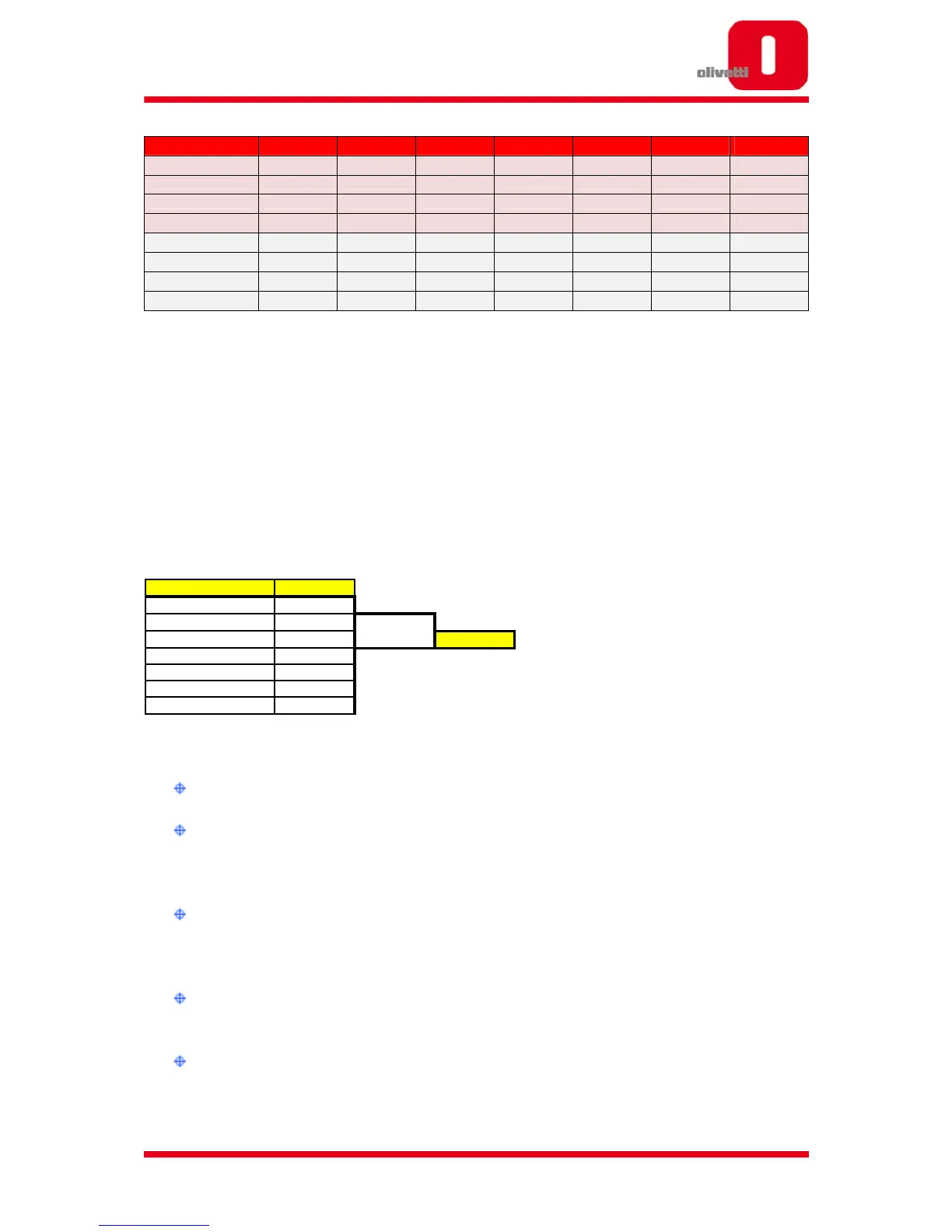

454,986 570,399 769,253 926,603 1,103,015 1,307,259 1,598,474

C.laser A4 ASP (€) 532 565 547 522 496 471 447

Colour laser A3 421,861 413,259 475,280 506,761 539,164 572,537 608,942

C.laser A3 ASP (€) 7,111 6,806 6,590 6,291 5,976 5,677 5,393

Mono laser A4 1,282,698 1,203,794 1,368,540 1,412,947 1,455,789 1,504,680 1,677,658

M.laser A4 ASP (€) 495 423 410 391 371 353 335

Mono laser A3 540,595 374,581 416,183 414,737 410,036 401,953 366,528

M.laser A3 ASP (€) 3,693 3,545 3,433 3,276 3,112 2,955 2,805

Source: Gartner, 2010 (for 2008-09, final data – for 2010-2014, forecast data)

In Western Europe, the Digital Colour MFP market will increase steadily in the next 4

years, in both A4 MFP (+108% in 2010-2014) and A3 MFP (+28% in 2010-2014).

The overall Digital Monochrome MFPs will also grow, but only in the A4 MFP part of it

(+23% in 2010-2014), while the A3 MFP devices will start to decline (-12% in 2010-

2014).

