18

Key function/machine feature (P3)

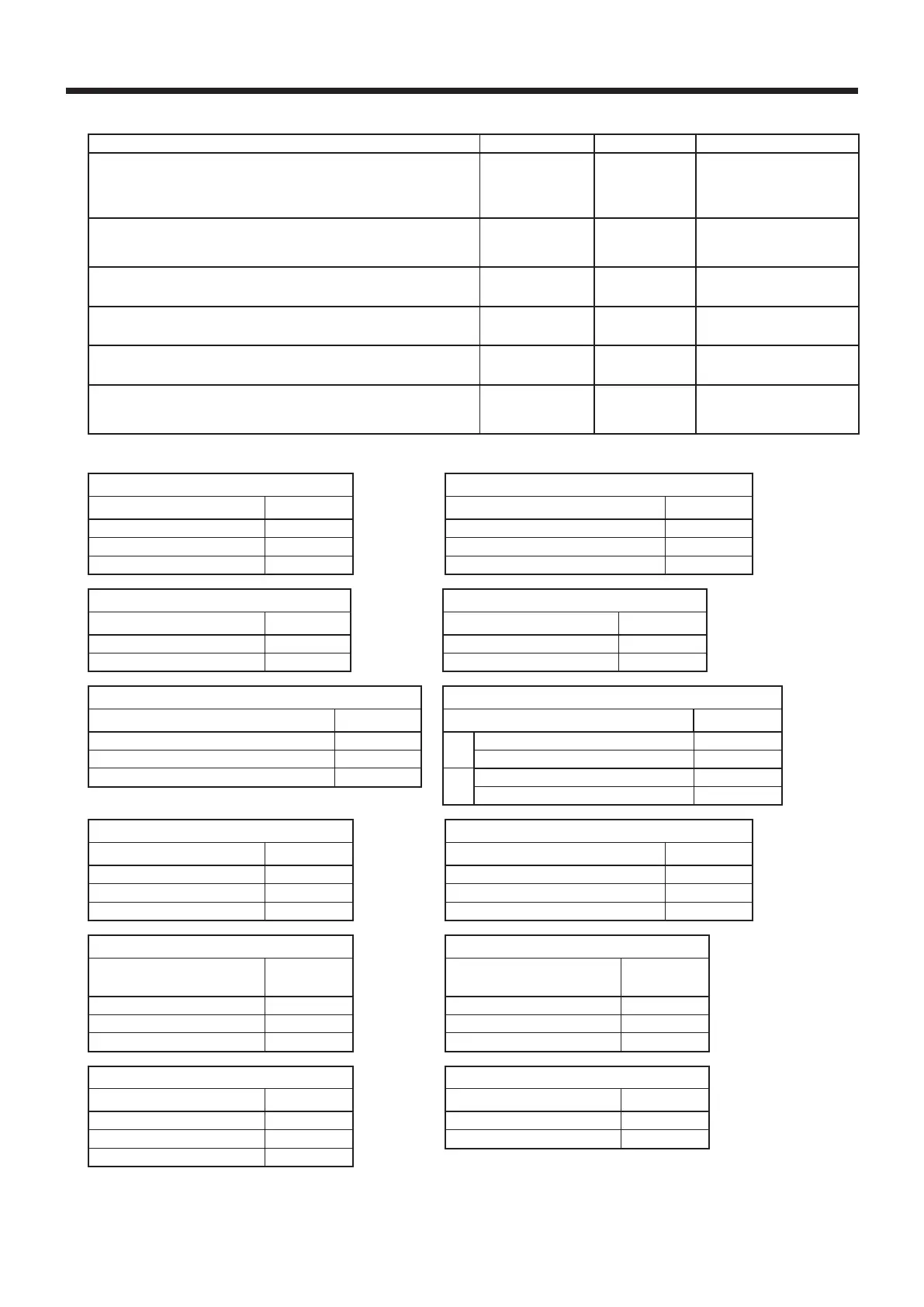

Address code 04 (tax system, rounding, etc.)

Description Choice Program code Initial value

Apply rounding for registration:

No rounding = 0, IF1 = 1, IF2 = 2, Danish = 3, Norwegian = 4,

Singaporean = 5, Finnish = 6, Australian, Canadian = 7, South

African = 8, Other roundings = 9 (Refer to D

1

)

Signicant number

(0~9)

:

D

10

;

D

10

Tax system:

Single tax system = 0, U.S. tax system = 1, Canadian tax system = 2,

Singaporean tax system = 3

Signicant number

(0~3)

:

D

9

;

Or

A

(Other area (U.S.) than U.S.) D

9

Always “000”

;;;

D

8

D

7

D

6

;;;

D

8

D

7

D

6

Always “000”

;;;

D

5

D

4

D

3

;;;

D

5

D

4

D

3

Print invoice number on receipt.

No = 0

Yes =1

:

D

2

;

D

2

Other roundings:

New Zealander (A) = 0, New Zealander (B) = 1, Malaysian = 2,

Czech = 3 (D

10

must be set to “9”.)

