UP-810F/820N/820F(U) SRV MODE PROGRAMMING (“SETTING”)

3 – 6

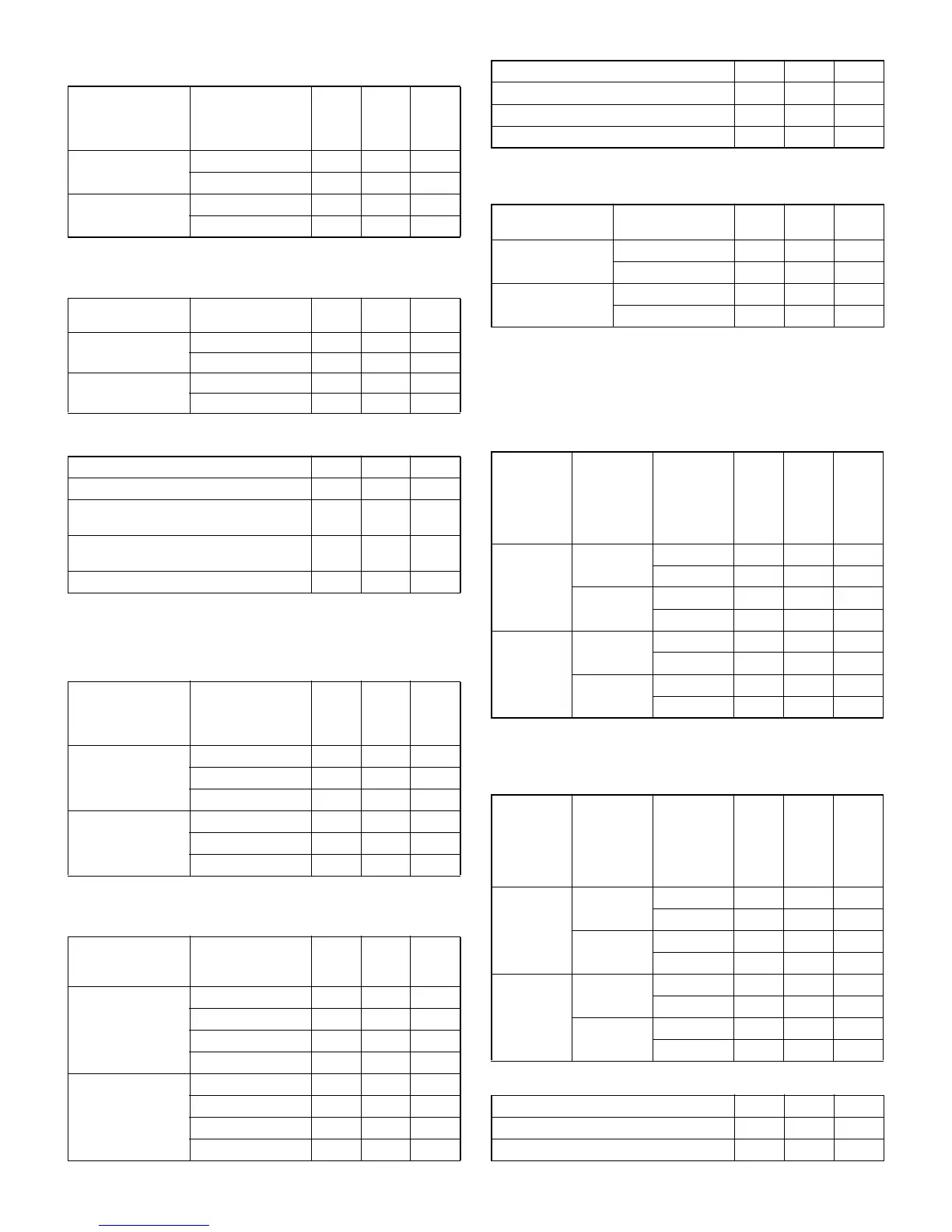

903-B: 1. Symbol of scale entry

2. Printing Gift Card No. at Gift Purchase Active and Reload

903-C: 1. Entry of tare

2. Unit of weight for the scale

903-D: 1. Food stamp / Cash benefit

[JOB#904] : MRS=0000

904-A: 1. Printing of date

2. Fraction treatment at gasoline (oil) q’ty calculation

904-B: 1. Printing of the consecutive No.

