14

Example 2: An office building was purchased for $1,400,000. The value

of depreciable improvements is $1,200,000.00 with a 35 year economic

life. Straight line depreciation will be used. The property is financed with a

$1,050,000 loan. The terms of the loan are 9.5% interest and $9,173.81

monthly payments for 25 years. The office building generates a Potential

Gross Income of $175,2000 which grows at a 3.5% annual rate. The

operating cost is $40,296.00 with a 1.6% annual growth rate. Assuming a

Marginal Tax Rate of 50% and a vacancy rate of 7%, what are the After-

Tax Cash Flows for the first 5 years?

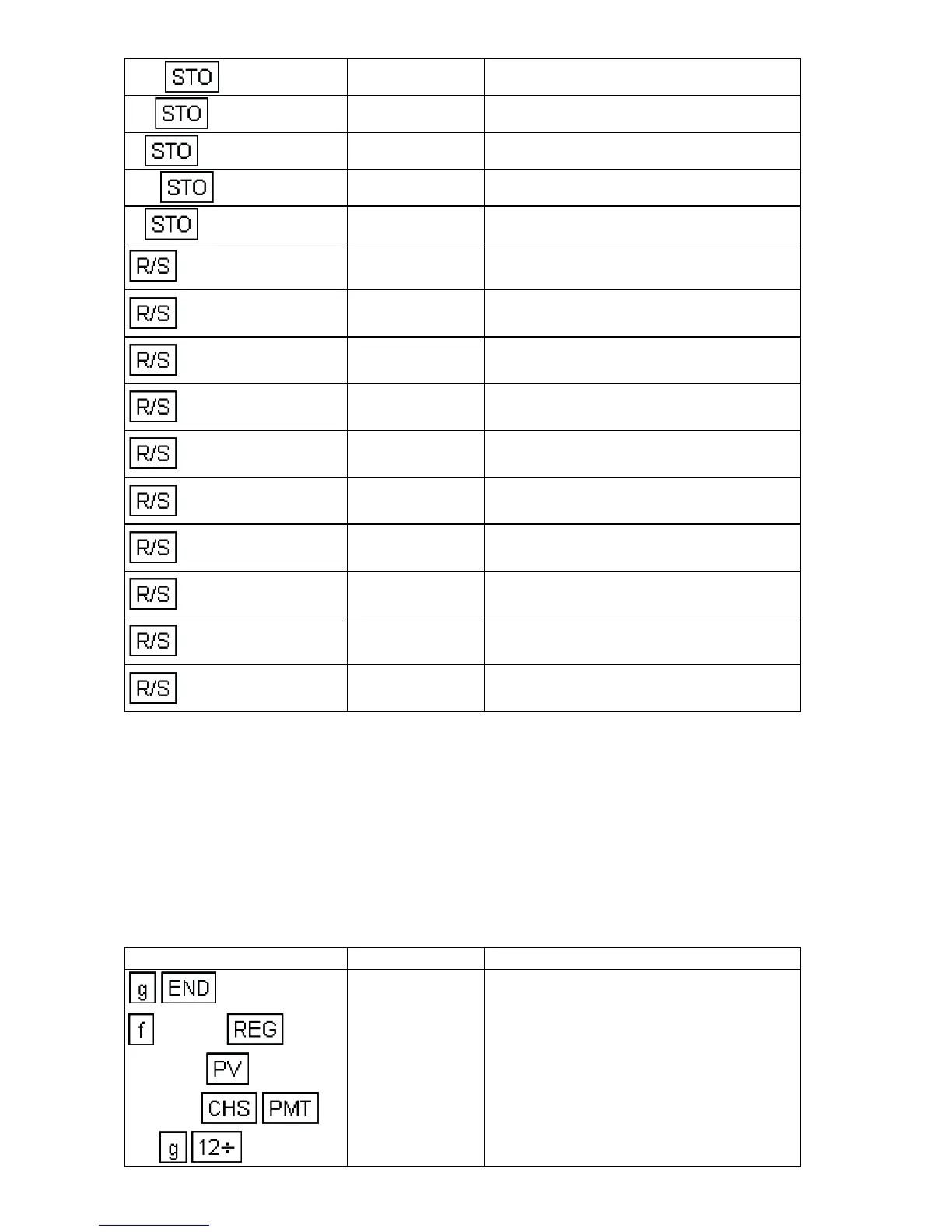

