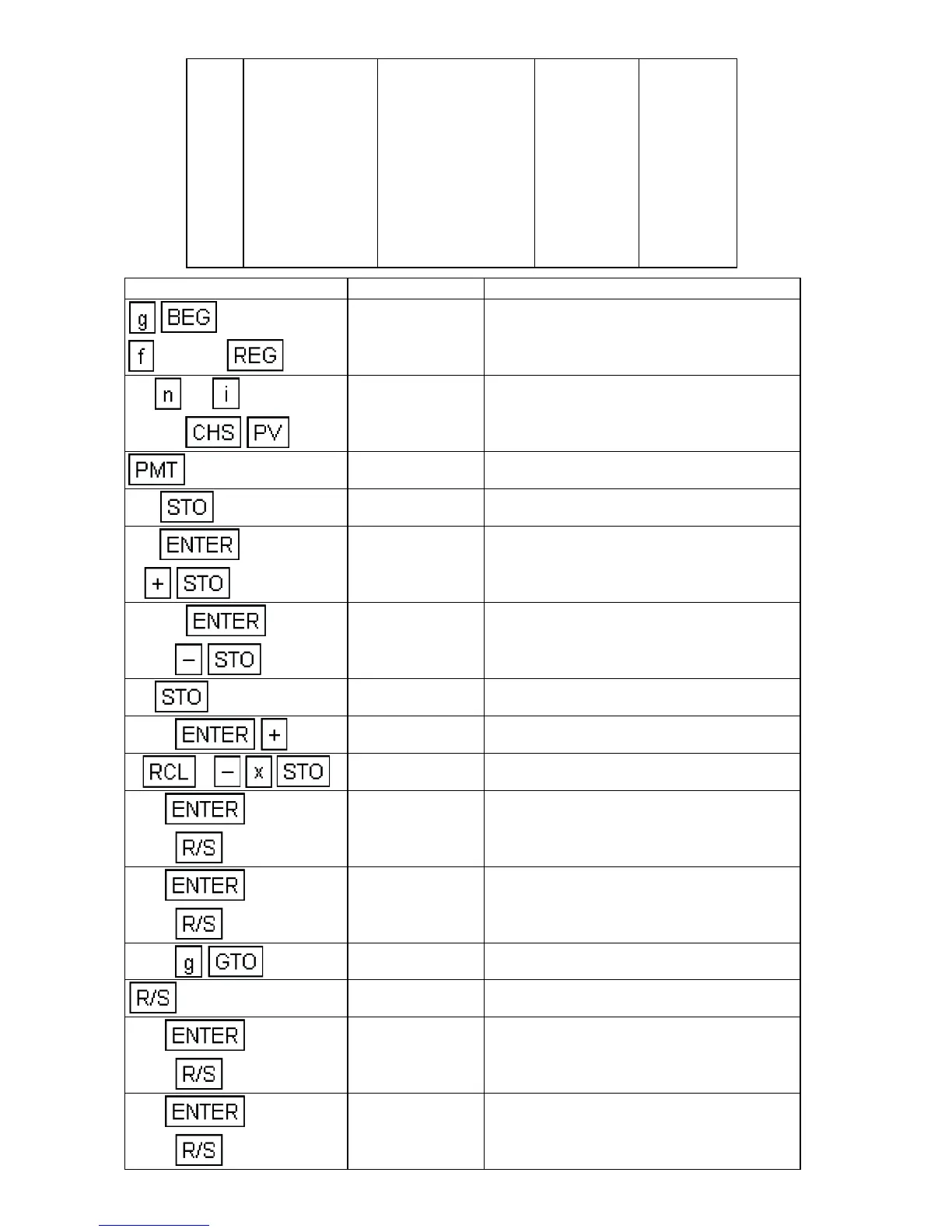

51

2

3

4

5

6

7

8

9

10

200

200

200

1500

300

300

300

300

300

1700

1700

1700

1700

1700

1700

1700

0

0

1000

750

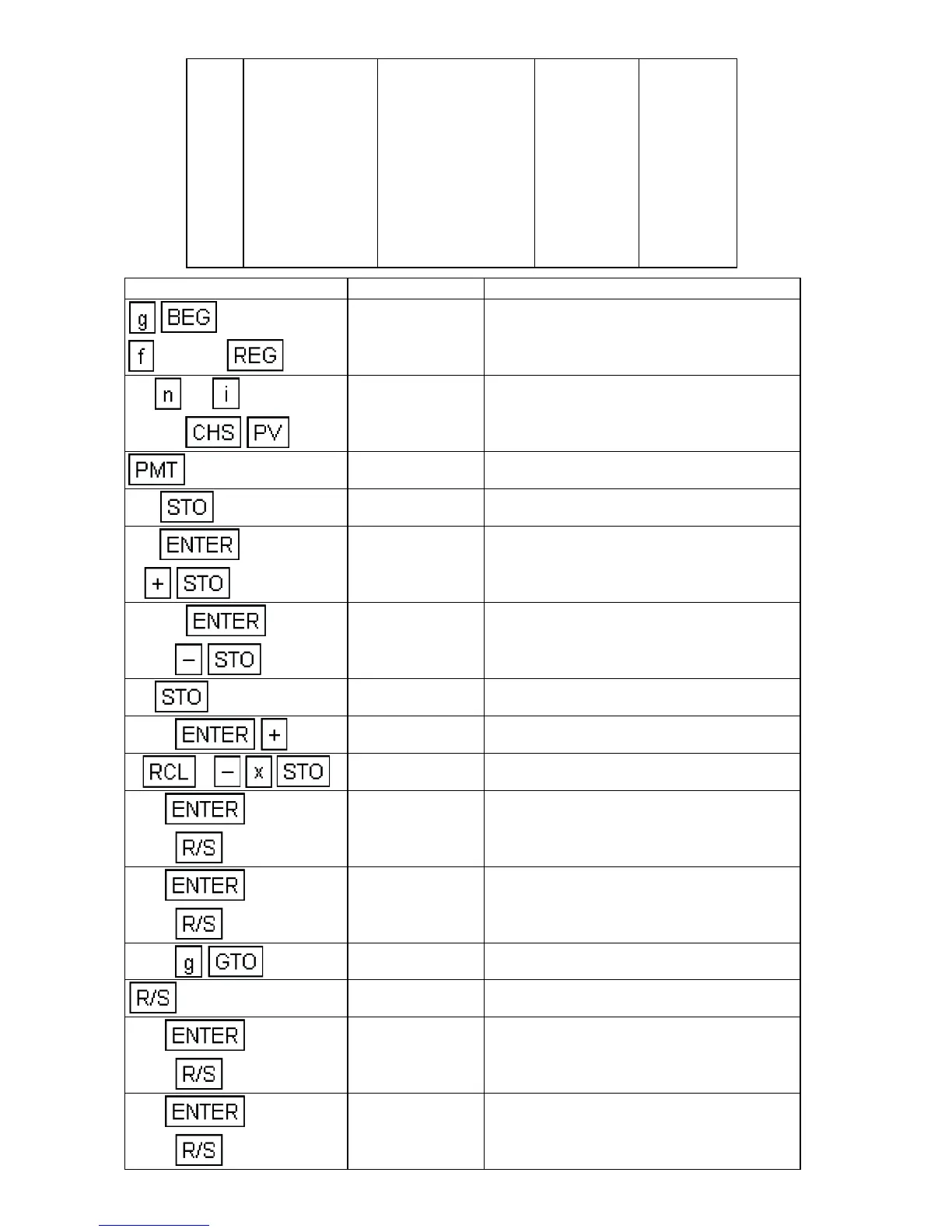

Keystrokes Display

CLEAR

0.00

10 12

10000

-10,000.00 Always use negative loan amount.

1,769.84 Purchase payment.

.48 3

0.48 Marginal tax rate.

.05

1 4

1.05 Discounting factor.

10000

1500 5

8,500.00 Depreciable value.

10 6

10.00 Depreciable life.

1700

3,400.00 1st lease payment.

1 3 2

1,768.00 After-tax expense.

200

1700

312.36

Present value of 1st year's net

purchase.

200

1700

200.43 2nd year's advantage.

1000 43

1,000.00 Tax credit.

907.03 Present value of tax credit.

200

1700

95.05 3rd year.

200

1700

-4.38 4th year.

Loading...

Loading...