2. Decimal point position of gasoline (oil) q’ty

904-C: 1. Fraction treatment at gasoline discount

904-D: 1. TAB for gasoline unit price

2. Gasoline function

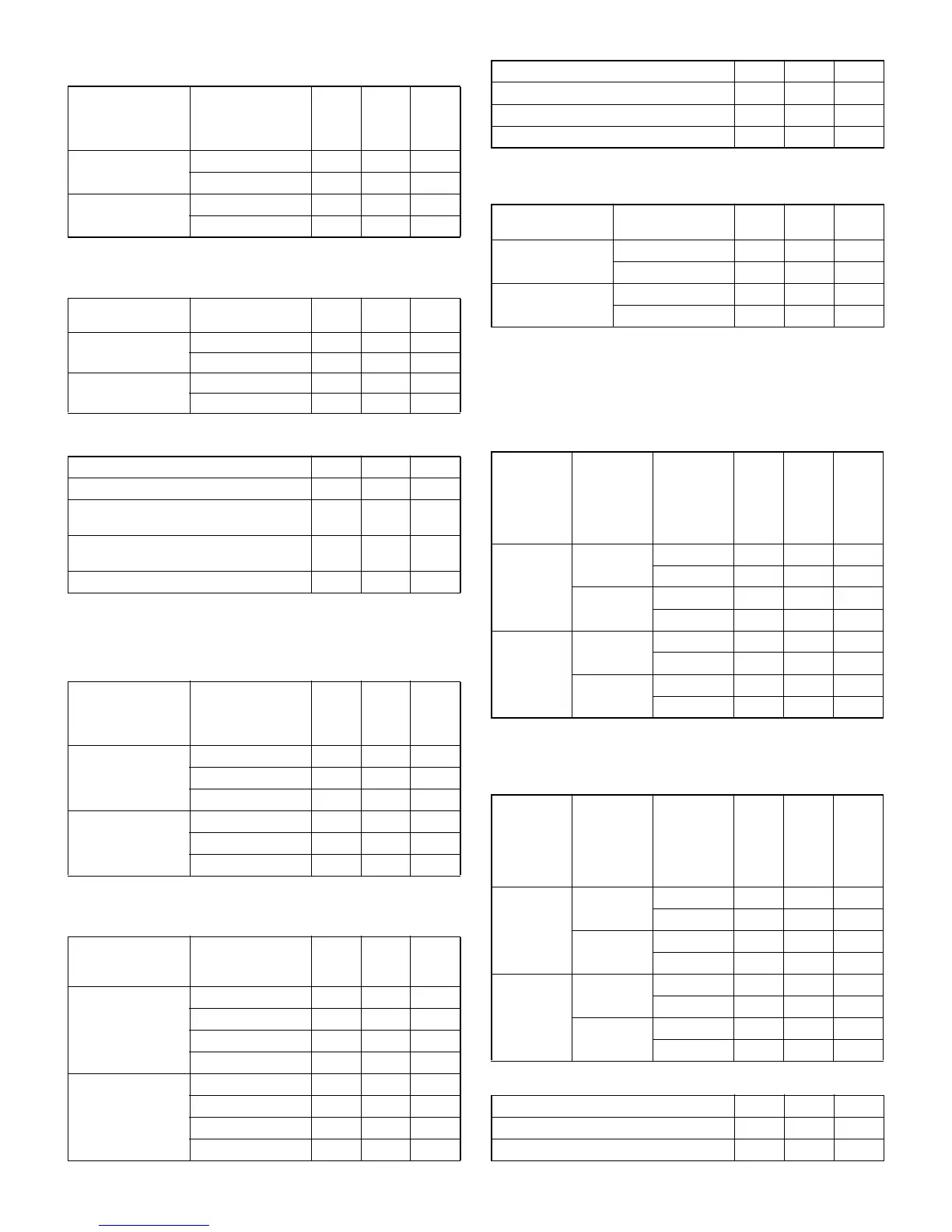

[JOB#905] MRS=0005

905-A: 1. Taxable SUBTOTAL4 (X/Z)

2. Gross TAX4, Refund TAX4 total (X/Z)

3. Net TAX4 total (X/Z)

905-B: 1. Tax printing when taxable SUBTOTAL is zero

2. Tax printing when GST is VAT

3. Tax printing when TAX is zero

905-C: 1. GST EXPT (X/Z)

1. Symbol of scale

entry

2. Printing Gift

Card No. at Gift

Purchase Active

and Reload

903-B Flat Normal

LB

No 0 ★★

Ye s 1

KG

No 2

Ye s 3

1. Entry of tare

2. Unit of weight for

the scale

903-C Flat Normal

Disallowed

2ID (3ID) + 2DD 0 ★★

1ID (2ID) + 3DD 1

Allowed

2ID (3ID) + 2DD 2

1ID (2ID) + 3DD 3

1. Food stamp / Cash benefit 903-D Flat Normal

No food stamp / Cash benefit 0 ★

Tax not payable in food stamps

/ Cash benefit

1

Tax payable in food stamps

/ Cash benefit

2

Forgiveness 3 ★

1. Printing of date

2. Fraction treat-

ment at gaso-

line (oil) q’ty

calculation

904-A Flat Normal

Ye s

Rounding 0 ★★

Raising to unit 1

Disregarding 2

No

Rounding 4

Raising to unit 5

Disregarding 6

1. Printing of the

consecutive No.

2. Decimal point

position of gaso-

line (oil) q’ty

904-B Flat Normal

Ye s

00★★

11

22

33

No

04

15

26

37

1. Fraction treatment at gasoline discount 904-C Flat Normal

ROUNDING 0 ★★

RAISING TO UNIT 1

DISREGARING 2

1. TAB for gasoline

unit price

2. Gasoline func-

tion

904-D Flat Normal

2

Disable 0 ★★

Enable 1

3

Disable 2

Enable 3

1. Taxable

SUBTOT

AL4

(X/Z)

2. Gross

TAX4,

Refund

TAX4

total

(X/Z)

3. Net TAX4

total

(X/Z)

905-A Flat Normal

Printed

Printed

Printed 0 ★★

Not printed 1

Not printed

Printed 2

Not printed 3

Not printed

Printed

Printed 4

Not printed 5

Not printed

Printed 6

Not printed 7

1. Tax print-

ing when

taxable

SUBTO-

TAL is

zero

2. Tax print-

ing when

GST is

VAT

3. Tax print-

ing when

TAX is

zero

905-B Flat Normal

No

Yes

Yes 0 ★★

No 1

No

Yes 2

No 3

Ye s

Yes

Yes 4

No 5

No

Yes 6

No 7

1. GST EXPT (X/Z) 905-C Flat Normal

PRINTED 0 ★★

NOT PRINTED 4

Loading...

Loading...