58 Section 3: Basic Financial Functions

File name: hp 12c pt_user's guide_English_HDPMF123E27 Page: 58 of 275

Printed Date: 2005/8/1 Dimension: 14.8 cm x 21 cm

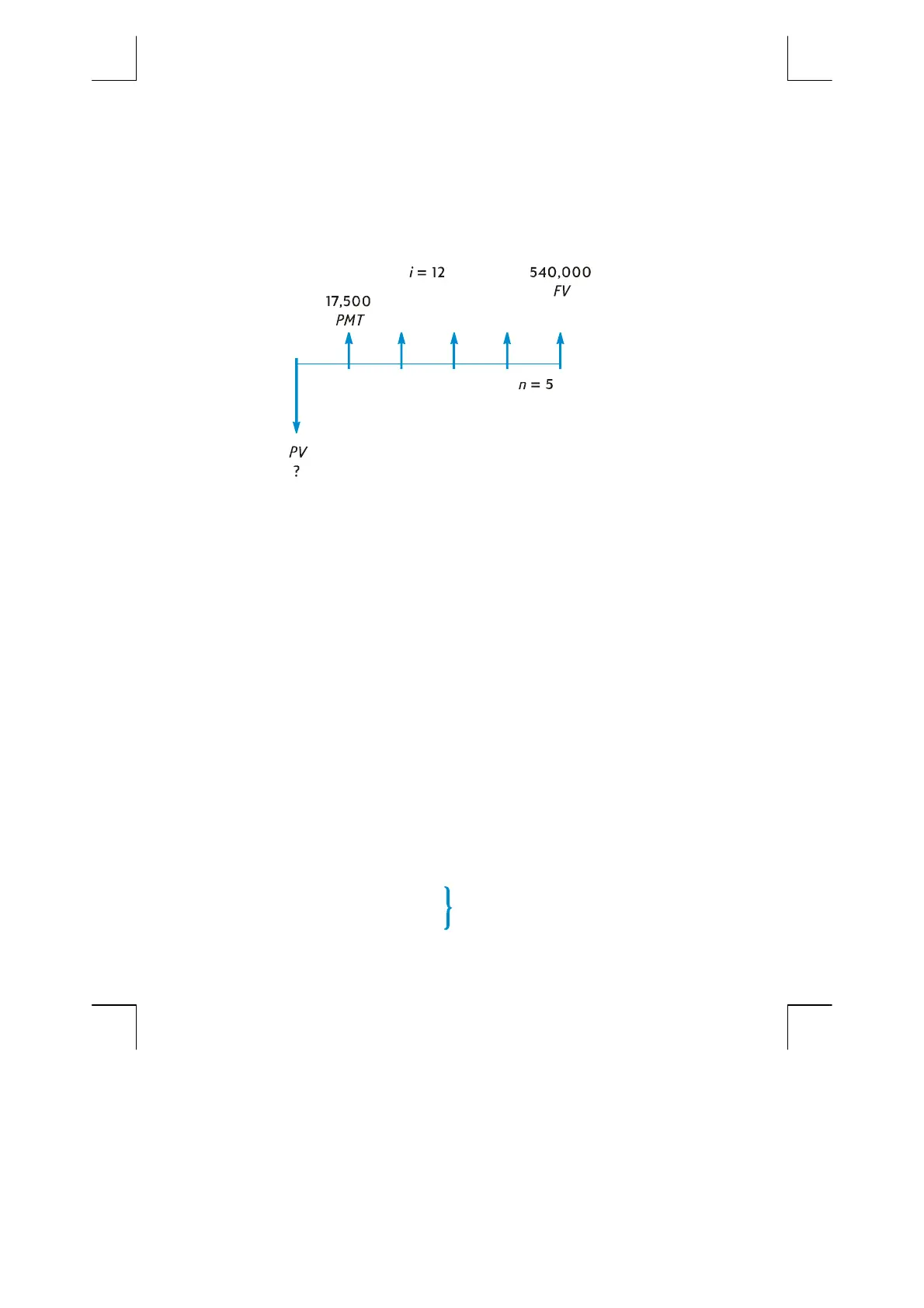

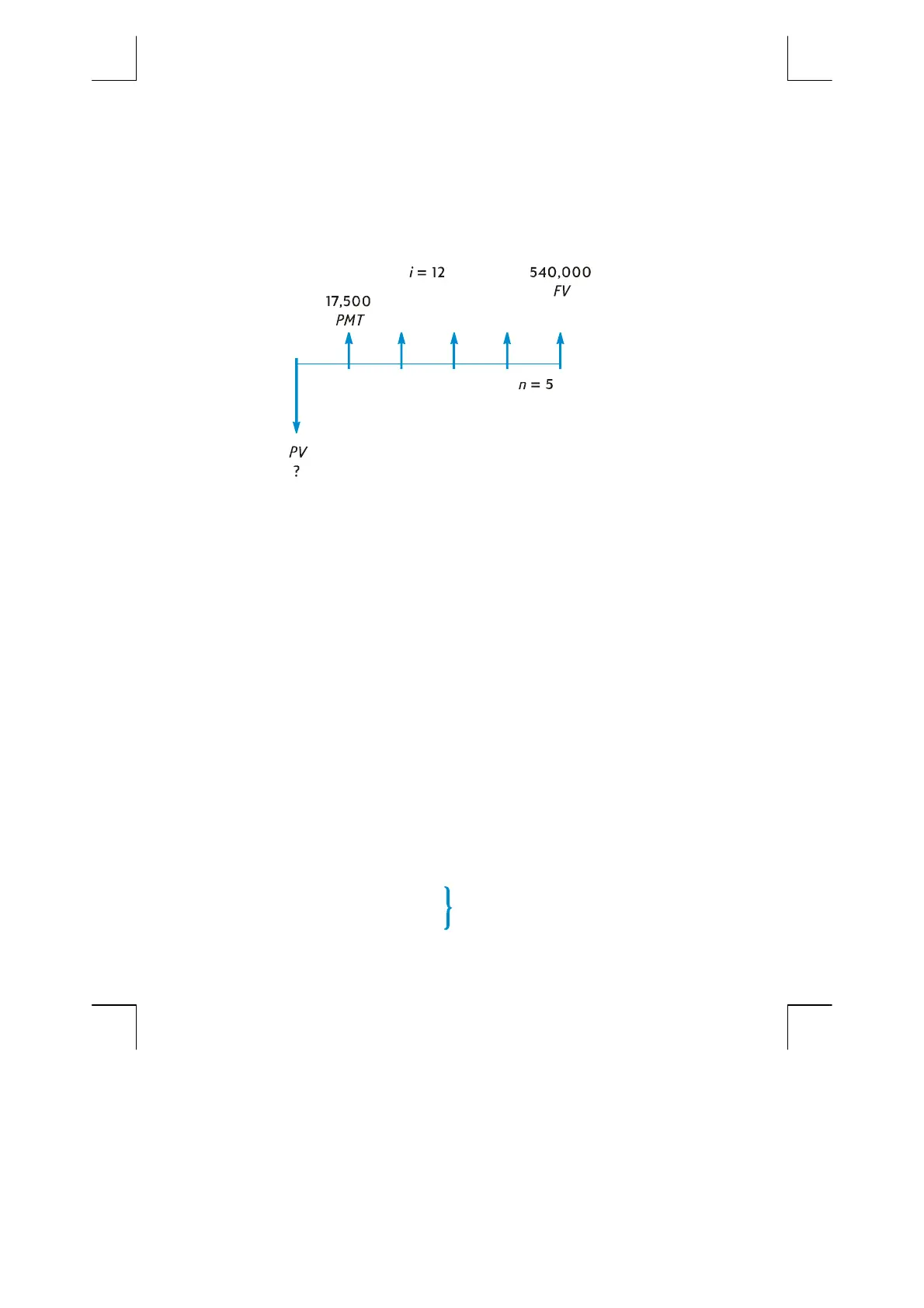

Example 2:

A development company would like to purchase a group of

condominiums with an annual net cash flow of $17,500. The expected holding

period is 5 years, and the estimated selling price at that time is $540,000.

Calculate the maximum amount the company can pay for the condominiums in

order to realize at least a 12% annual yield.

Keystrokes Display

f

CLEAR

G

5

n

5.00

Stores n.

12

¼

12.00

Stores i.

17500

P

17,500.00

Stores PMT. Unlike in the previous

problem, here PMT is positive

since it represents cash received.

540000

M

540,000.00

Stores FV.

gÂ

540,000.00

Sets payment mode to End.

$

–369,494.09

The maximum purchase price to

provide a 12% annual yield. PV

is displayed with a minus sign

since it represents cash paid out.

Calculating the Payment Amount

1. Press fCLEARG to clear the financial registers.

2. Enter the number of payments or periods, using n or gA.

3. Enter the periodic interest rate, using ¼ or gC.

4. Enter either or both of the following:

z Present value, using $.

z Future value, using M.

Note:

Remember to observe the

cash flow sign convention.

Loading...

Loading...