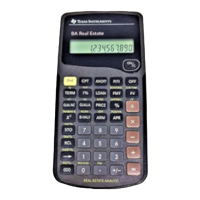

72 Other Financial Tools

BEAR-CH3.DOC BA Real Estate Guidebook Bob Fedorisko Revised: 08/29/96 9:19 AM Printed: 09/28/99 1:21 PM

Page 72 of 20

Key Sequence Function

#

F

Enters the nominal interest rate (APR).

#

G

Enters the annual effective interest rate.

#

H

Enters the number of compounding

periods per year.

Note: PDS/YR is always an entered value. Attempting to

compute PDS/YR causes an error.

What would the nominal rate with quarterly compounding

have to be to yield an annual effective rate of 16%?

Steps Keystrokes Display

Enter desired

effective rate.

16

G

EFF = 16.00

Enter periods per

year.

4

PDS = 4.00

Compute nominal

rate.

$

NOM= 15.12

Convert a 15% nominal interest rate with quarterly

compounding to the equivalent annual effective interest

rate.

Steps Keystrokes Display

Enter nominal rate.

15

NOM= 15.00

Enter periods per

year.

4

PDS = 4.00

Compute effective

rate.

$

G

EFF = 15.87

Interest Conversion Model

This model lets you convert between nominal (NOM)

interest rates (the compound interest rates for the

period) and annual effective (EFF) interest rates (the

rates at which you actually earn or pay).

Values Used by

the Model

Examples

Loading...

Loading...