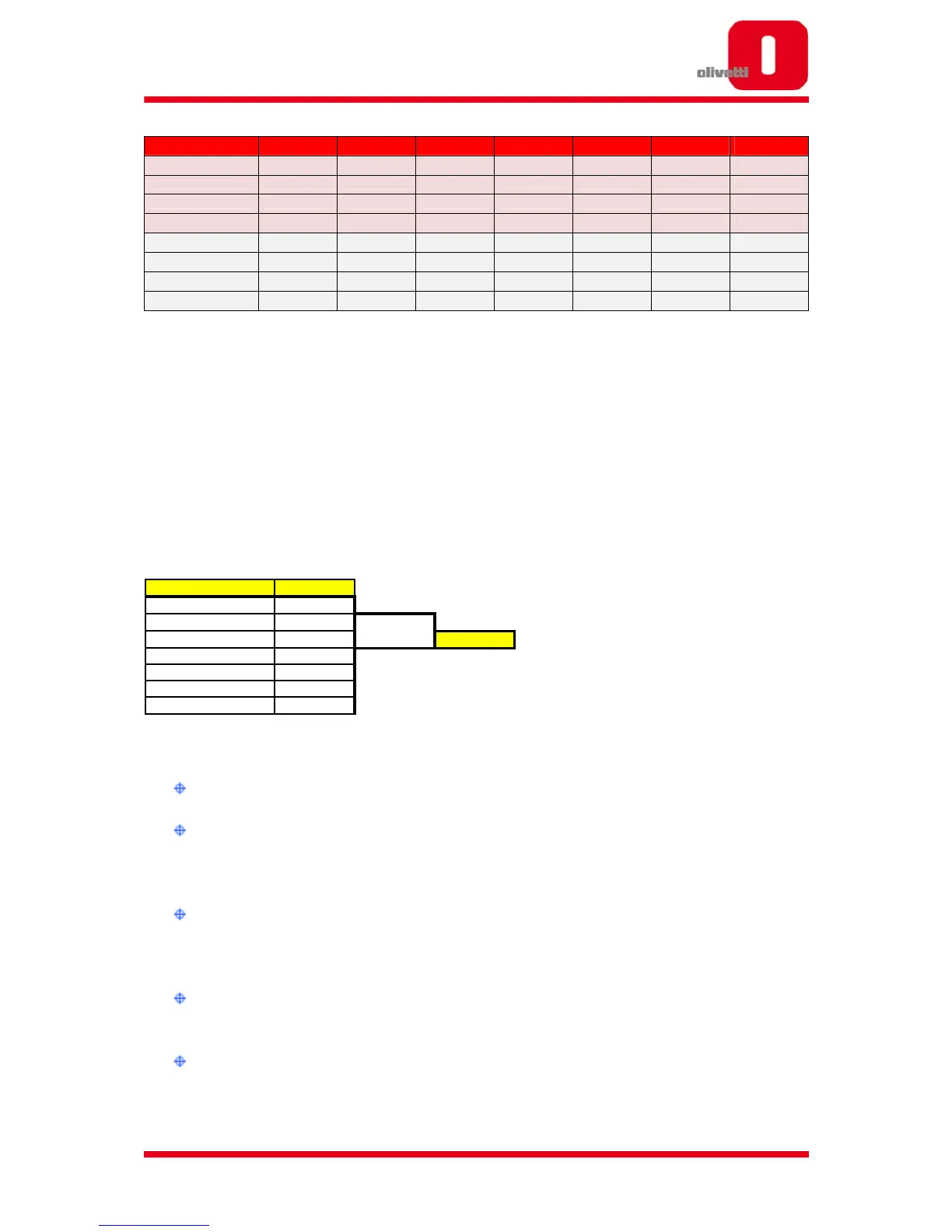

The new d-Color MF2001 and d-Color MF2501 offer the perfect mix of speed and

functionality as 64% of the total Colour A3 MFP placements are within the 11-30 ppm

segments:

Digital MFP Market Trends Summary

A continuing shift from monochrome to colour continues

Customers are replacing office monochrome MFPs with colour MFPs –

creating important opportunities for the placement of both the d-Color MF2001

and d-Color MF2501

A4 MFPs and A3 MFPs are jointly operated and managed; and the

differentiation between the printer and MFP markets is getting smaller. Both

markets are merging

An important customer motivation when replacing existing equipment is the

increased focus on environmental issues: “Green IT” is fast emerging

The focus on Managed Print Services and complete fleet management

continues to increase. In this context, integrated workflows are fast gaining

importance

Color Seg Middle 2010 YR

Page 1-10 ppm 2.814 0,6%

Page 11-20 ppm 79.275 16,3%

Page 21-30 ppm 232.454 47,8% 64,1%

Page 31-40 ppm 91.691 18,8%

Page 41-69 ppm 77.685 16,0%

Page 70-90 ppm 2.694 0,6%

Total 486.613

Loading...

Loading...