42 BA II PLUS™ Calculator

Perpetual Annuities

A perpetual annuity consists of equal payments that continue

indefinitely. An example of a perpetual annuity is a preferred

stock that yields a constant dollar dividend.

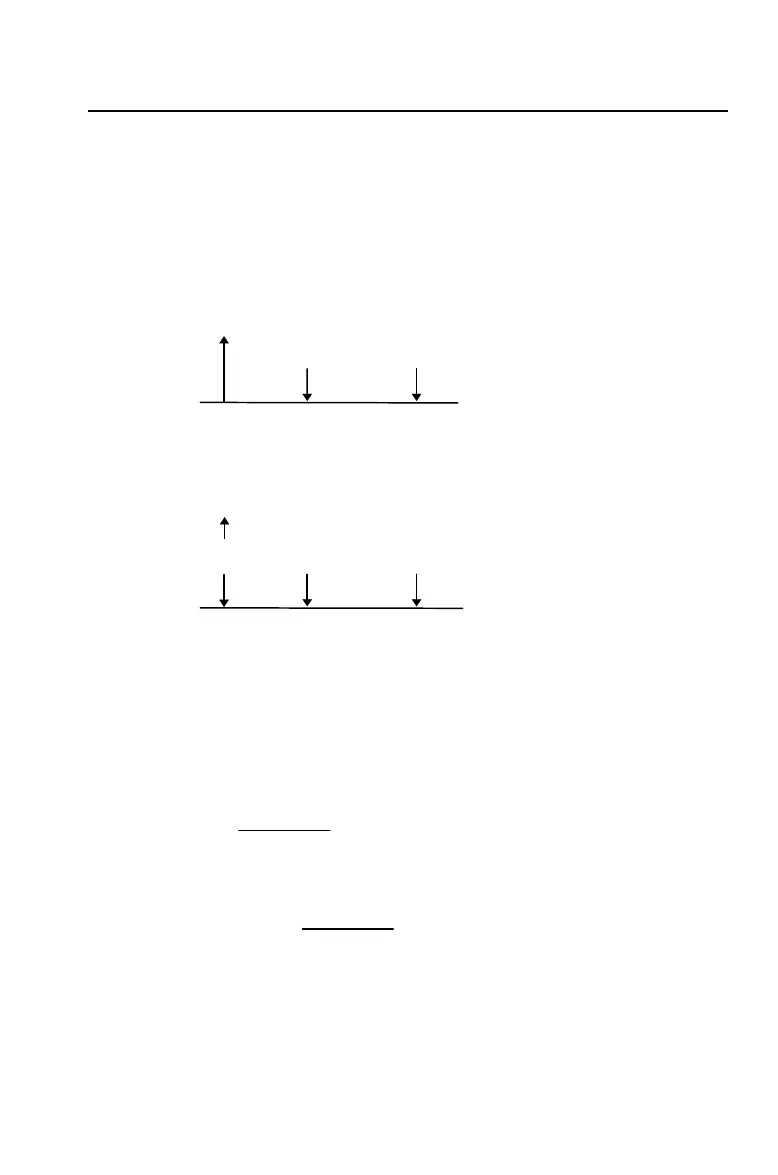

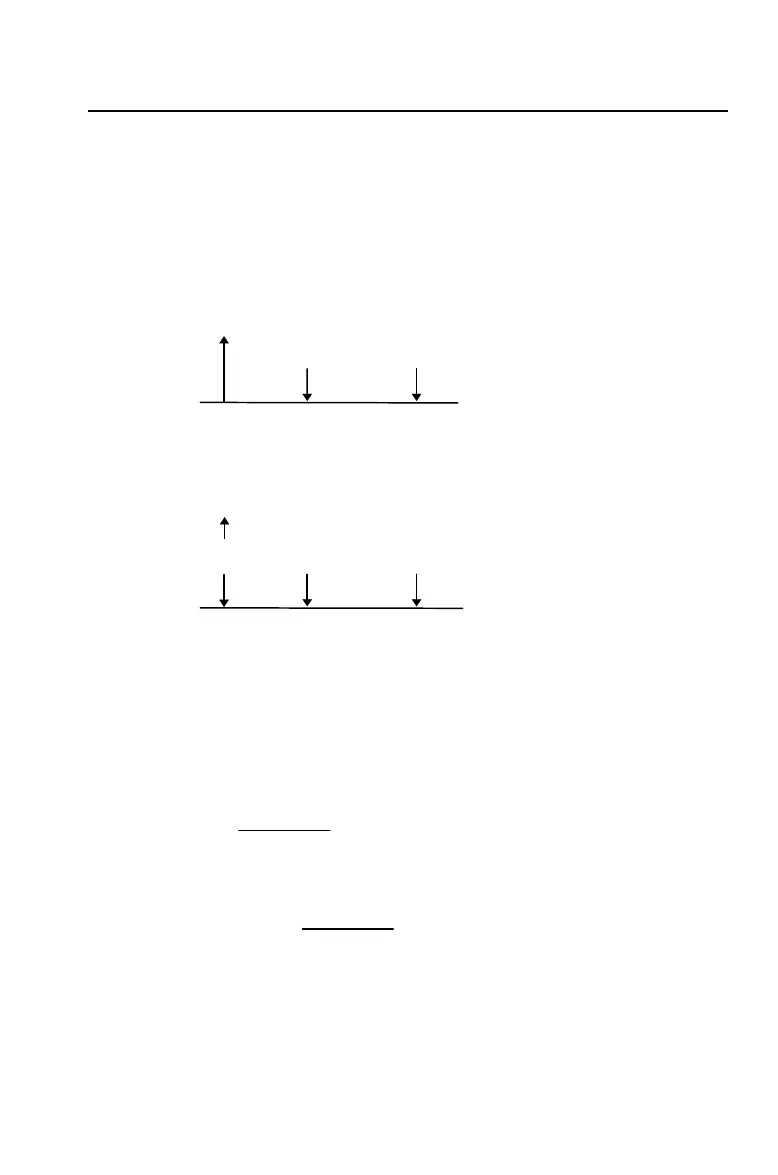

These time-line diagrams represent a perpetual annuity as an

ordinary annuity and as an annuity due.

•

For a perpetual ordinary annuity:

PV

PMT PMT

. . . to infinity

01 2

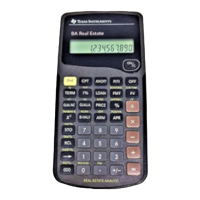

•

For a perpetual annuity due:

PV

PMT PMT PMT

. . . to infinity

01 2

Because the term (1 + I/Y / 100)

-

N

in the present value annuity

equations approaches zero as N becomes larger, you can use

the following equations to solve for the present value of a

perpetual annuity.

•

For a perpetual ordinary annuity:

PV =

PMT

(

I/Y

/ 100)

•

For a perpetual annuity due:

PV = PMT +

PMT

(

I/Y

/ 100)

Loading...

Loading...