Signicant number

(0~3)

:

D

1

;

D

1

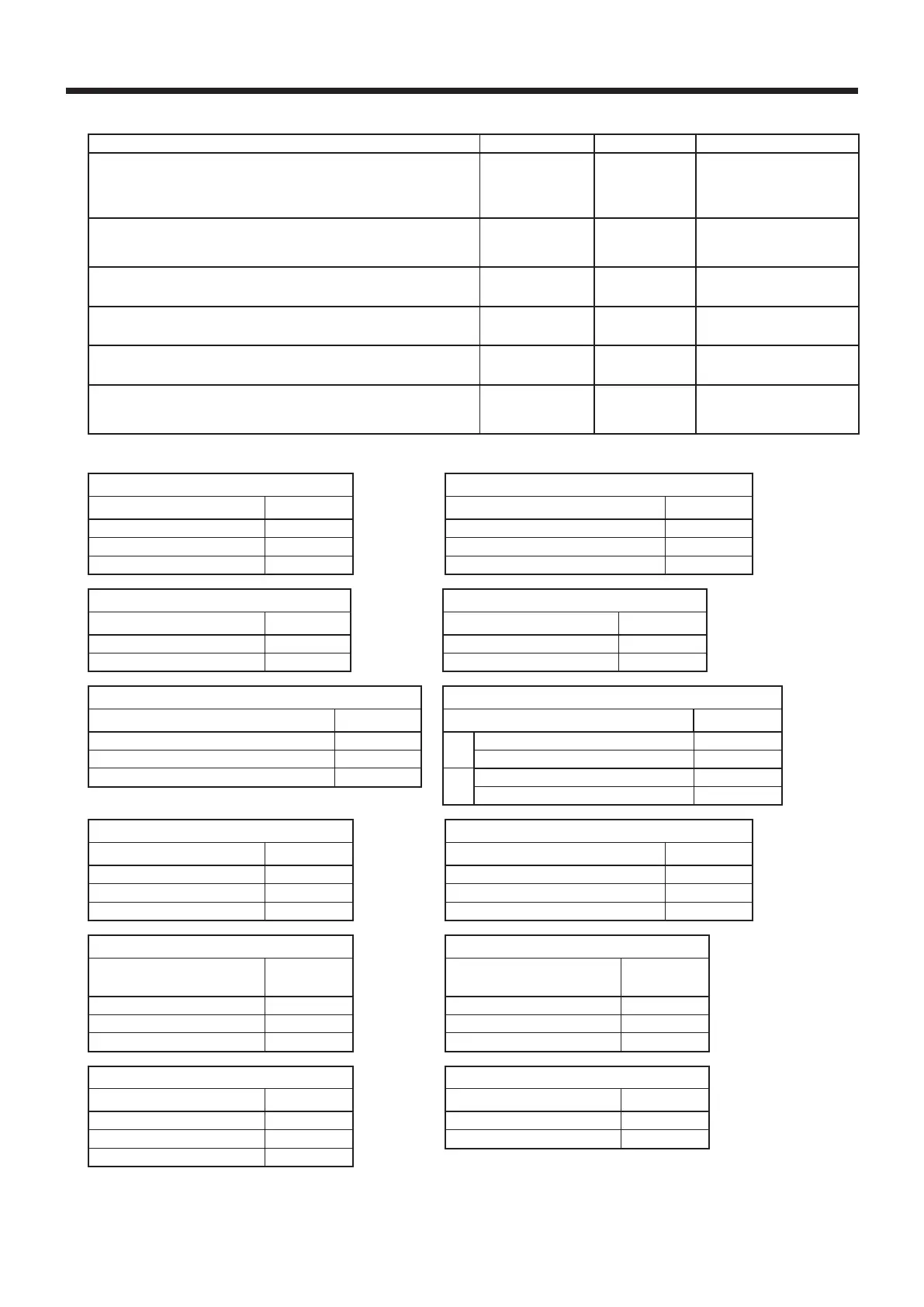

Rounding

IF 1 rounding Finnish rounding

Last 1 digit of subtotal Result Last 1 digit of subtotal/cash change Result

0~2 0 0~2 0

3~7 5 3~7 5

8~9

10

8~9

10

IF 2 rounding South African rounding

Last 1 digit of subtotal Result Last 1 digit of subtotal Result

0~4 0 0~4 0

5~9 10 5~9 5

Singaporean rounding New Zealander (A/B) rounding

Last 1 digit of item, %+, %- registration Result Last 1 digit of subtotal/cash change Result

0~2 0

A

0~4 0

3~7 5 5~9 10

8~9 10

B

0~5 0

6~9 10

Danish rounding Malaysian rounding

Last 2 digits of subtotal Result Last 1 digit of subtotal/cash change Result

00~24 00 0~2 0

25~74 50 3~7 5

75~99 100 8~9 10

Australian rounding Canadian rounding

Last 1 digit rounding

(only for cash transactions)

Result

Last 1 digit rounding

(only for cash transactions)

Result

0~2 0 0~2 0

3~7 5 3~7 5

8~9 10 8~9 10

Norwegian rounding

Czech rounding

Last 2 digits of subtotal Result Last 2 digits of subtotal Result

0~24 0 00~49 00

25~74 50 50~99 100

75~99 100

Loading...

Loading...