Section 13: Investment Analysis 193

File name: hp 12c pt_user's guide_English_HDPMF123E27 Page: 193 of 275

Printed Date: 2005/8/1 Dimension: 14.8 cm x 21 cm

Example:

An investor has the following unconventional investment opportunity.

The cash flows are:

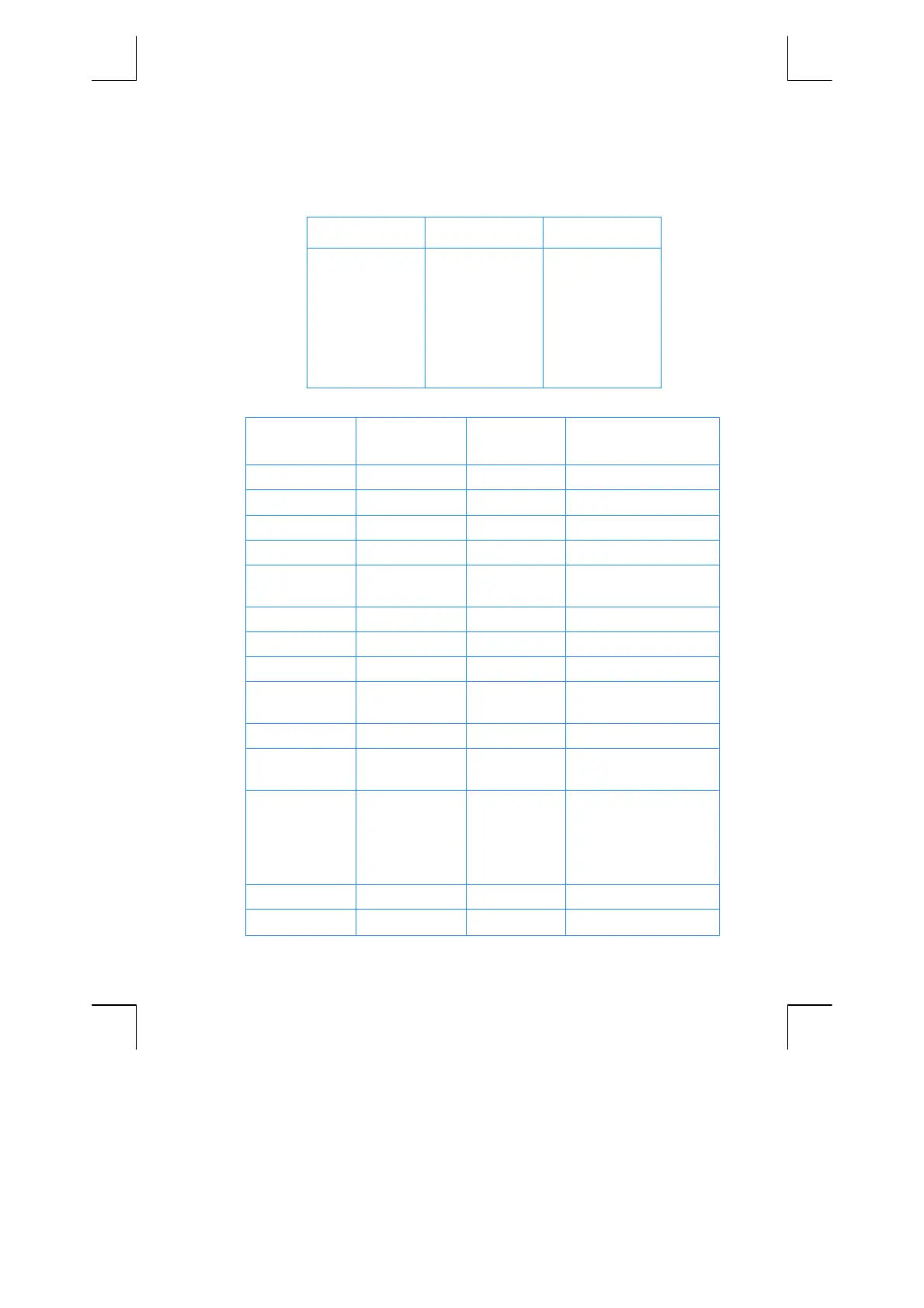

Group # of Months Cash Flow ($)

0 1 –180,000

1 5 100,000

2 5 –100,000

3 9 0

4 1 200,000

Calculate the MIRR using a safe rate of 6% and a reinvestment (risk) rate of 10%.

