CE47N Opntlon

Manual

Food Stamp

Transaction

Cash

Transaction

Food

Stamp

+

Taxable

1 and

Taxable

2

Method

I

Price of

items:

$1.00

and

$2.50

Tax:

$0.00

Total due:

$3.50

Amount tendered:

$5.00

(in

food stamps)

Amount due:

$3.50

Change amount

due:

$1.50

($0.50

in cash,

$1.00

in food stamps)

Price of item:

$5.00

Tax:

$0.00

Total due:

$5.00

Amount tendered:

$4.50

(cash)

and

$0.50

(change

from food stamp

transaction)

Total:

$5.00

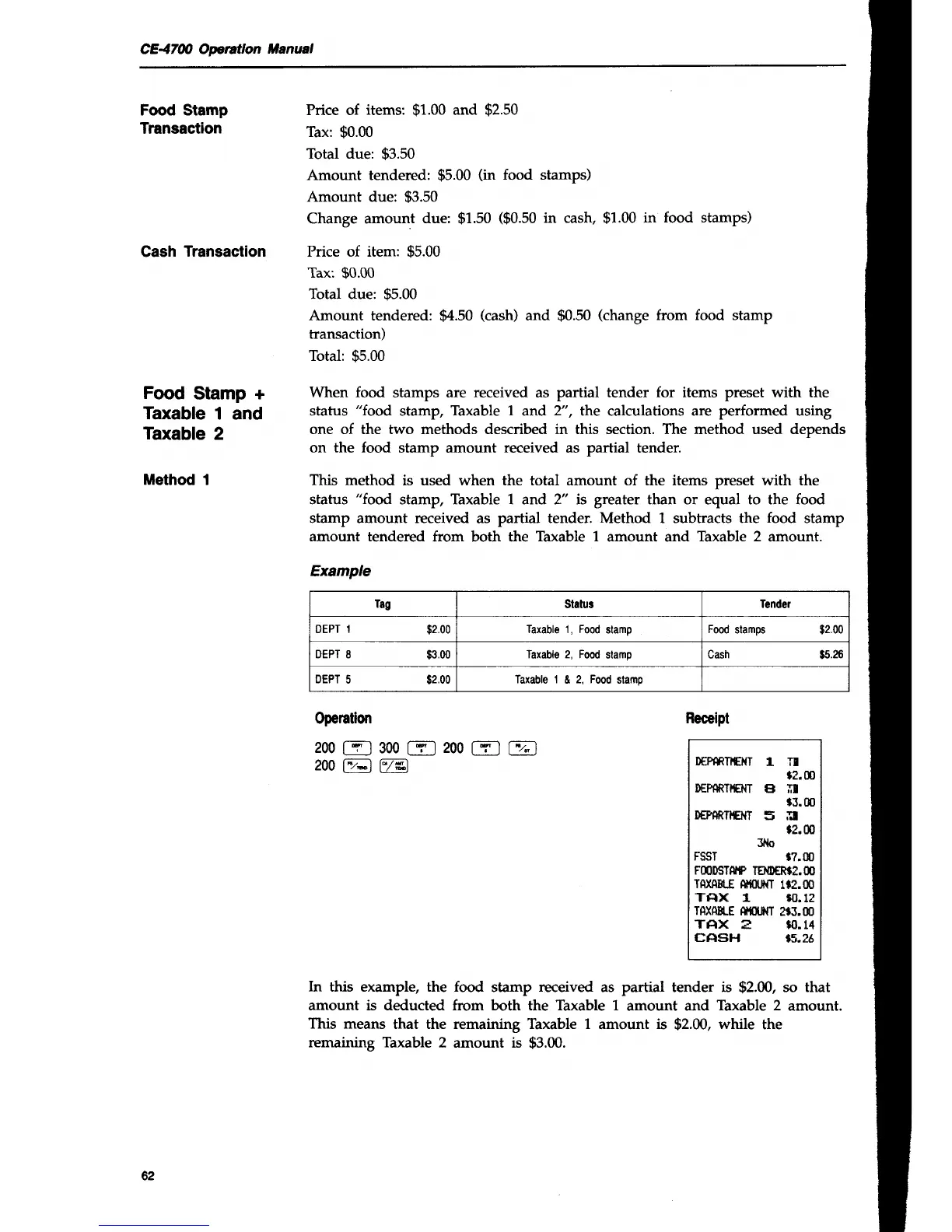

When food

stamps are

received

as

partial tender for items preset with the

status

"food

stamp, Taxable

1

and

2",

the calculations are performed using

one of the two methods described in this section. The method used depends

on the food

stamp amount

received

as

partial

tender.

This method

is used when the total amount of the items preset with the

status

"food

stamp, Thxable 1 and 2" is

greater

than or equal to the food

stamp amount received

as

partial

tender. Method 1 subtracts the

food

stamp

amount tendered

from

both

the

Thxable L

amount and

Thxable 2

amount.

