26

Tax rate

* A: Enter a corresponding tax rate number. For example, when you program a tax rate as tax rate 1, enter “1”,

and when you program it as tax rate 6, enter “6”.

** Sign and tax rate: XYYY.YYYY

• The lowest taxable amount is valid only when you select add on tax system. If you select VAT

(Value added tax) system, it is ignored.

• If you make an incorrect entry before pressing the second

≈

key in programming a tax rate,

cancel it with the

c

key; and if you make an error after pressing the second

≈

key, cancel it

with the

:

key. Then program again from the beginning.

• If you select VAT system, the sign which you program is ignored.

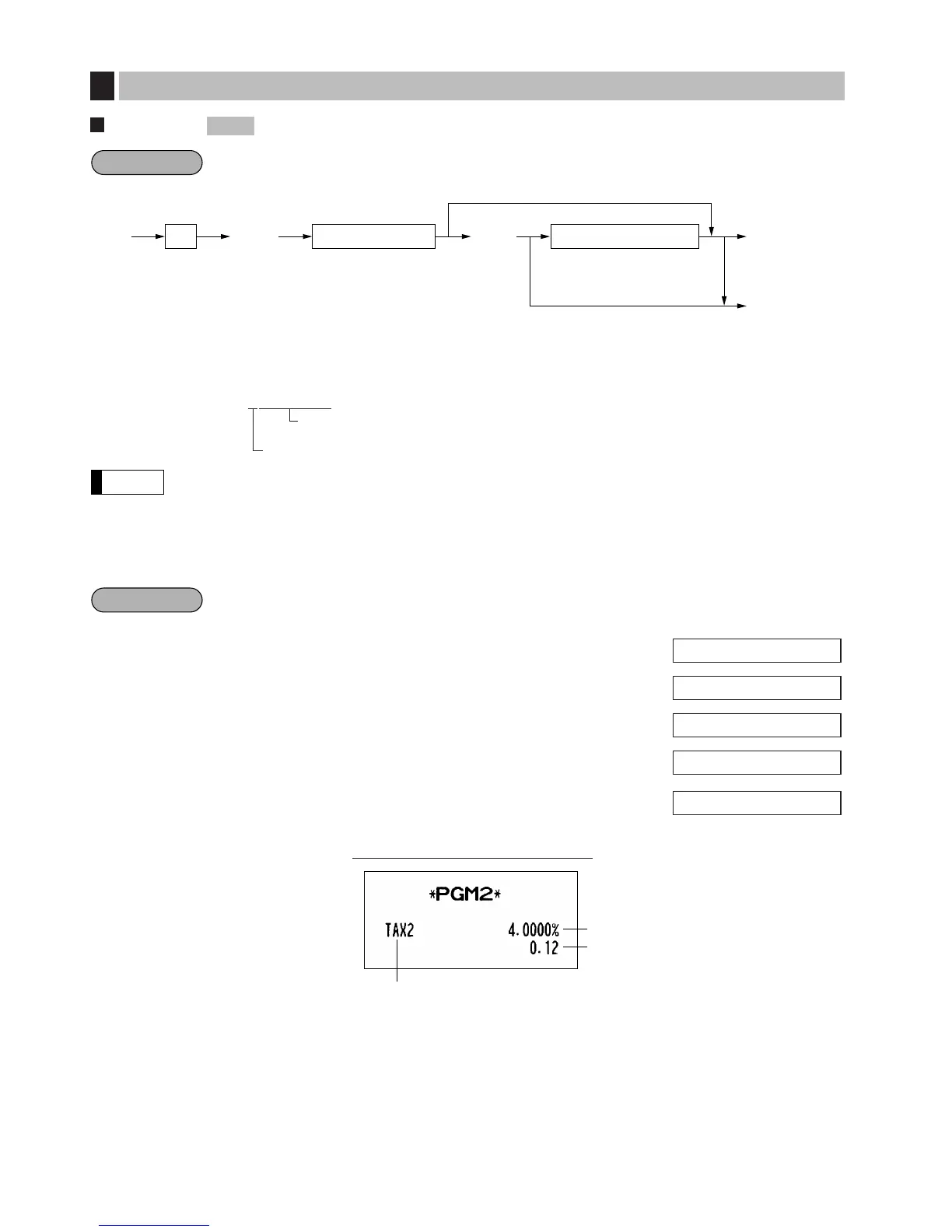

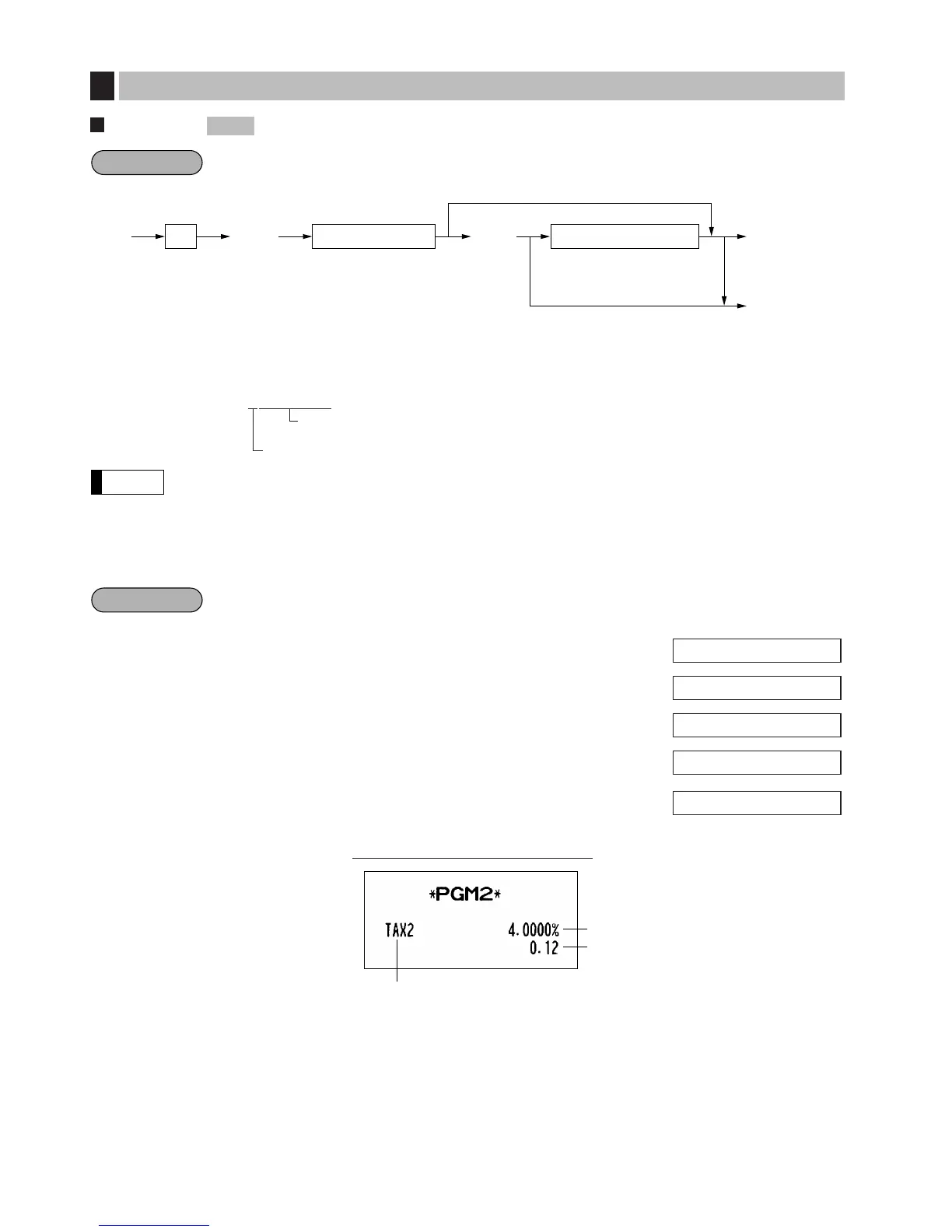

Programming the tax rate (+4%) as tax rate 2 with lowest taxable income as 0.12

1.

Press the

◊

key.

◊

2.

Enter the tax rate “2”. 2 ≈

3.

Enter the tax rate “+4%.” 4

≈

4.

Enter the lowest taxable amount “12.”

12

5.

Press the

;

key to finalize the programming

;

and generate a programming report.

Loading...

Loading...