Appendix E: Formulas Used 253

File name: hp 12c pt_user's guide_English_HDPMF123E27 Page: 253 of 275

Printed Date: 2005/8/1 Dimension: 14.8 cm x 21 cm

Bonds

Reference:

Jan Mayle, TIPS Inc., Standard Securities Calculation Methods, Volume 1, Third

Edition, Securities Industry Association Inc., New York, 1993.

DIM = days between issue date and maturity date.

DSM = days between settlement date and maturity date.

DCS = days between beginning of current coupon period and

settlement date.

E = number of days in coupon period where settlement occurs.

DSC = E – DCS = days from settlement date to next 6–month coupon

date.

N = number of semiannual coupons payable between settlement

date and maturity date.

CPN = annual coupon rate (as a percentage).

YIELD = annual yield (as a percentage).

PRICE = dollar price per $100 par value.

RDV = redemption value.

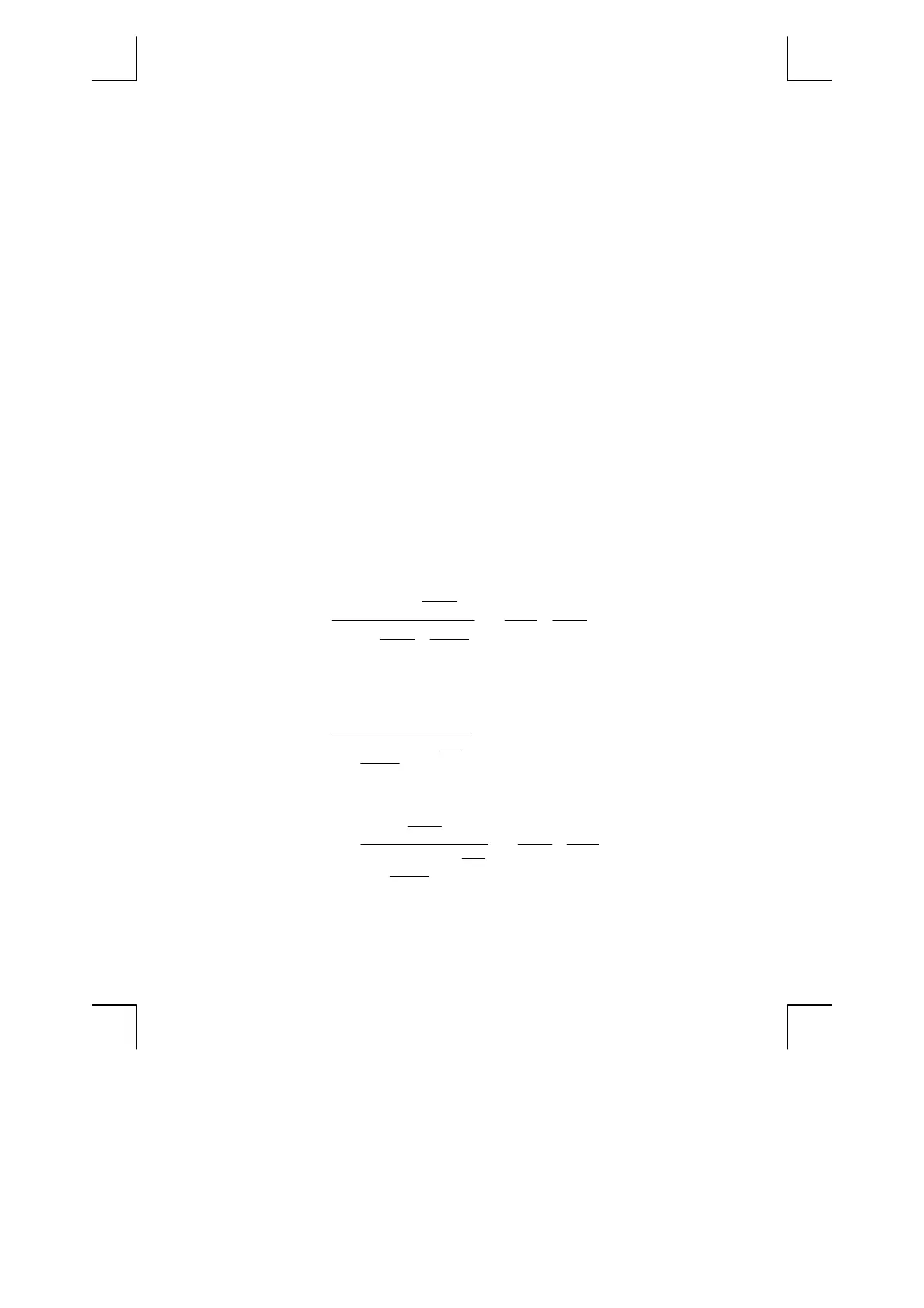

For semiannual coupon with 6 months or less to maturity:

