Section 13: Investment Analysis 137

Example 2: A new car was purchased for $6,730 with 4½ months remaining in

the year. If the expected life of the car is 5 years, what is the amount of

depreciation in the first year?

Declining-Balance Depreciation

The following HP 12C Platinum program (written in RPN mode) calculates the

declining-balance depreciation for the year desired with the acquisition date

occurring at any time during the year.

t

~

26.00

3,333.33

0.00

Twenty-sixth year:

depreciation,

remaining depreciable value.

Keystrokes (RPN mode) Display

gi000

fCLEARG

6730$

6,730.00

Book value.

5n

5.00

Life.

1\

1.00

4.5t

1.00

504.75

First year:

depreciation.

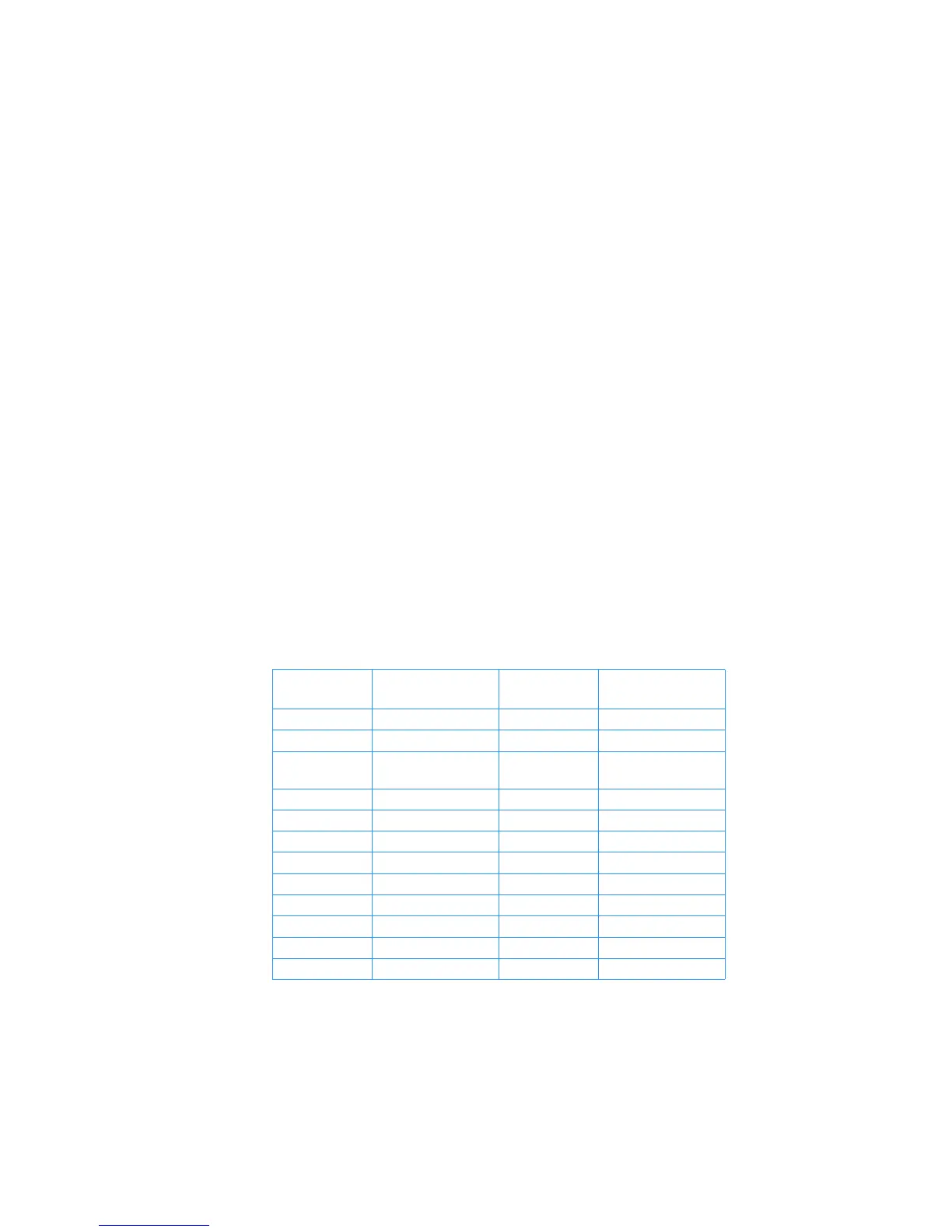

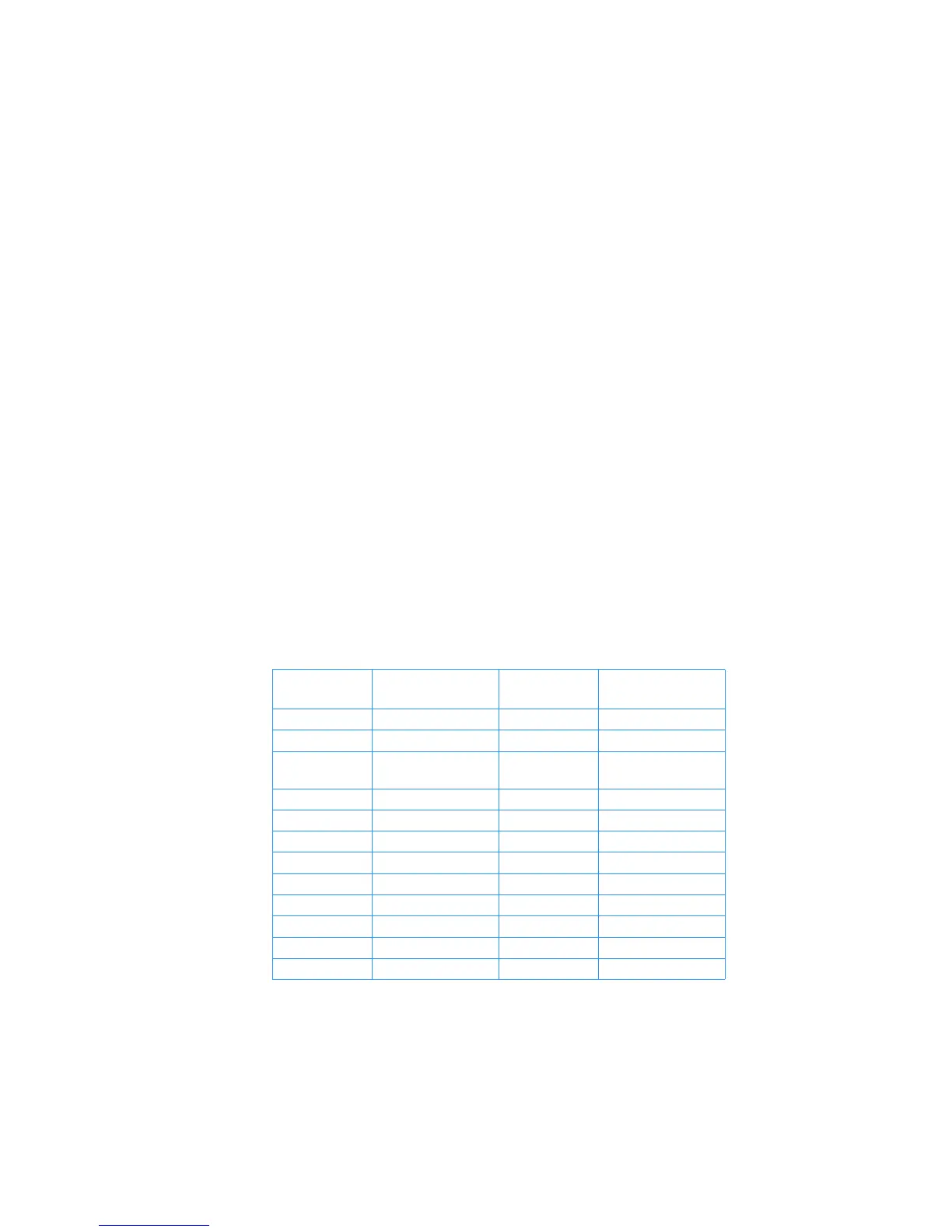

KEYSTROKES

(RPN mode)

DISPLAY

KEYSTROKES

(RPN mode)

DISPLAY

f] :0

019, 45 0

fs

000,

gm

020, 43 35

fCLEAR

Î

000,

gi031

021, 43,33,031

1

001, 1

:2

022, 45 2

2

002, 2

gu

023, 43 31

z

003, 10

:0

024, 45 0

?1

004, 44 1

f#

025, 42 25

~

005, 34

t

026, 31

?2

006, 44 2

1

027, 1

1

007, 1

?+0

028, 44 40 0

-

008, 30

?+2

029, 44 40 2

?0

009, 44 0

gi022

030,43,33,022

Keystrokes (RPN mode) Display

Loading...

Loading...