63

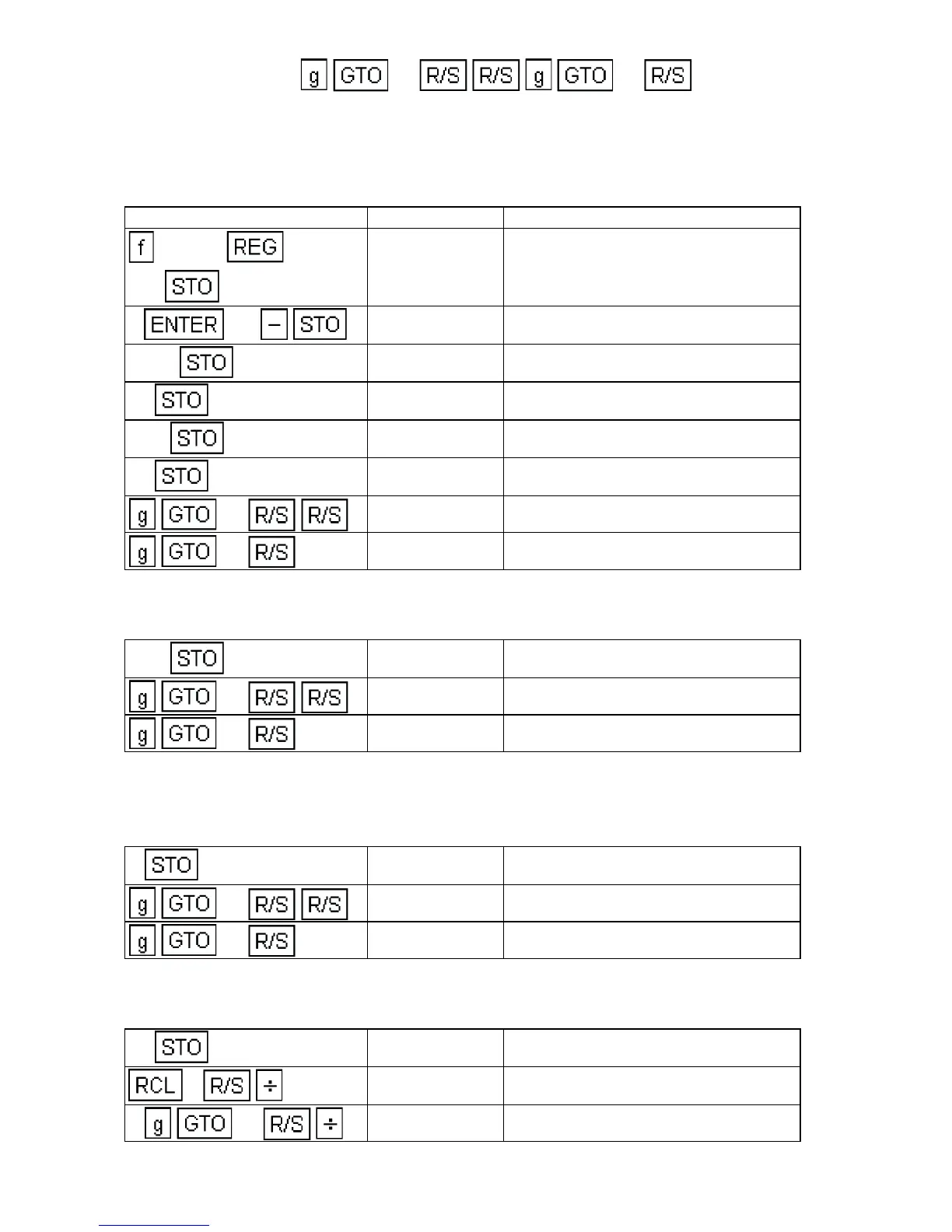

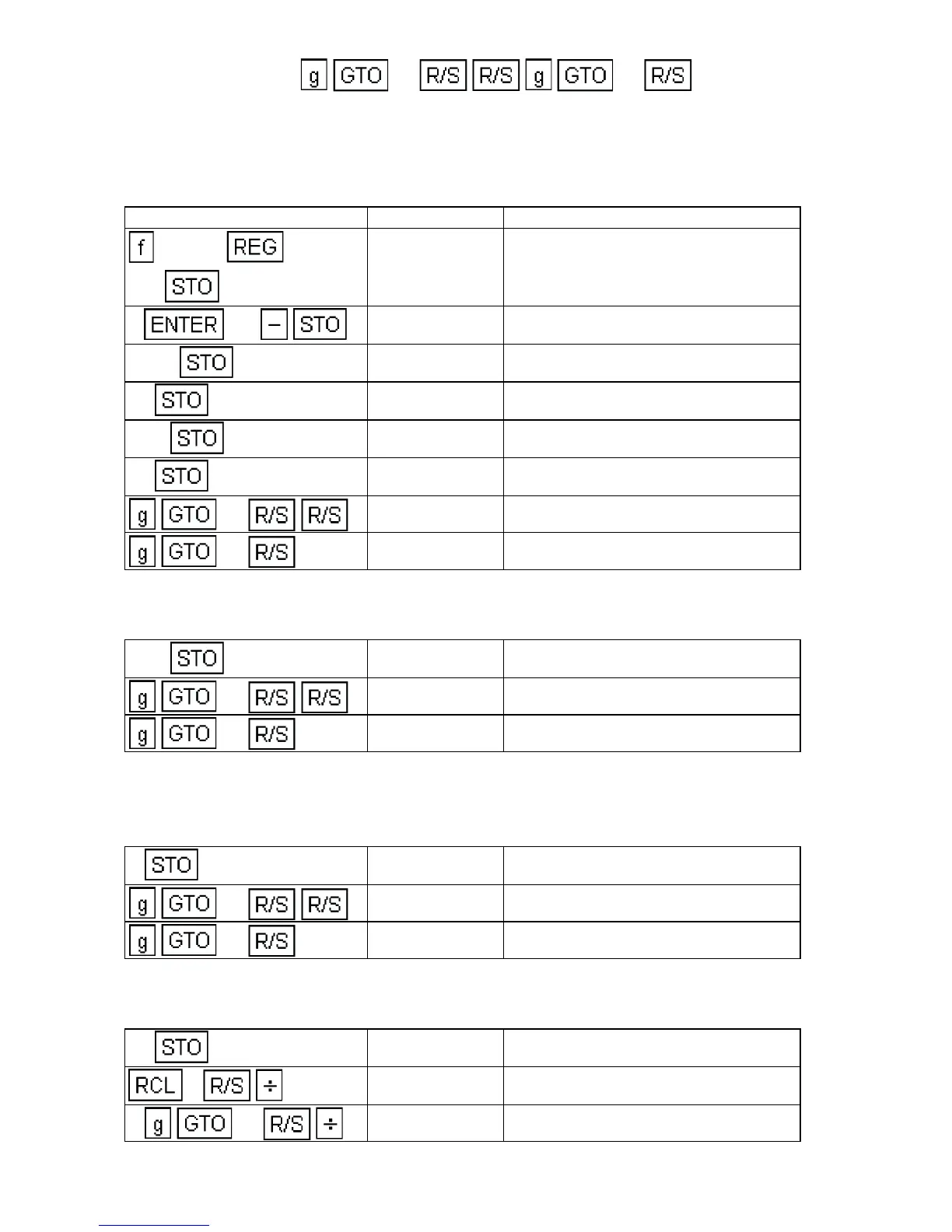

b. Press 12 43 .

Example: What is the net return on an item that is sold for $11.98,

discounted through distribution an average of 35% and has a

manufacturing cost of $2.50? The standard company operating expense

is 32% of net shipping (sales) price and tax rate is 48%.

If manufacturing expenses increase to $3.25, what is the effect on net

profit?

If the manufacturing cost is maintained at $3.25, how high could the

overhead (operating expense) be before the product begins to lose

money?

At 32% operating expense and $3.25 manufacturing cost, what should the

list price be to generate 20% net profit?

Keystrokes Display

CLEAR

100 0

100.00

1 .48 6

0.52 48% tax rate.

11.98 1

11.98 List price ($).

35 2

35.00 Discount (%).

2.50 3

2.50 Manufacturing cost ($).

32 4

32.00 Operating expenses (%).

12

67.90

43

18.67 Net profit (%).

3.25 3

3.25 Manufacturing cost.

12

58.26

43

13.66 Net profit reduced to 13.66%

0 5

0.00

12

58.26

38

58.26 Maximum operating expense (%).

20 5

20.00

3

11.00

1 14

16.93 List price ($).

Loading...

Loading...