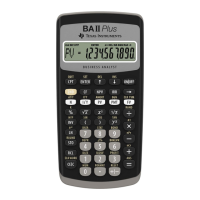

50 BA II PLUS™ Calculator

Yield to Maturity on Bond Purchased on Interest Date

A 9% $1,000 semiannual commercial bond has 13 remaining

coupon payments. You can purchase the bond for $852.50

(ignoring commissions). At this price, what is your yield to

maturity and the annual effective rate?

Example: Yield to Maturity

Procedure Keystrokes Display

Set all variables to defaults.

&

}

!

RST 0.00

Set payments per year to 2.

&

[

2

!

P/Y= 2.00

Return to calculator mode.

&

U

0.00

Enter number of remaining

coupon payments.

13

,

N= 13.00

Enter bond price.

852.5

S

.

PV= -852.50

Calculate the coupon payment.

9

2

6

2

<

1000

N

/

PMT= 45.00

Enter bond redemption value.

1000

0

FV= 1,000.00

Compute annual yield.

%

-

I/Y= 12.37

Store in memory.

D

1

Example: Effective Annual Interest

(continued from previous example)

Use the Interest Conversion worksheet (Chapter 7) to calculate

the effective annual interest rate.

Procedure Keystrokes Display

Select and clear Interest

Conversion worksheet.

&

v

&

z

NOM= 0.00

Recall rate from memory.

J

1

!

NOM= 12.37

Enter compounding periods.

#

#

2

!

C/Y= 2.00

Compute annual effective rate.

"

%

EFF= 12.75

The annual yield to maturity is 12.37% with semiannual

compounding. The equivalent annual effective rate is 12.75%.

Loading...

Loading...