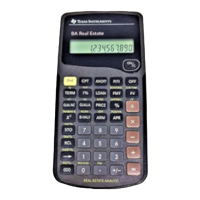

Mortgages and Amortization 47

BEAR-CH1.DOC BA Real Estate Guidebook Jackie Quiram Revised: 09/28/99 1:16 PM Printed: 09/28/99 1:16 PM

Page 47 of 36

The first tax year (May through December) includes

payments 1 through 8.

Steps Keystrokes Display

Clear TVM Values.

0.00

Set P/Y and C/Y to 12.

+

12

j

j

P/Y = 12.00

C/Y = 12.00

12.00

Enter known loan

alues.

30

9.125

1

105

q

TRM =30.00

I% = 9.13

LN = 105,000.00

Calculate payment.

$

PMT=

-

854.31

Start amortization.

P1 = 1.00

Set P2 for 1st year.

j

8

P2 8

Display balance,

principal, and

interest for the first

tax year.

j

j

j

P2 = 8.00

BAL = 104,540.93

PRN=

-

459.07

INT =

-

6,375.41

(continued)

Finding the Principal and Interest Paid

You are buying a home with a 30-year, $105,000

mortgage with an annual interest rate of 9.125%. Assume

that the first payment is due in May. Find the principal

and interest you will pay on the loan during the first three

tax years.

Solution: First

Tax Year

Loading...

Loading...