60

Any of the five variables: a) list price, b) discount (as a percentage of list

price), c) manufacturing cost, d) operating expense (as a percentage), e)

net profit after tax (as a percentage) may be calculated if the other four are

known.

Since the tax rage varies from company to company, provision is made for

inputting your applicable tax rate. The example problem uses a tax rate of

48%.

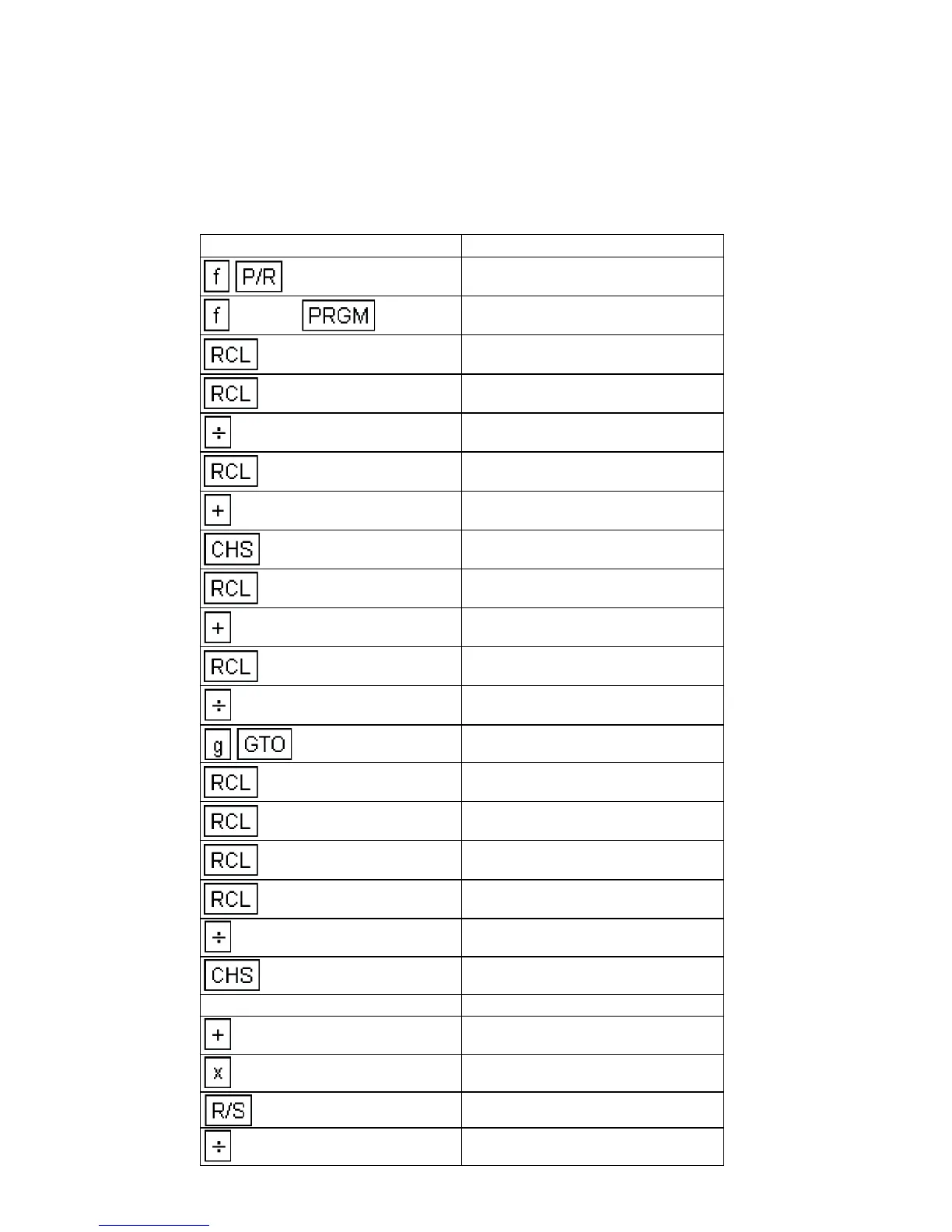

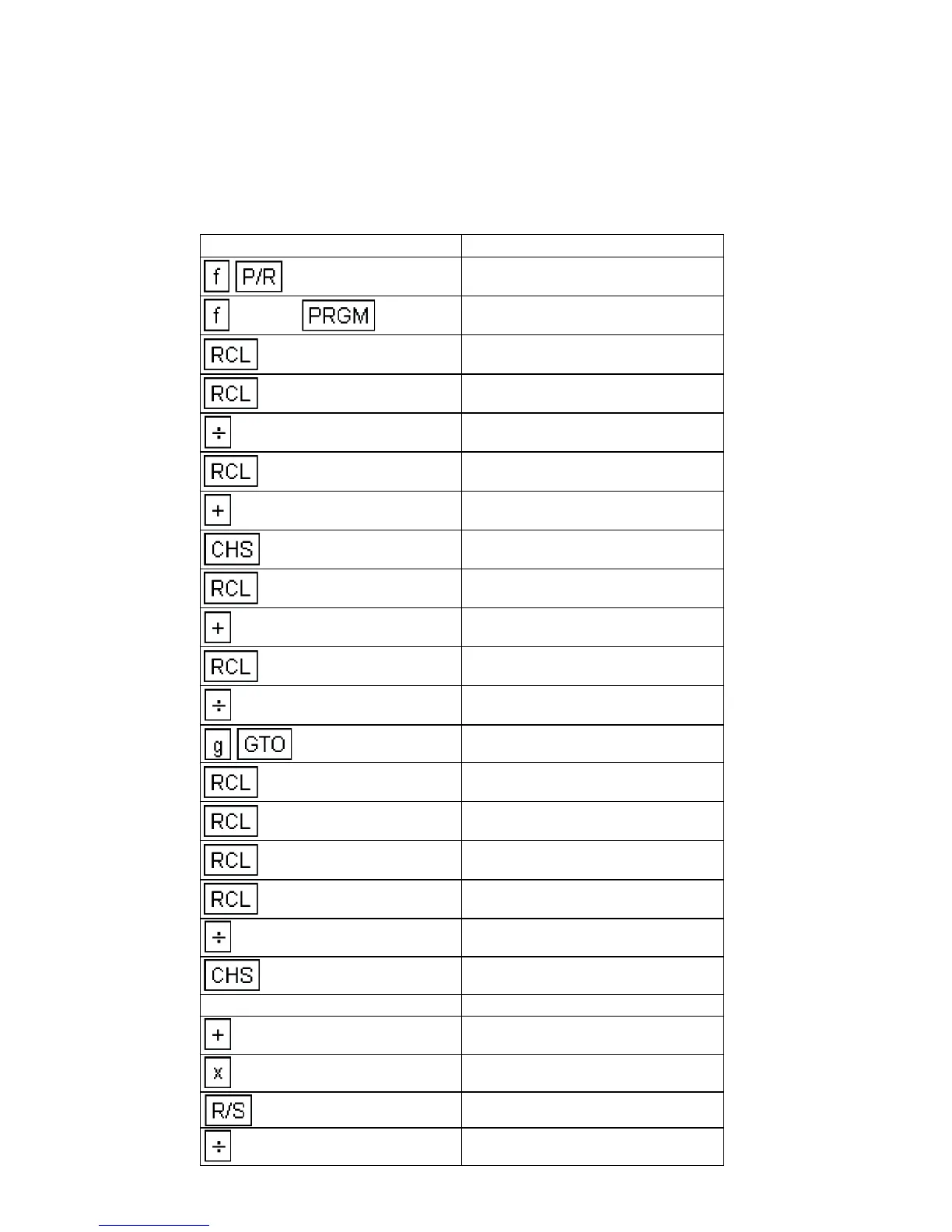

KEYSTROKES DISPLAY

CLEAR

00-

5

01- 45 5

6

02- 45 6

03- 10

4

04- 45 4

05- 40

06- 16

0

07- 45 0

08- 40

0

09- 45 0

10- 10

00

11-43, 33 00

3

12- 45 3

1

13- 45 1

2

14- 45 2

0

15- 45 0

16- 10

17- 16

1 18- 1

19- 40

20- 20

21- 31

22- 10

Loading...

Loading...