8

Before-Tax Reversions (Resale Proceeds)

The reversion receivable at the end of the income projection period is

usually based on forecast or anticipated resale of the property at that time.

The before tax reversion amount applicable to real estate analysis and

problems are:

• Sale Price.

• Cash Proceeds of Resale.

• Outstanding Mortgage Balance.

• Net Cash Proceeds of Resale to Equity.

The derivation of these reversions are as follows:

1. Forecast or estimate Sales Price. Deduct sales and Transaction Costs.

The result is the Proceeds of Resale.

2. Calculate the Outstanding Balance of the Mortgage at the end of the

Income Projection Period and subtract it from Proceeds of Resale. The

result is net Cash Proceeds of Resale.

Thus:

Cash Proceeds of Resale =

Sales Price - Transaction Costs.

Net Cash Proceeds of Resale =

Cash Proceeds of Resale - Outstanding Mortgage Balance.

Example: The apartment property in the preceding example is expected

to be resold in 10 years. The anticipated resale price is $800,000. The

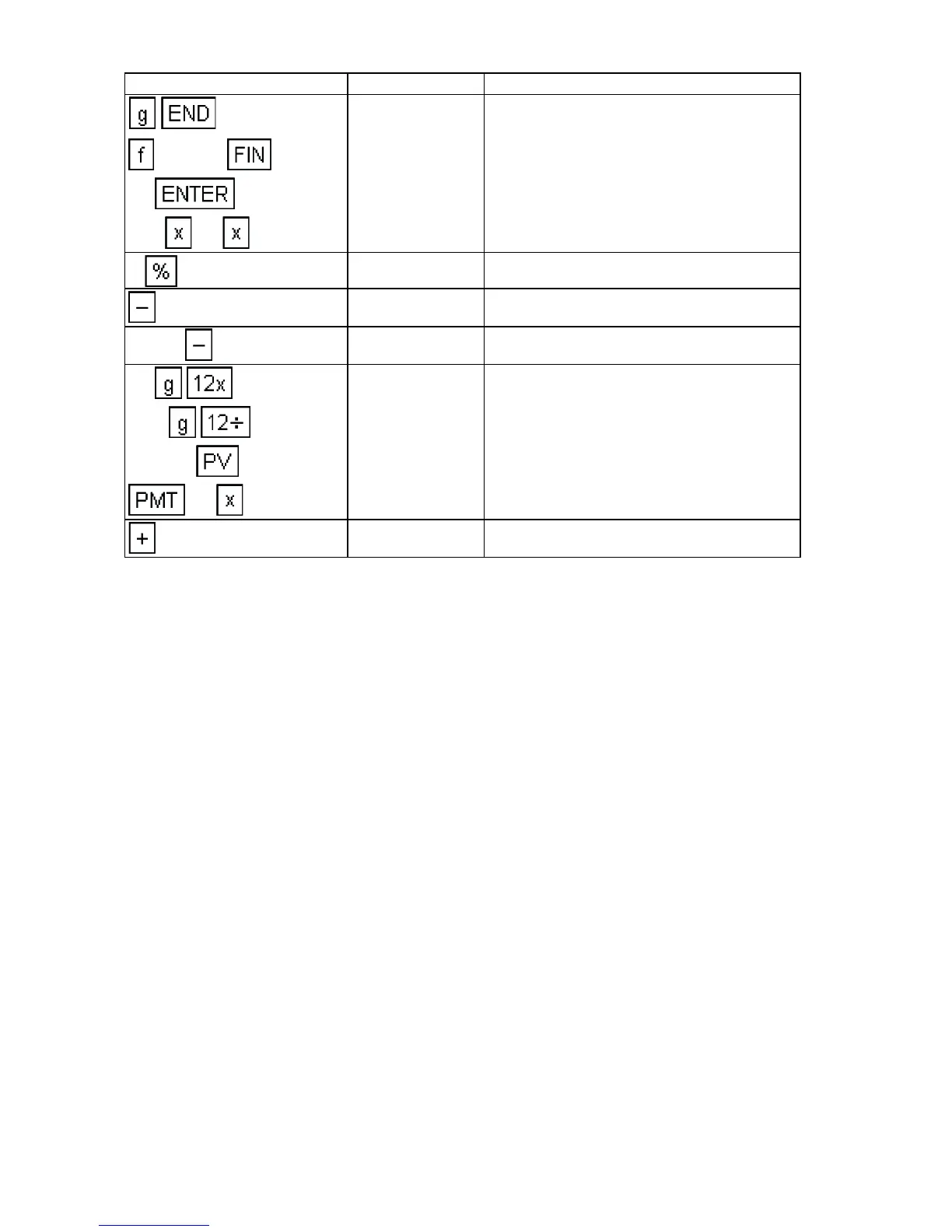

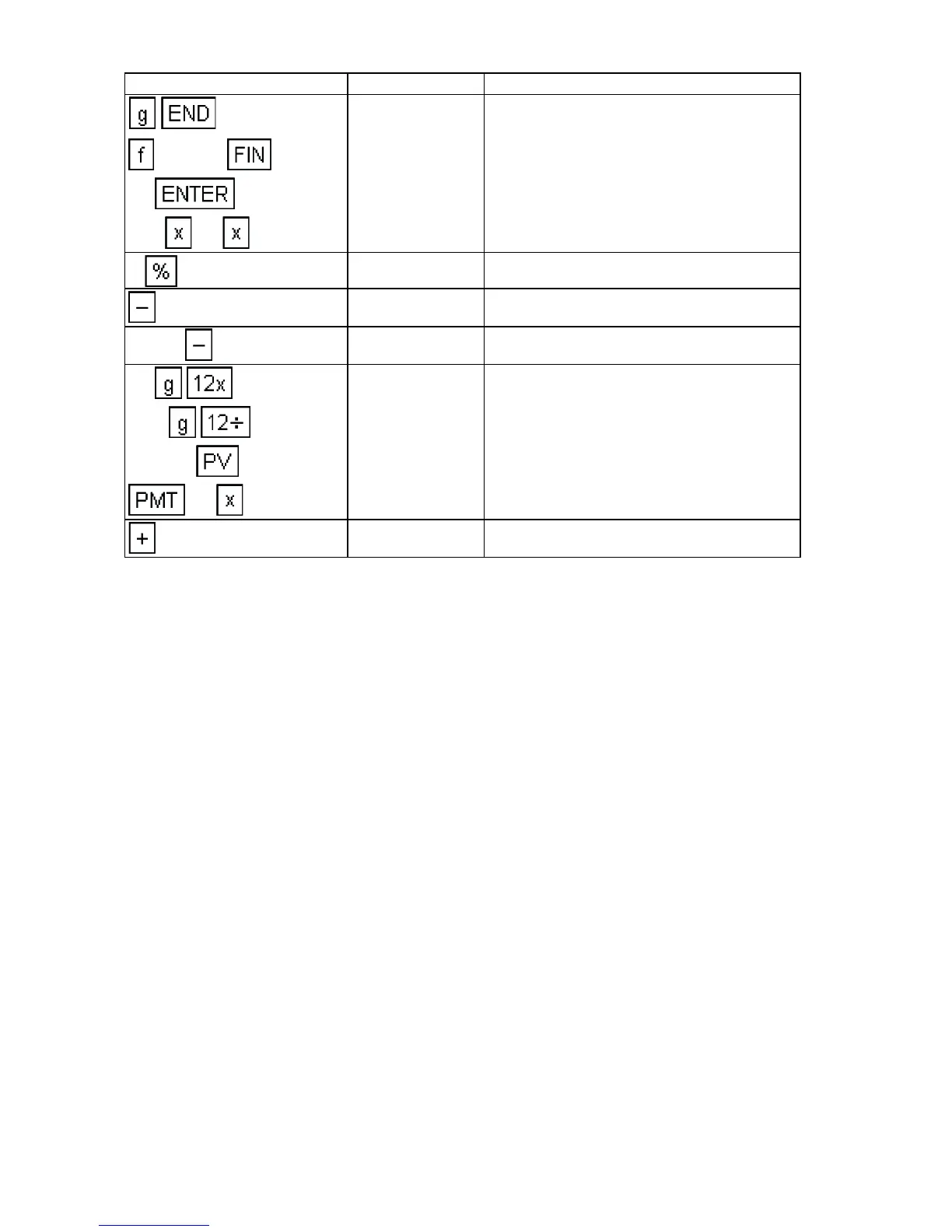

Keystrokes Display

CLEAR

60

250 12

180,000.00 Potential Gross Income.

5

9,000.00

Vacancy Loss.

171,000.00 Effective Gross Income.

76855

94,145.00 Net Operating Income.

20

11.5

700000

12

-89,580.09 Annual Debt Service.

4,564.91 Cash Throw-Off.

Loading...

Loading...