58 Buyer Qualification

Press # , until the BGN indicator disappears.

Steps Keystrokes Display

Clear TVM values.

# - 0.00

Enter income percent.

28 # m IN% = 28.00

Enter debt percent.

36 # d DB%= 36.00

Enter tax percent.

1.5 # Z TX%= 1.50

Enter insurance

percent.

.5 # Q IS%= 0.50

Enter term.

30 0 TRM= 30.00

Enter interest rate.

8 1 I% = 8.00

Start qualification.

> PRC= 0.00

Enter price.

125 q j PRC= 125,000.00

DN%= 0.00

Enter down payment

percent (0 to 99).

10 j DN%= 10.00

DBT= 0.00

Enter a zero for

monthly debt amount,

and compute

qualifying loan

amount.

0 j DBT= 0.00

LN = 112,500.00

Compute payment.

j PMT=

825.49

Compute PITI and

store the result.

j T g PITI =

1,033.82

Compute qualifying

income.

j QI = 3,692.21

Multiply by debt

ratio.

O ]

# d A j

1,329.20

Calculate maximum

debt.

a ] g j

295.38

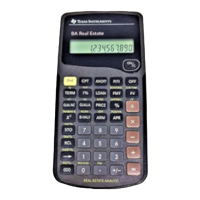

Finding the Maximum Allowable Debt

Assuming a sales price of $125,000, 10% down payment,

8% annual fixed rate, 30-year term, and an income/debt

ratio of 28/36, determine the maximum debt a buyer can

have and still qualify for the loan. Also assume that the

annual tax rate is 1.5% and the annual insurance rate is

0.5%

Solution

Loading...

Loading...