Prepared for ________________________________ By _________________________ Date ____________

Copyright © 1993, 1996 by Texas Instruments Incorporated.

23

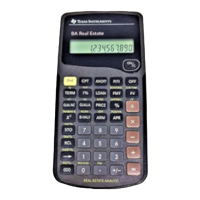

BA Real Estate™ Worksheet

Texas Instruments grants permission to reproduce this page for limited office use with clients. All other rights reserved.

Finding Qualifying Income Based on

Tax and Insurance Percents and Down Payment Amount

1. Clear TVM values (if not already cleared).

#

-

2. Enter income percent (if not already entered).

#

m

3. Enter debt percent (if not already entered).

#

d

4. Enter tax percent (if not already entered).

#

Z

5. Enter insurance percent (if not already entered).

#

Q

6. Enter term of loan (in years).

0

7. Enter interest rate.

1

8. Start the qualification.

>

9. Enter price.

j

10. Enter down payment amount (in dollars).*

j

11. Enter monthly debt amount (total).

12. Compute qualifying loan amount.

j

13. Compute payment.

j

14. Compute PITI.

j

15. Compute qualifying income.

j

* The calculator accepts any number greater than 99 as a down payment dollar amount.

Loading...

Loading...