⎥

⎦

⎤

⎢

⎣

⎡

×−

⎥

⎥

⎥

⎥

⎦

⎤

⎢

⎢

⎢

⎢

⎣

⎡

×+

+

=

2

)

2

(100

)

2

(100

CPN

E

DCS

YIELD

E

DSM

CPN

RDV

PRICE

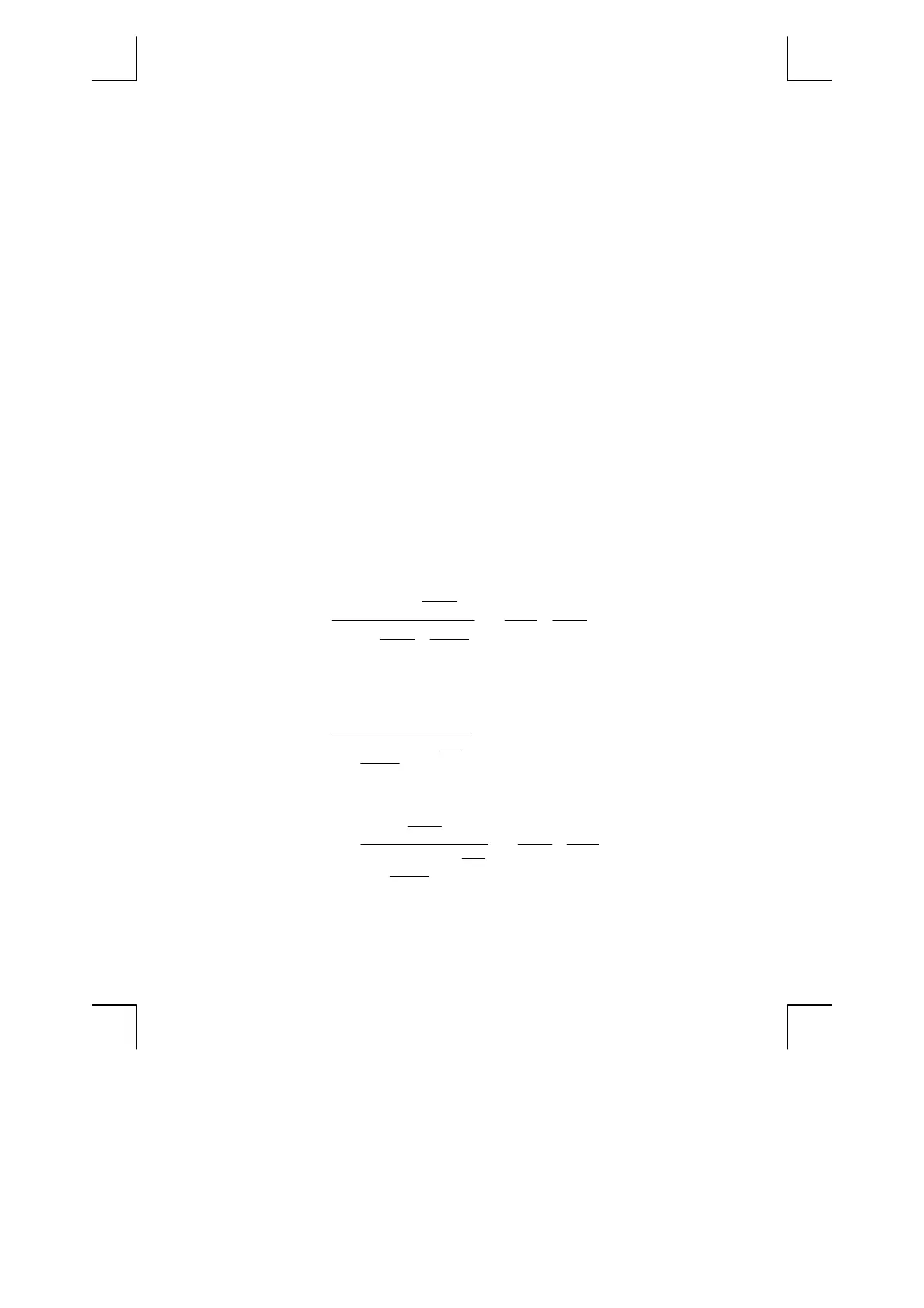

For semiannual coupon with more than 6 months to maturity:

⎥

⎦

⎤

⎢

⎣

⎡

×−

⎥

⎥

⎥

⎥

⎥

⎥

⎦

⎤

⎢

⎢

⎢

⎢

⎢

⎢

⎣

⎡

⎟

⎠

⎞

⎜

⎝

⎛

+

+

⎥

⎥

⎥

⎥

⎥

⎦

⎤

⎢

⎢

⎢

⎢

⎢

⎣

⎡

⎟

⎠

⎞

⎜

⎝

⎛

+

=

∑

=

+−

+−

E

DCSCPN

YIELD

CPN

YIELD

RDV

PRICE

N

K

E

DSC

K

E

DSC

N

2

200

1

2

200

1

1

1

1

Loading...

Loading...