58

Section 4

Additional Financial Functions

Discounted Cash Flow Analysis: NPV and IRR

The HP 12C Platinum provides functions for the two most widely-used methods

of discounted cash flow analysis: l (net present value) and L (internal rate

of return). These functions enable you to analyze financial problems involving

cash flows (money paid out or received) occurring at regular intervals. As in

compound interest calculations, the interval between cash flows can be any time

period; however, the amounts of these cash flows need not be equal.

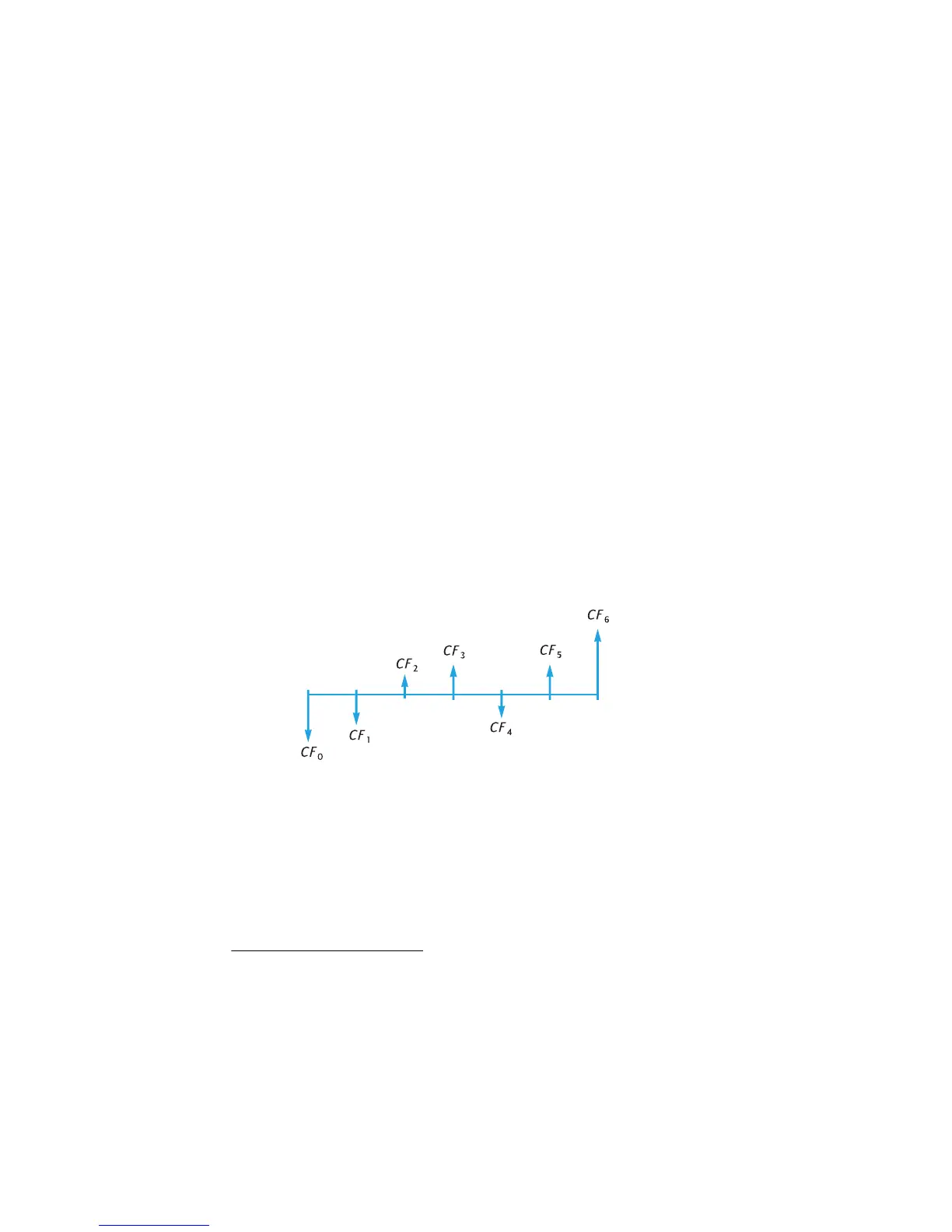

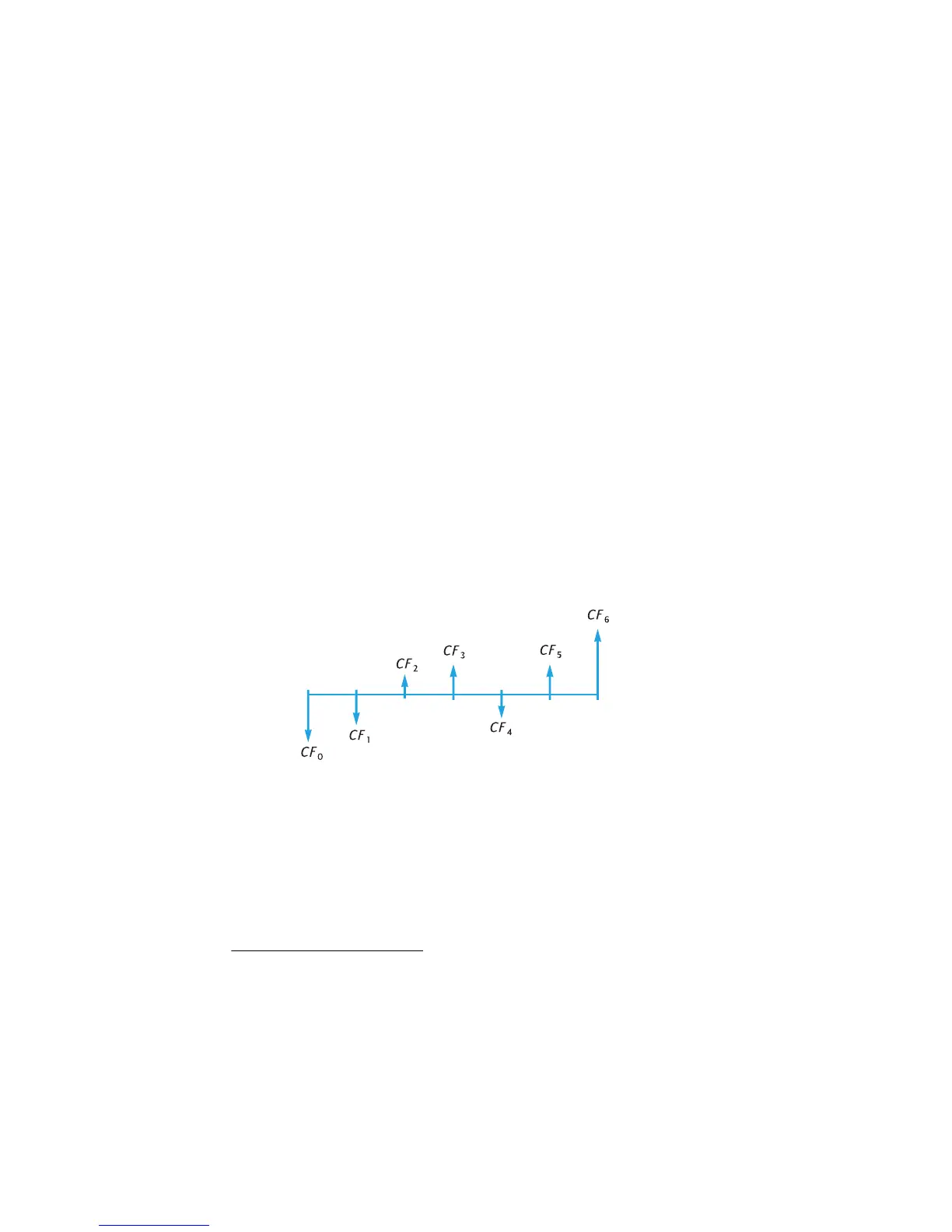

To understand how to use l and L, let’s consider the cash flow diagram for

an investment that requires an initial cash outlay (CF

0

) and generates a cash flow

(CF

1

) at the end of the first year, and so on up to the final cash flow (CF

6

) at the

end of the sixth year. In the following diagram, the initial investment is denoted

by CF

0

, and is depicted as an arrow pointing down from the time line since it is

cash paid out. Cash flows CF

1

and CF

4

also point down from the time line,

because they represent projected cash flow losses.

NPV is calculated by adding the initial investment (represented as a negative

cash flow) to the present value of the anticipated future cash flows. The interest

rate, i, will be referred to in this discussion of NPV and IRR as the rate of

return.

14

The value of NPV indicates the result of the investment.

z If NPV is positive, the financial value of the investor’s assets would be

increased: the investment is financially attractive.

z If NPV is zero, the financial value of the investor’s assets would not

change: the investor is indifferent toward the investment.

z If NPV is negative, the financial value of the investor’s assets would be

decreased: the investment is not financially attractive.

14.

Other terms are sometimes used to refer to the rate of return. These include: required rate of

return, minimally acceptable rate of return, and cost of capital.

Loading...

Loading...