4: Bond Worksheet 79

Bond Price and Accrued Interest Example

You want to purchase a semiannual corporate bond that

matures on 12/31/97 to settle on 6/12/96. The bond is based on

the 30/360 day-count method with a coupon rate of 7%. It will be

redeemed at 100% of its par value. For an 8% yield to maturity,

compute the bond’s price and the accrued interest.

Example: Entering Bond Data

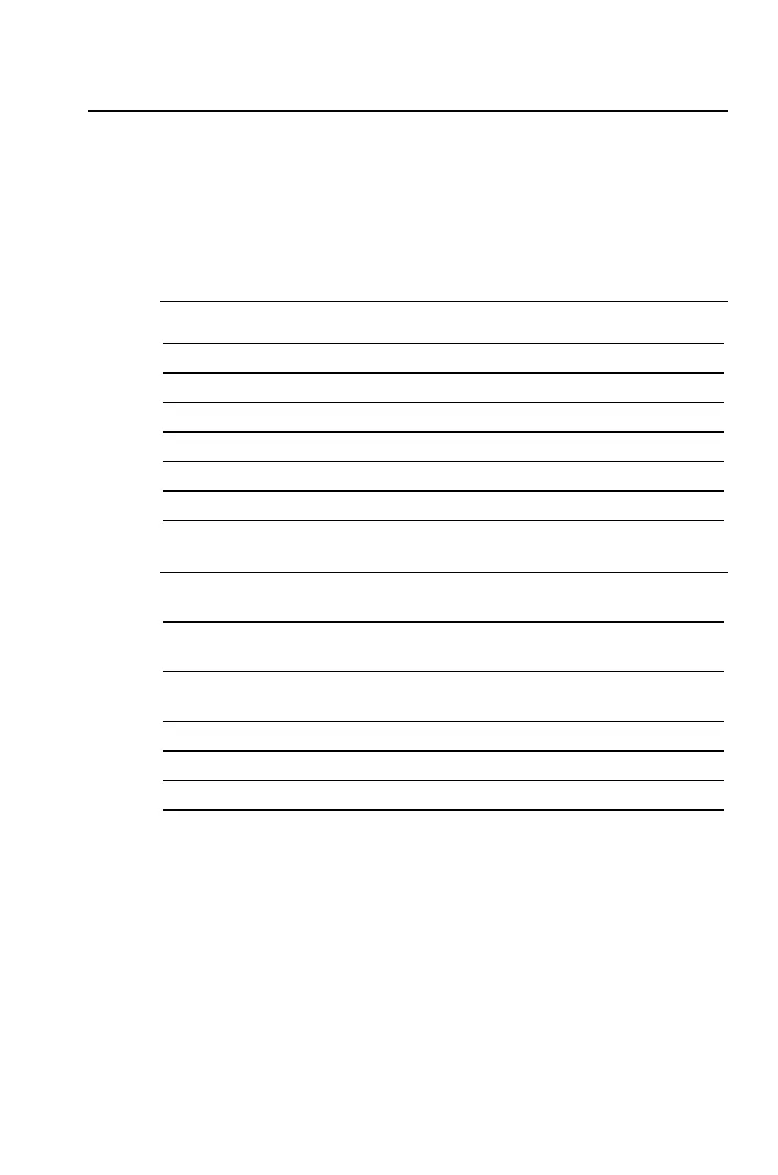

Procedure Keystrokes Display

Set all variables to defaults.

&

}

!

RST 0.00

Select Bond worksheet.

&

l

SDT = 12-31-1990

Enter settlement date.

6.1296

!

SDT = 6-12-1996

Enter coupon rate.

#

7

!

CPN = 7.00

Enter redemption date.

#

12.3197

!

RDT = 12-31-1997

Leave redemption value as is.

#

RV = 100.00

Example: Computing Bond Price and Accrued Interest

(continued from previous example)

Select 30/360 day-count

method.

#

&

V

360

Leave two coupon payments

per year.

#

&

V

2/Y

Enter yield.

#

8

!

YLD = 8.00

Compute price

#

%

PRI = 98.56

View accrued interest.

#

AI = 3.15

For an 8% yield to maturity, the price of the bond is $98.56 per

100 and the accrued interest is $3.15 per 100.

Loading...

Loading...