125 6

125.00 Decline in balance factor.

35 7

35.00 Marginal Tax Rate.

6 8

6.00 Potential Gross Income growth rate.

2.5 9

2.50 Operating cost growth.

5 .0

5.00 Vacancy rate.

1.00

-1,020.88

Year 1

ATCF

1

2.00

-822.59

Year 2

ATCF

2

3.00

-598.85

Year 3

ATCF

3

4.00

-72.16

Year 4

ATCF

4

5.00

232.35

Year 5

ATCF

5

6.00

565.48

Year 6

ATCF

6

7.00

928.23

Year 7

ATCF

7

8.00

1,321.62

Year 8

ATCF

8

9.00

1,746.81

Year 9

ATCF

9

10.00

-1,020.88

Year 10

ATCF

10

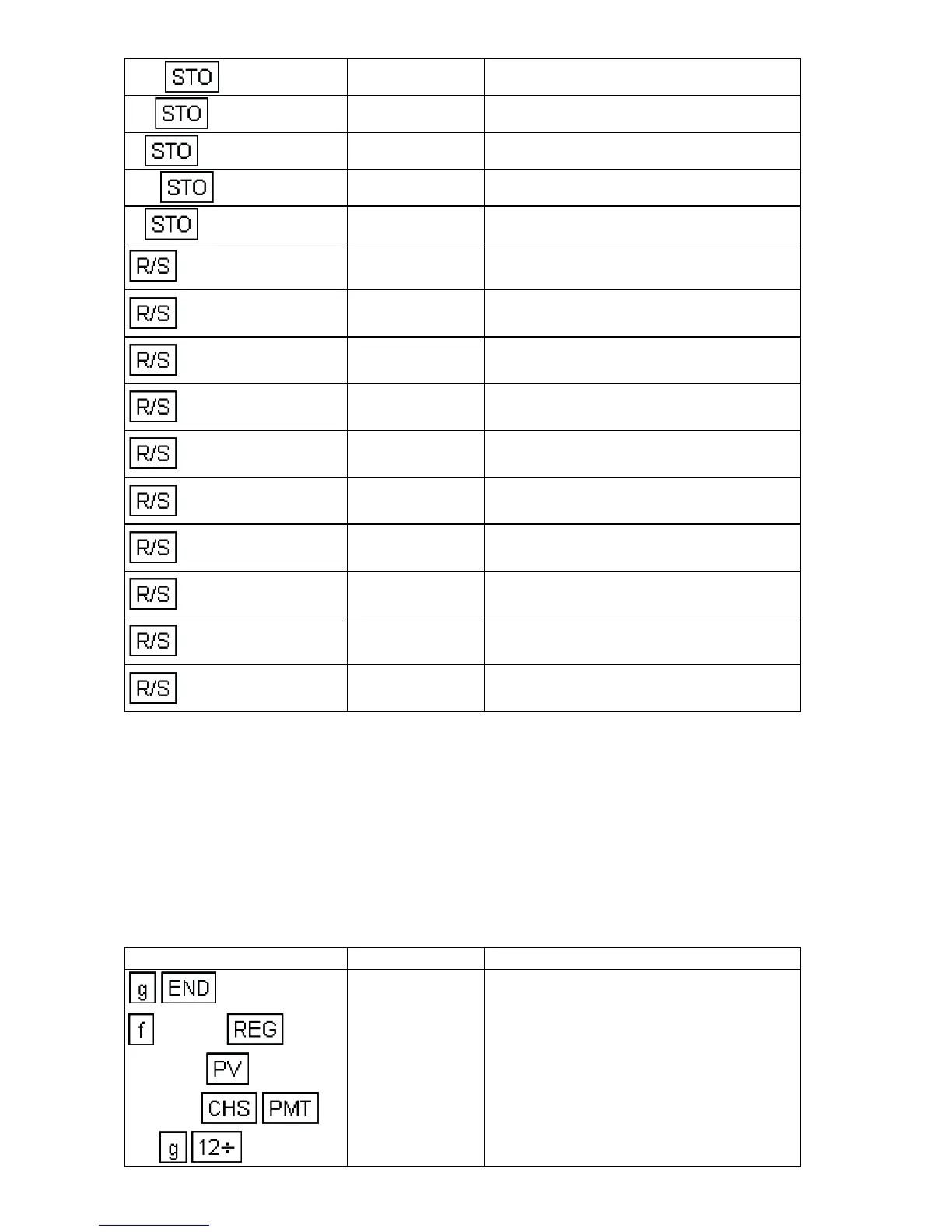

Keystrokes Display

CLEAR

1050000

9173.81

9.5

175,200.00 Potential Gross Income.

Loading...

Loading...