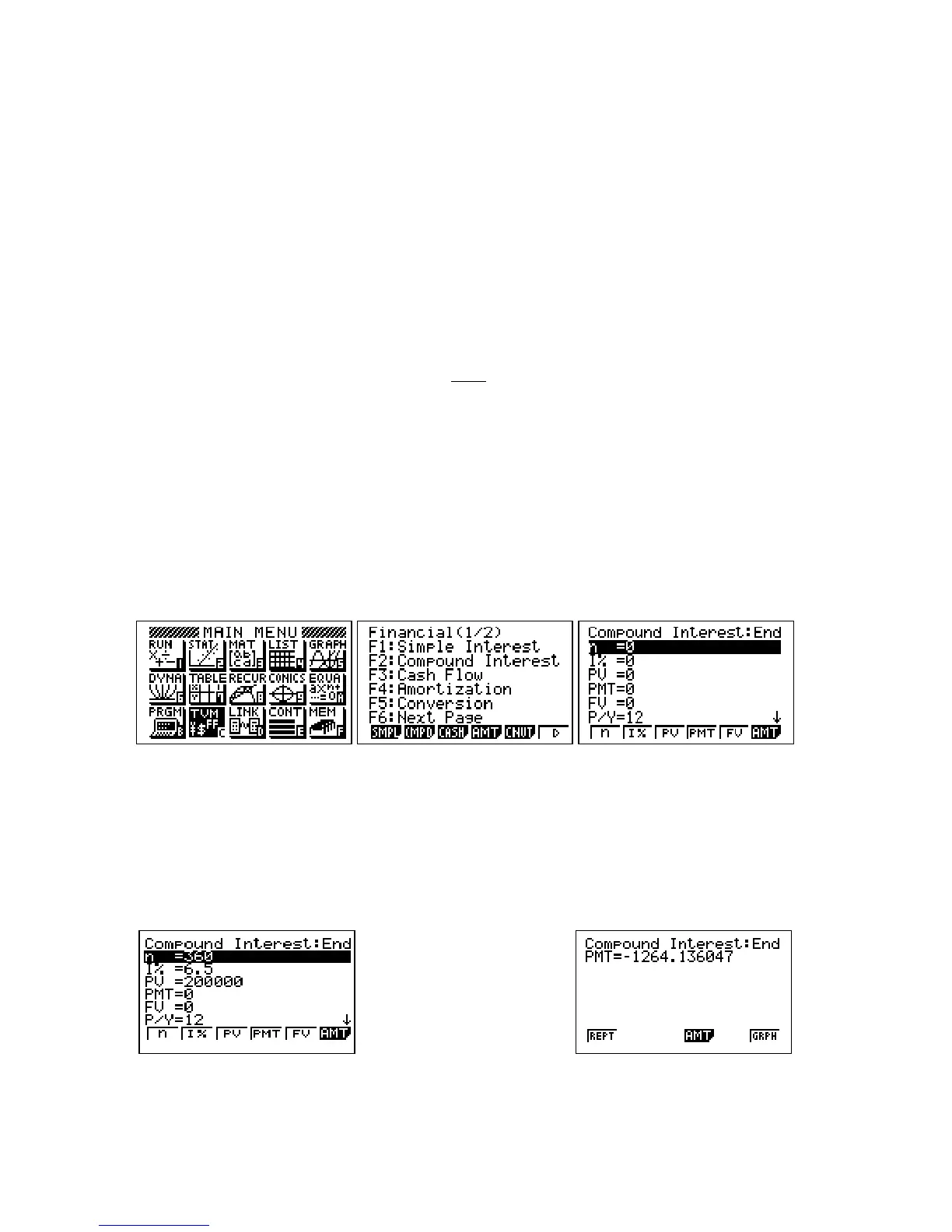

Initially, consider the repayments required to repay a loan of $200,000.00 at 6.5%

p.a, repaid monthly (and compounded monthly) over a 30-year period.