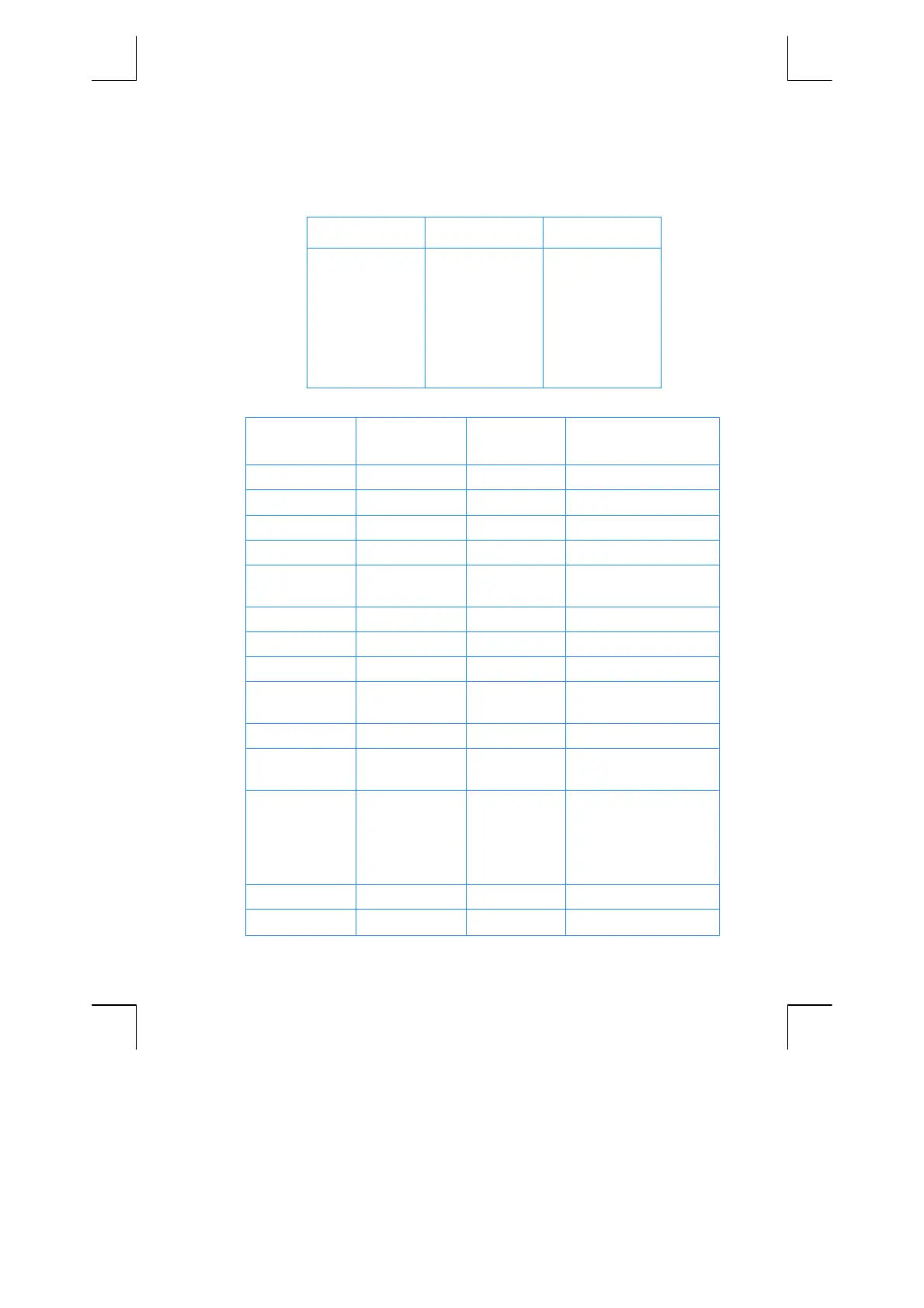

Keystrokes

(RPN mode)

Keystrokes

(ALG mode)

Display

f]

f[

f

CLEAR

H

f

CLEAR

H

0.00

0

gJ

0

gJ

0.00

First cash flow.

100000

gK

100000

gK

100,000.00

5

ga

5

ga

5.00

Second through sixth

cash flows.

0

gK

5

ga

0

gK

5

ga

5.00

Next five cash flows.

0

gK

9

ga

0

gK

9

ga

9.00

Next nine cash flows.

200000

gK

200000

gK

200,000.00

Last cash flow.

10

gCfl

10

gCfl

657,152.37

NPV of positive cash

flows.

Þ$

Þ$

-657,152.37

20

nM

20

nM

775,797.83

NFV of positive cash

flows.

180000

Þg

J

0

gK

5

g

a

100000

Þ

gK

5

ga

6

gCfl

180000

Þg

J

0

gK

5

g

a

100000

Þ

gK

5

ga

6

gCfl

-660,454.55

NPV of negative cash

flows.

20

n¼

20

n¼

0.81

Monthly MIRR

12

§

§12³

9.70

Annual MIRR.

Loading...

Loading...