134

Section 13

Investment Analysis

Partial-Year Depreciation

For both income tax purposes and financial analyses, it is valuable to calculate

depreciation based on a calendar or fiscal accounting year. When the acquisition

date of an asset does not coincide with the start of the year – which is the rule

rather than the exception – the amounts of depreciation in the first and last years

are computed as fractions of a full year’s depreciation.

Straight-Line Depreciation

The following HP 12C Platinum program (written in RPN mode) calculates the

straight-line depreciation for the year desired with the acquisition date occurring

at any time during the year.

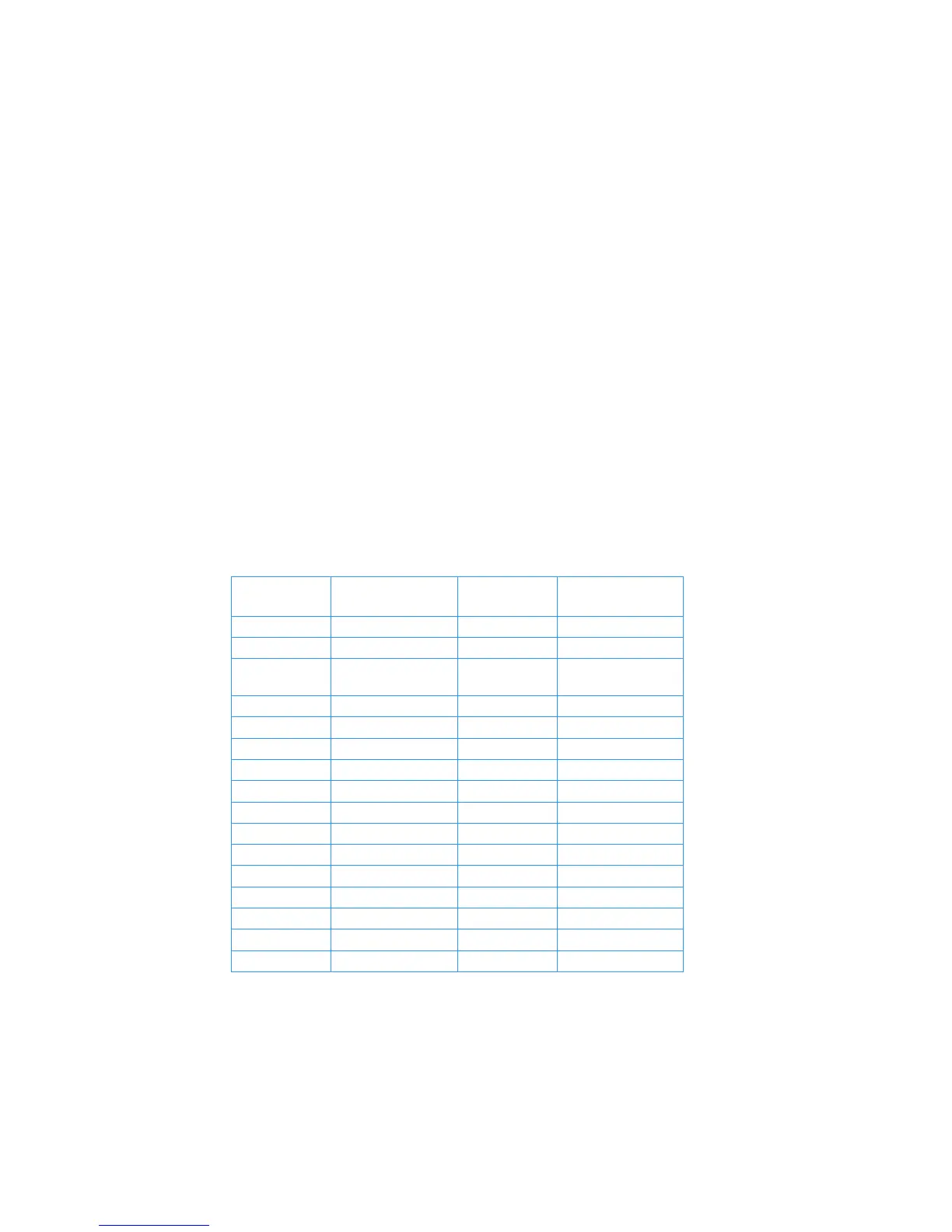

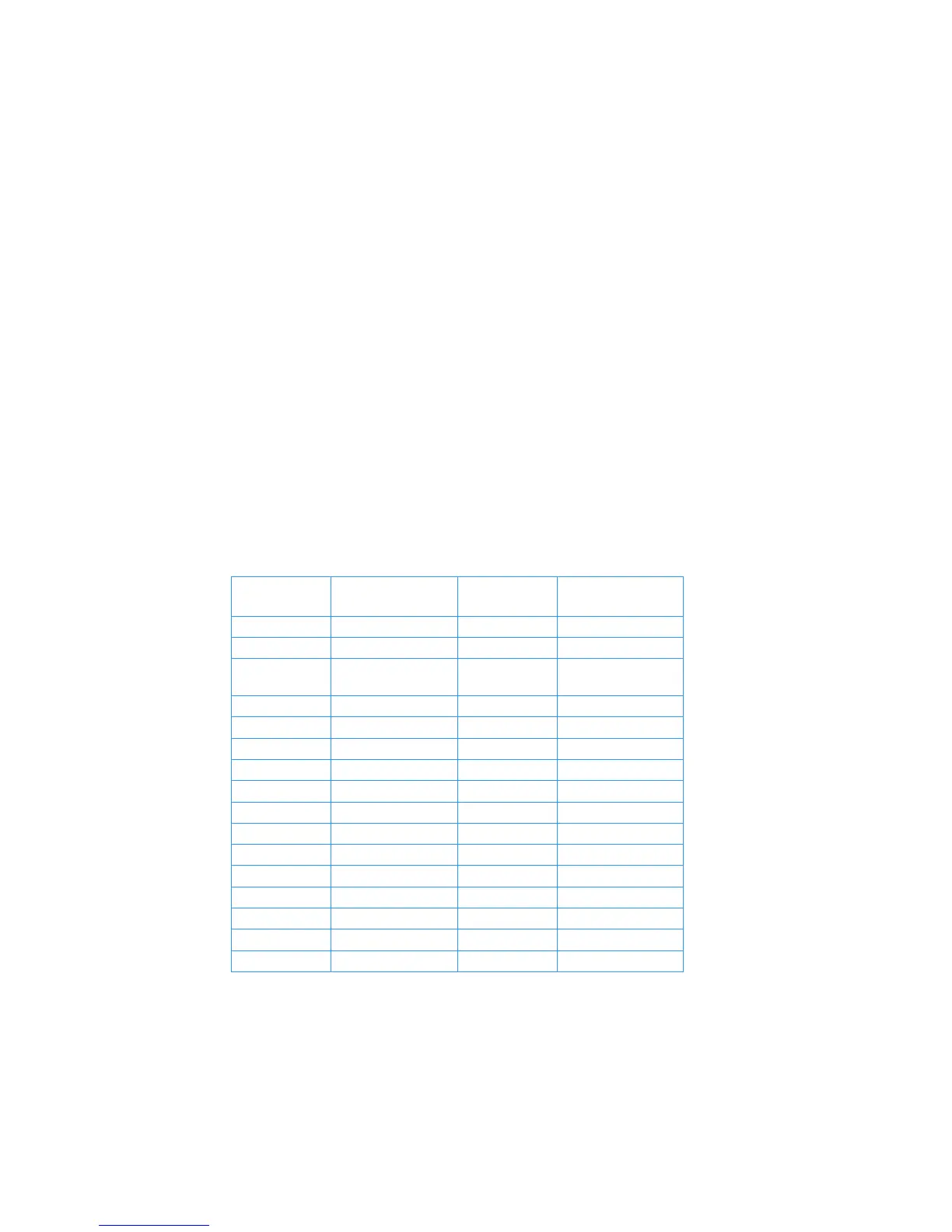

KEYSTROKES

(RPN mode)

DISPLAY

KEYSTROKES

(RPN mode)

DISPLAY

f] -

021, 30

fs

000,

n

022, 11

fCLEAR

Î

000,

:0

023, 45 0

1

001, 1

gm

024, 43 35

2

002, 2

gi035

025, 43,33,035

z

003, 10

:2

026, 45 2

?1

004, 44 1

gu

027, 43 31

~

005, 34

:0

028, 45 0

?2

006, 44 2

fV

029, 42 23

1

007, 1

t

030, 31

-

008, 30

1

031, 1

?0

009, 44 0

?=0

032, 44 40 0

1

010, 1

?=2

033, 44 40 2

fV

011, 42 23

gi026

034, 43,33,026

:1

012, 45 1

:2

035, 45 2

§

013, 20

gu

036, 43 31

Loading...

Loading...