136 Section 13: Investment Analysis

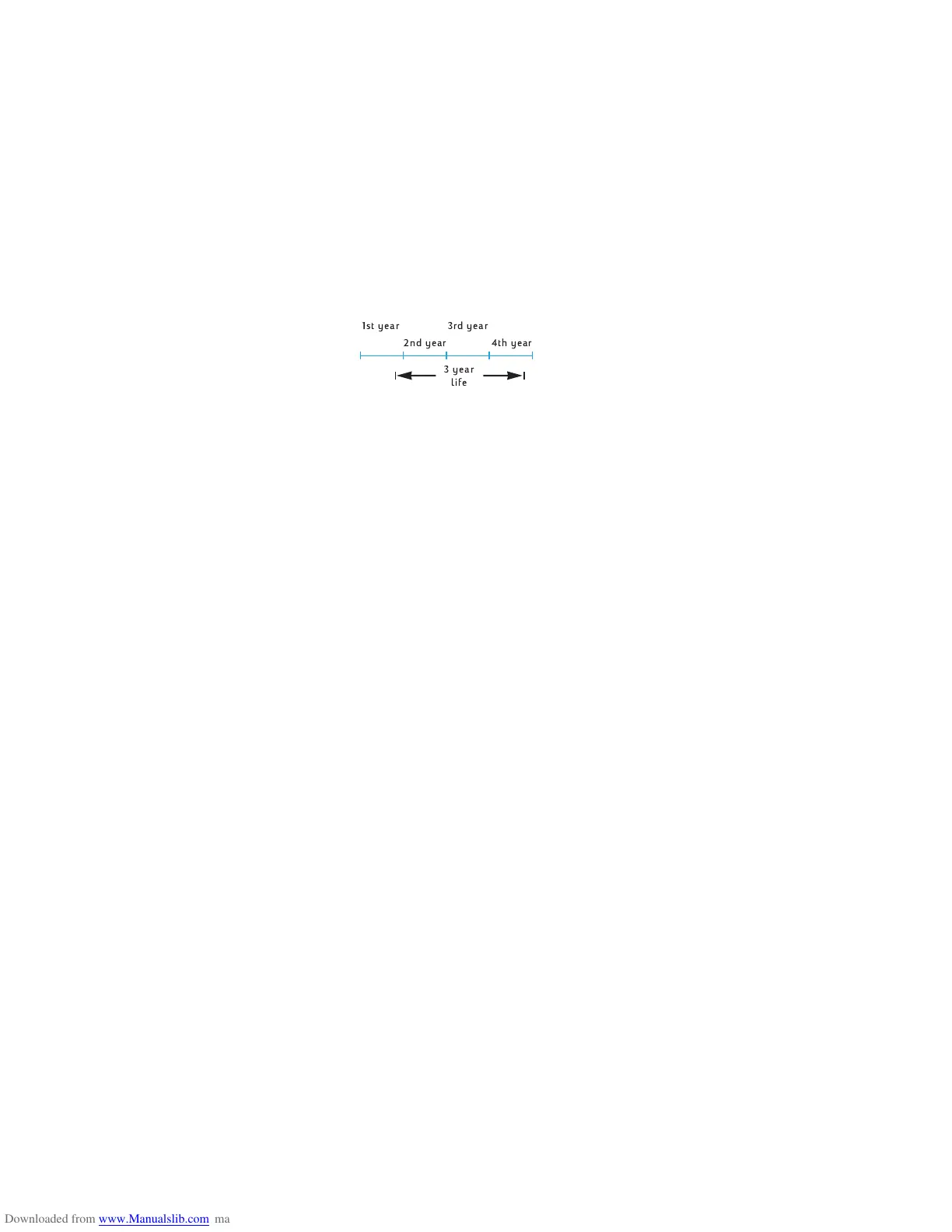

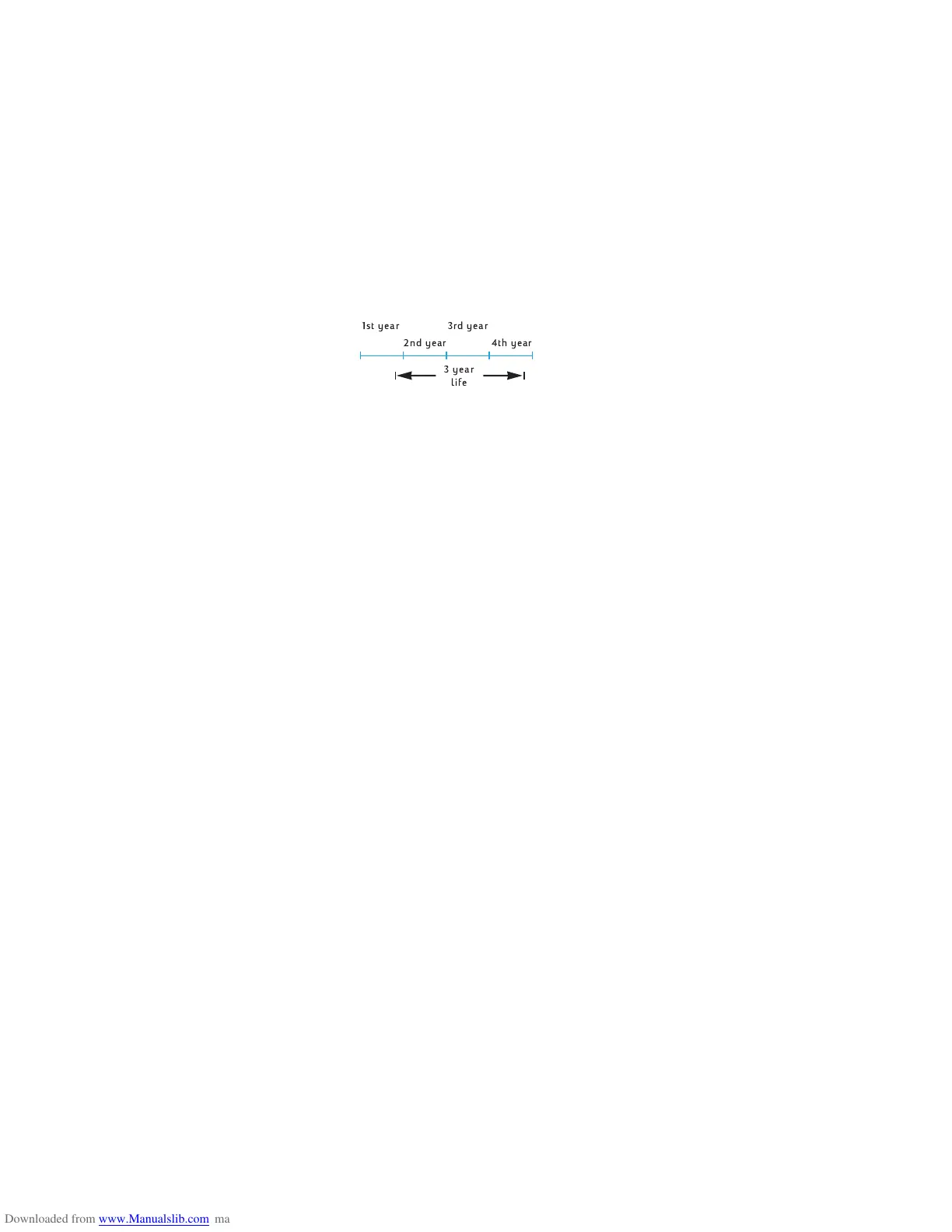

equal to the life +1. For example, a drill has a life of 3 years and is

purchased 3 months before the year end. The following time diagram

shows that depreciation will occur over 4 calendar years.

Example 1: A property has just been purchased for $150,000. The purchase

price is allocated between $25,000 for land and $125,000 for improvements

(building). The remaining useful life of the building is agreed to be 25 years.

There is no salvage value forecasted at the end of the useful life of the building.

Thus, the depreciable value and book value is $125,000.

The building was acquired 4 months before the end of the year. Using

straight-line depreciation, find the amount of depreciation and remaining

depreciable value for the 1st, 2nd, 25th, and 26th years. What is the total

depreciation after 3 years?

Keystrokes (RPN mode) Display

fCLEARG Salvage value = 0 so FV = 0.

125000$

125,000.00

Book value.

25n

25.00

Life.

1\

1.00

Year desired.

4t

~

1.00

1,666.67

123,333.33

First year:

depreciation,

remaining depreciable value.

t

~

2.00

5,000.00

118,333.33

Second year:

depreciation,

remaining depreciable value.

t

3.00

5,000.00

Third year:

depreciation.

~:$:3

+~-

gi000

11,666.67

Total depreciation through third

year.

fCLEARG

11,666.67

125000$

125,000.00

Book value.

25n

25.00

Life.

25\

25.00

Year desired.

4t

~

25.00

5,000.00

3,333.33

Twenty-fifth year:

depreciation,

remaining depreciable value.

1st year 3rd year

2nd year 4th year

3 year

life

Loading...

Loading...