Copyright © 1993, 1996 by Texas Instruments Incorporated.

2

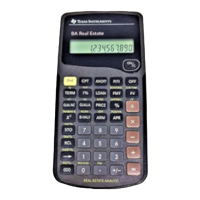

BA Real Estate™ Worksheets

Table of Contents

Mortgage Payment—Principal and Interest .............................................................................................................. 3

Calculating Unpaid Balance on an Existing Mortgage............................................................................................. 4

Paying Off a Loan Early by Making Larger Payments.............................................................................................. 5

Calculating a Balloon Payment to Retire a Mortgage .............................................................................................. 6

Calculating Monthly Payment for a Mortgage with a Balloon Payment................................................................ 7

Time Required to Reduce a Loan to a Specific Amount .......................................................................................... 8

PITI—Principal, Interest, Tax, and Insurance Based on Annual Tax and Insurance Amounts ........................ 9

PITI—Principal, Interest, Tax, and Insurance Based on Tax and Insurance Percents .................................... 10

Bi-Weekly Mortgage Payments ................................................................................................................................. 11

Adjustable Rate Mortgage.......................................................................................................................................... 12

Adjustable Rate Mortgage vs. Fixed-Rate Mortgage .............................................................................................. 13

Adjustable Rate Mortgage vs. Fixed-Rate Mortgage (Continued)........................................................................ 14

Payment and Remaining Balance on a Canadian Mortgage.................................................................................. 15

Amortization Schedule............................................................................................................................................... 16

Amortization for a Specific Range of Payments ..................................................................................................... 17

Finding Qualifying Loan Amount Based on Tax, Insurance, and Down Payment Percents............................ 18

Finding Qualifying Loan Amount Based on Tax and Insurance Percents and Down Payment Amount ....... 19

Finding Qualifying Loan Amount Based on Tax and Insurance Amounts and Down Payment Percent ....... 20

Finding Qualifying Loan Amount Based on Tax, Insurance, and Down Payment Amounts ........................... 21

Finding Qualifying Income Based on Tax, Insurance, and Down Payment Percents ...................................... 22

Finding Qualifying Income Based on Tax and Insurance Percents and Down Payment Amount.................. 23

Finding Qualifying Income Based on Tax and Insurance Amounts and Down Payment Percent.................. 24

Finding Qualifying Income Based on Tax, Insurance, and Down Payment Amounts...................................... 25

Finding Maximum Allowable Debt........................................................................................................................... 26

Net Cost of Housing Based on Tax and Insurance Percents................................................................................ 27

Savings Account with One Deposit .......................................................................................................................... 28

Savings Account with Regular Deposits .................................................................................................................. 29

Appreciation ................................................................................................................................................................ 30

Total Percent Change/Appreciation Rate ................................................................................................................ 30

Per-Period Percent Change/Appreciation Rate....................................................................................................... 30

Estimate of Appreciated Value ................................................................................................................................. 30

Interest Conversion .................................................................................................................................................... 31

From Effective to Nominal........................................................................................................................................ 31

From Nominal to Effective........................................................................................................................................ 31

Annual Percentage Rate Considering Points and Fees.......................................................................................... 32

Monthly Payment and APR of a Refinanced Loan.................................................................................................. 33

Finding the Purchase Price of a Note to Meet a Required Yield ......................................................................... 34

Yield of a Discounted Mortgage................................................................................................................................ 35

Loading...

Loading...