Section 13: Investment Analysis 201

File name: hp 12c pt_user's guide_English_HDPMF123E27 Page: 201 of 275

Printed Date: 2005/8/1 Dimension: 14.8 cm x 21 cm

Example 2:

The stock price six months from the expiration of an option is $42,

the exercise price of the option is $40, the risk-free interest rate is 10% per annum,

and the volatility is 20% per annum. Find Call and Put values.

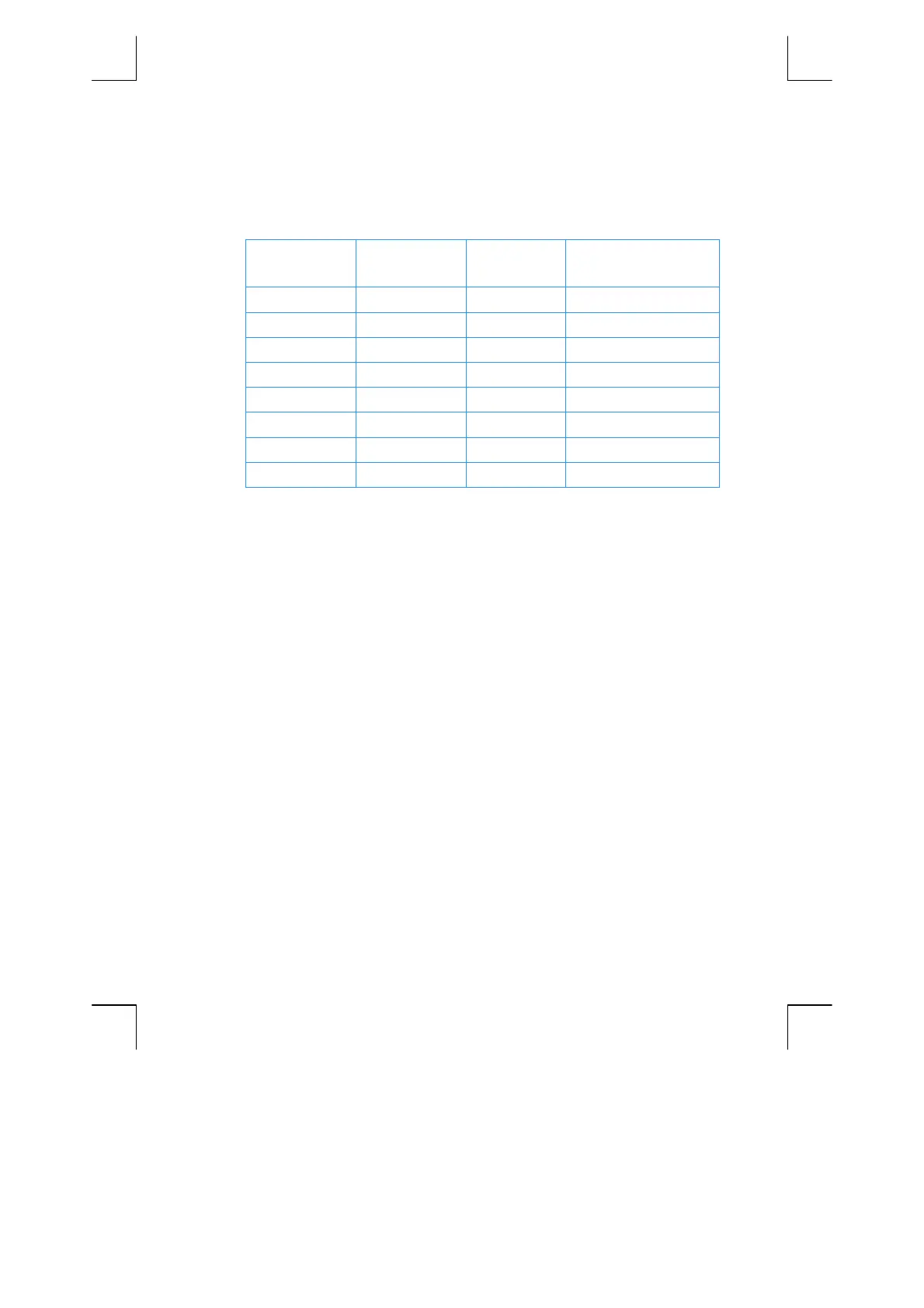

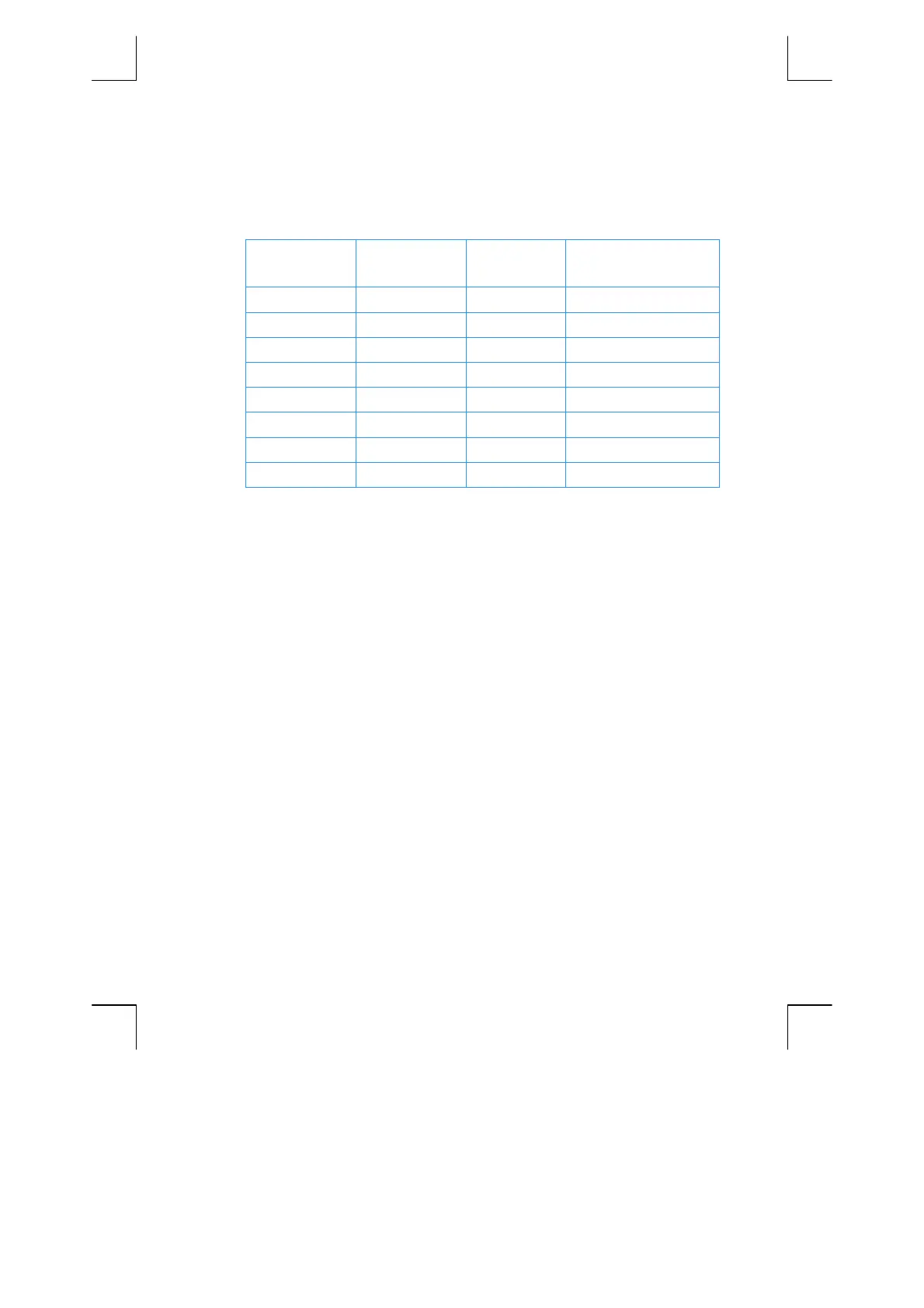

Keystrokes

(RPN mode)

Keystrokes

(ALG mode)

Display

f]

f[

.5

n

.5

n

0.50

Time to expiry (years).

10

¼

10

¼

10.00

Interest rate (% per year).

42

$

42

$

42.00

Stock price.

20

P

20

P

20.00

Volatility (% per year).

40

M

40

M

40.00

Strike price.

t t

4.76

Call value.

~ ~

0.81

Put value.

Loading...

Loading...