Example

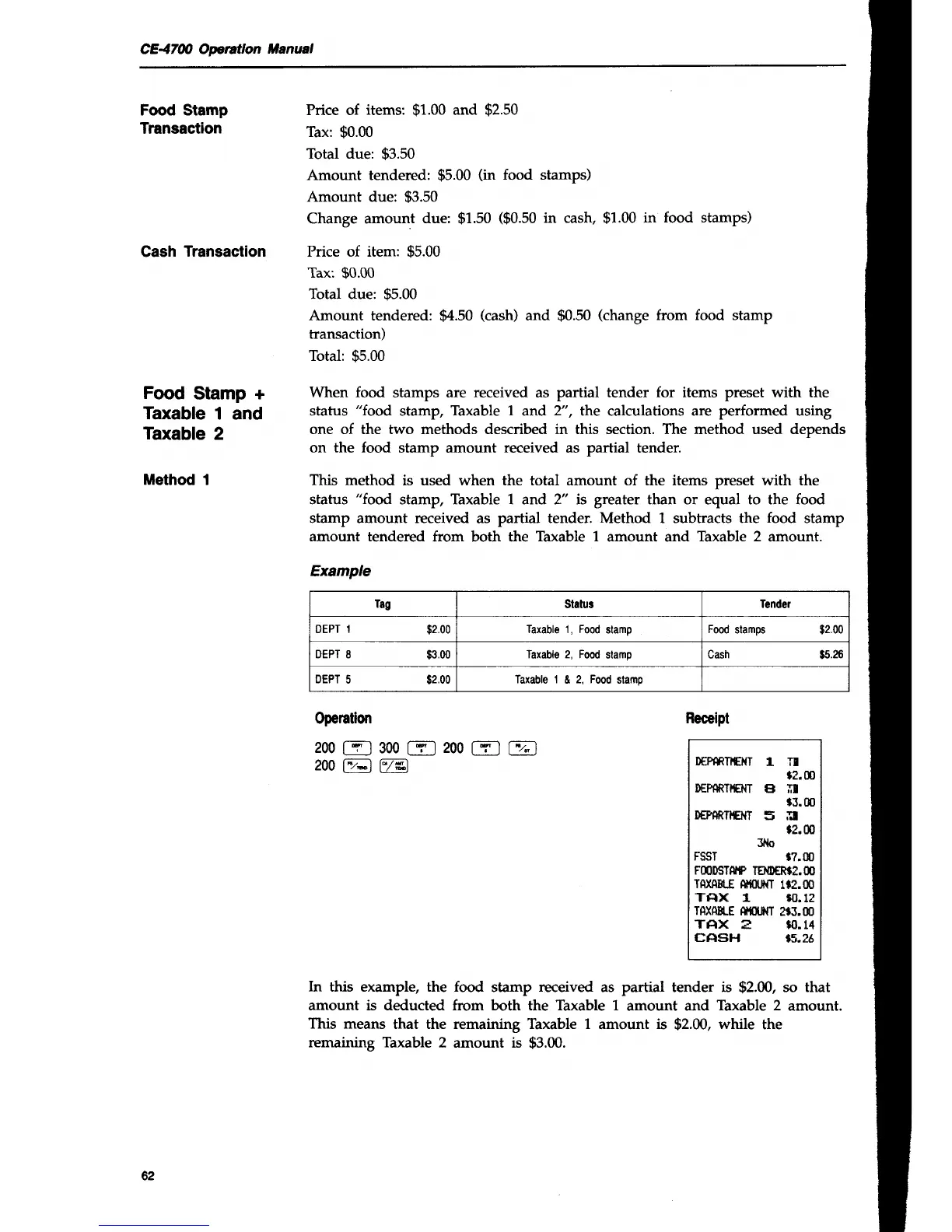

Operatlon

200

t-fl]

300

T'rrl

200

t-Y

I

f"Z;]

200

l*t

gA

Receipt

DEffiTIGilT

1 TI

t2.m

DEPARTI{€NT

8 ;iI

t3.m

DEPffilI€NT

5

;iI

t2.00

3t{o

FSST

r?,00

FMMTOf

TEIID€ffiI.M

TRXABLE

AI{TJI{T

Itz.M

TAX

1 flt.12

TAXAH-E

Afiou{T

213.00

TAX

e $.14

CASH

t5.?6

In this example, the food

stamp

received

as partial tender is

$2.00,

so that

amount is deducted from both the Thxable 1

amount and

Thxable

2 amount.

This means

that the remaining Taxable 1

amount

is

$2.00,

while

the

remaining Thxable

2 amount is

$3.00.

Tag

Strtus

Tendel

DEPT

1

$2.00

Taxable 1, Food

stamp

Food

stamos

$2.00

DEPT

8 $3.00

Taxable 2, Food

stamp Cash

$5.26

DEPT

5 $2.00

Taxable 1

&

2. Food

stamo

62

Loading...

Loading...