Prepared for ________________________________ By _________________________ Date ____________

Copyright © 1993, 1996 by Texas Instruments Incorporated.

24

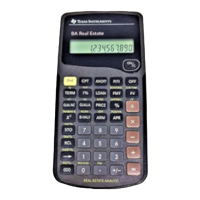

BA Real Estate™ Worksheet

Texas Instruments grants permission to reproduce this page for limited office use with clients. All other rights reserved.

Finding Qualifying Income Based on

Tax and Insurance Amounts and Down Payment Percent

1. Clear TVM values (if not already cleared).

#

-

2. Enter income percent (if not already entered).

#

m

3. Enter debt percent (if not already entered).

#

d

4. Enter annual tax amount.

5. Add annual insurance amount, and enter total.*

a

j

#

E

6. Enter term of loan (in years).

0

7. Enter interest rate.

1

8. Start the qualification.

>

9. Enter price.

j

10. Enter down payment percent (0 to 99).

j

11. Enter monthly debt amount (total).

12. Compute qualifying loan amount.

j

13. Compute payment.

j

14. Compute PITI.

j

15. Compute qualifying income.

j

* The calculator uses the TAX&INS$ amount, ignoring the TAX% and INS% settings. TAX% and INS% are used only when

TAX&INS$ is zero.

Loading...

Loading...