Section 3: Basic Financial Functions 47

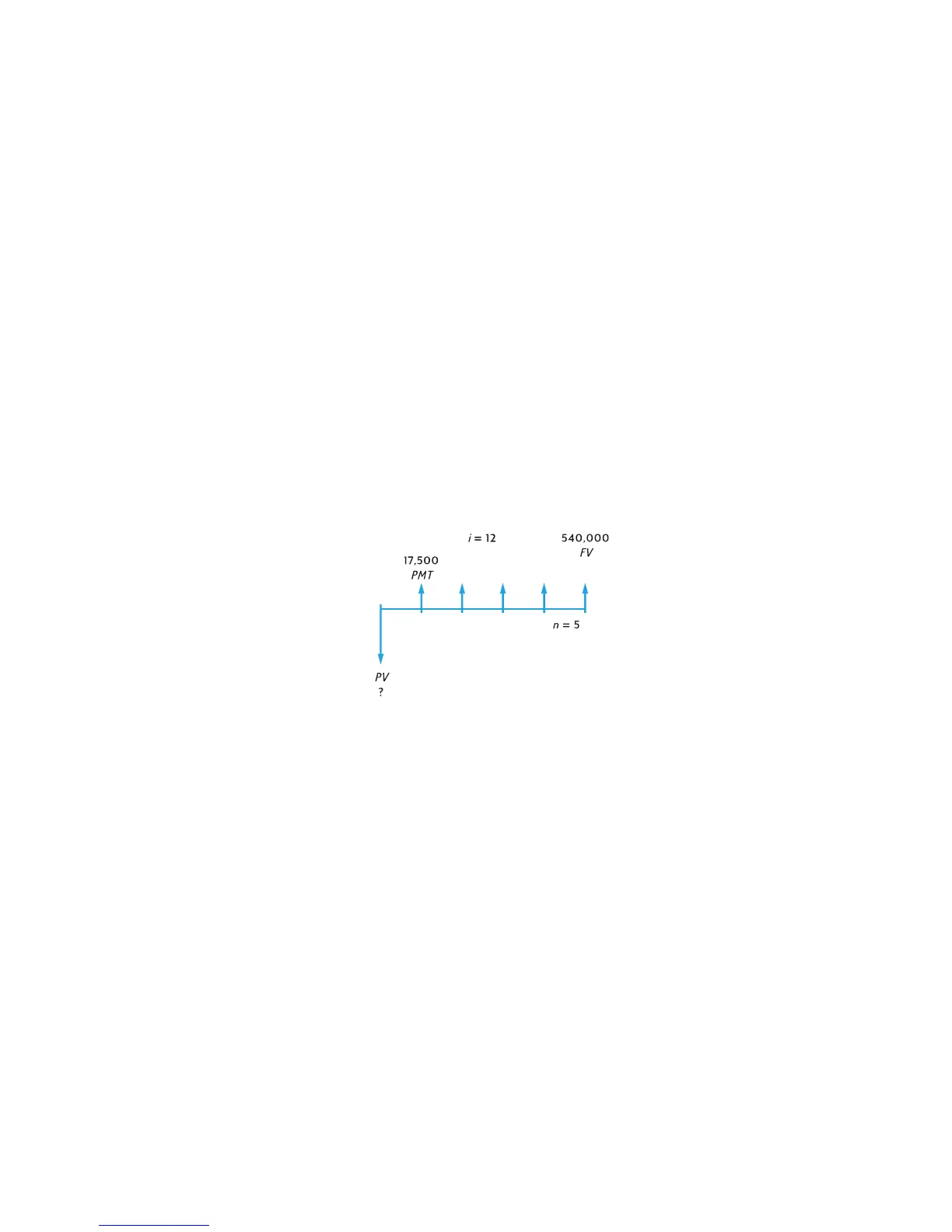

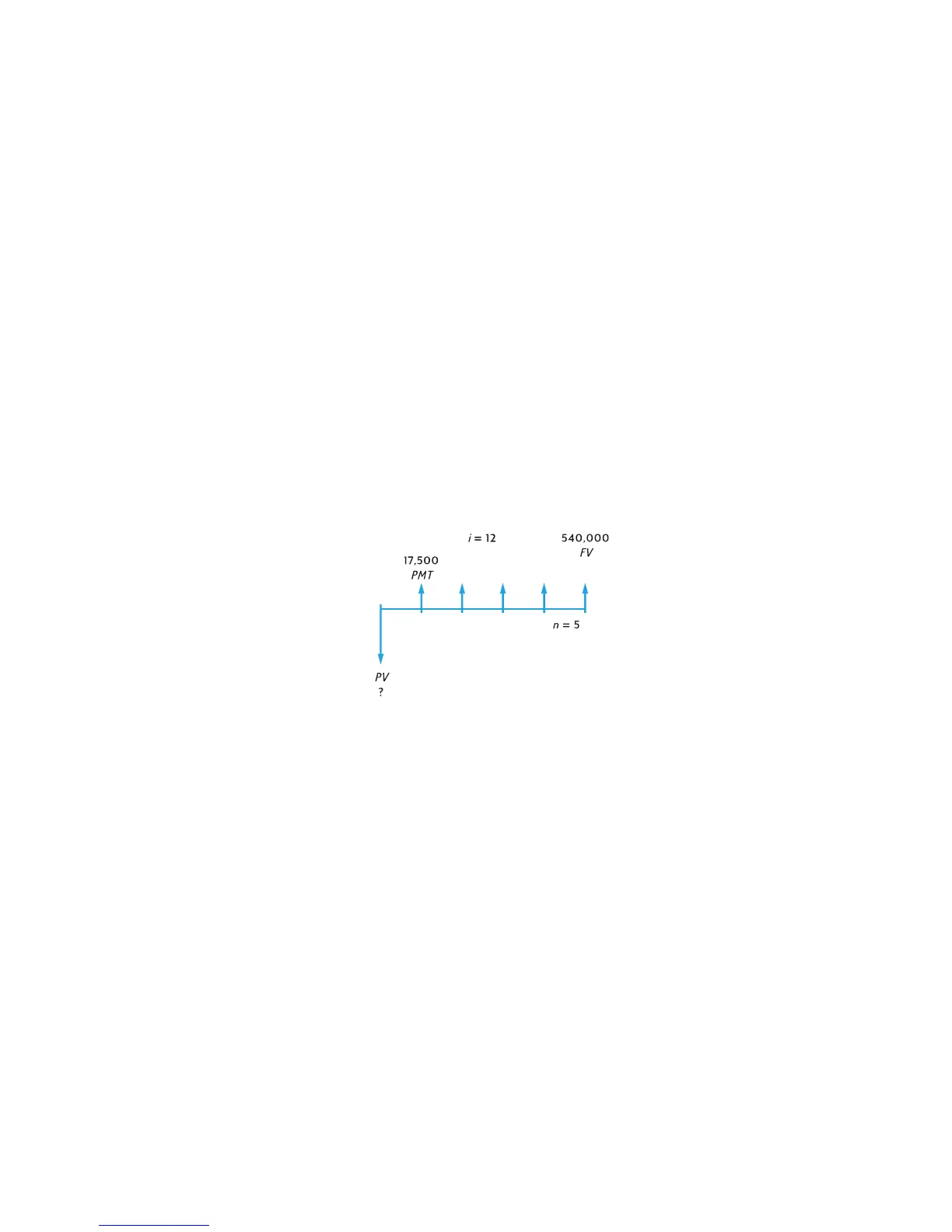

Example 2: A development company would like to purchase a group of

condominiums with an annual net cash flow of $17,500. The expected holding

period is 5 years, and the estimated selling price at that time is $540,000.

Calculate the maximum amount the company can pay for the condominiums in

order to realize at least a 12% annual yield.

Keystrokes(RPN mode) Display

fCLEARG

4gA

48.00

Calculates and stores n.

15gC

1.25

Calculates and stores i.

150ÞP

–150.00

Stores PMT (with minus sign for

cash paid out).

gÂ

–150.00

Sets payment mode to End.

$

5,389.72

Maximum amount of loan.

1500+

6,889.72

Maximum purchase price.

Keystrokes Display

fCLEARG

5n

5.00

Stores n.

12¼

12.00

Stores i.

17500P

17,500.00

Stores PMT. Unlike in the

previous problem, here PMT

is positive since it represents

cash received.

540000M

540,000.00

Stores FV.

gÂ

540,000.00

Sets payment mode to End.

$

–369,494.09

The maximum purchase price

to provide a 12% annual

yield. PV is displayed with a

minus sign since it represents

cash paid out.

Loading...

Loading...