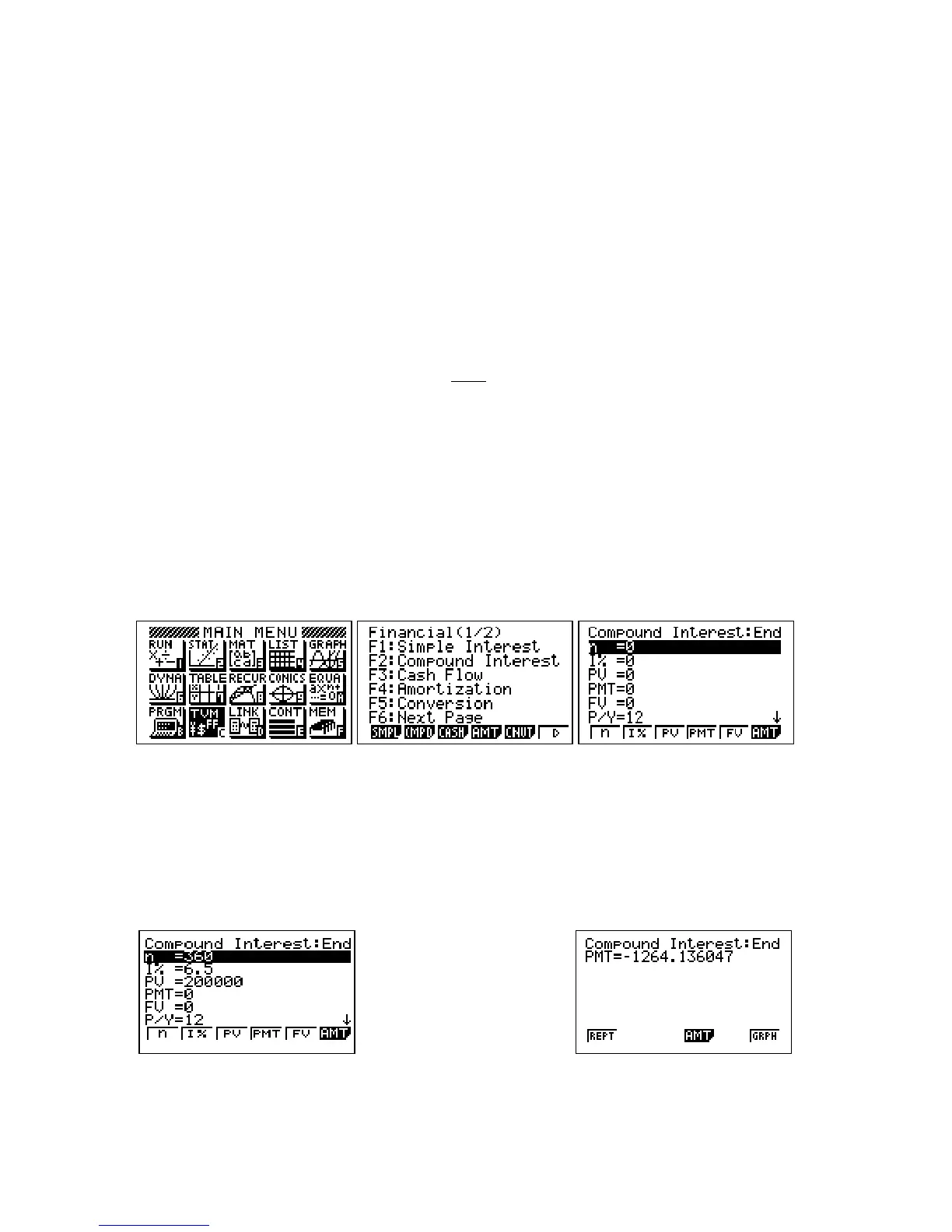

Enter the TVM module from the main menu, then press Compound Interest (F2)

Perform the following key operations from the input screen:

n = 30 x 12 EXE (360 months)

I% = 6.5 EXE (6.5% p.a)

PV = 200 000 EXE (Purchase Value = $200 000)

PMT = arrow down

FV = 0 EXE (Future Value = $0)

P/Y = 12 EXE (Payments per year)

C/Y = 12 EXE (Compounded monthly)

Press PMT (F4) to evaluate the amount of each payment for the period of the loan.

Press AMT (F4) to enter into the Amortisation module.

PM1 = initial installment

PM2 = final installment

Loading...

Loading...