10 Real Estate

Where:

n

1

= number of years remaining in original mortgage

PMT

1

= yearly payment of original mortgage

PV

1

= remaining balance of original mortgage

n

2

= number of years in wrap-around mortgage

PMT

2

= yearly payment of wrap-around mortgage

PV

2

= total amount of wrap-around mortgage

BAL = balloon payment

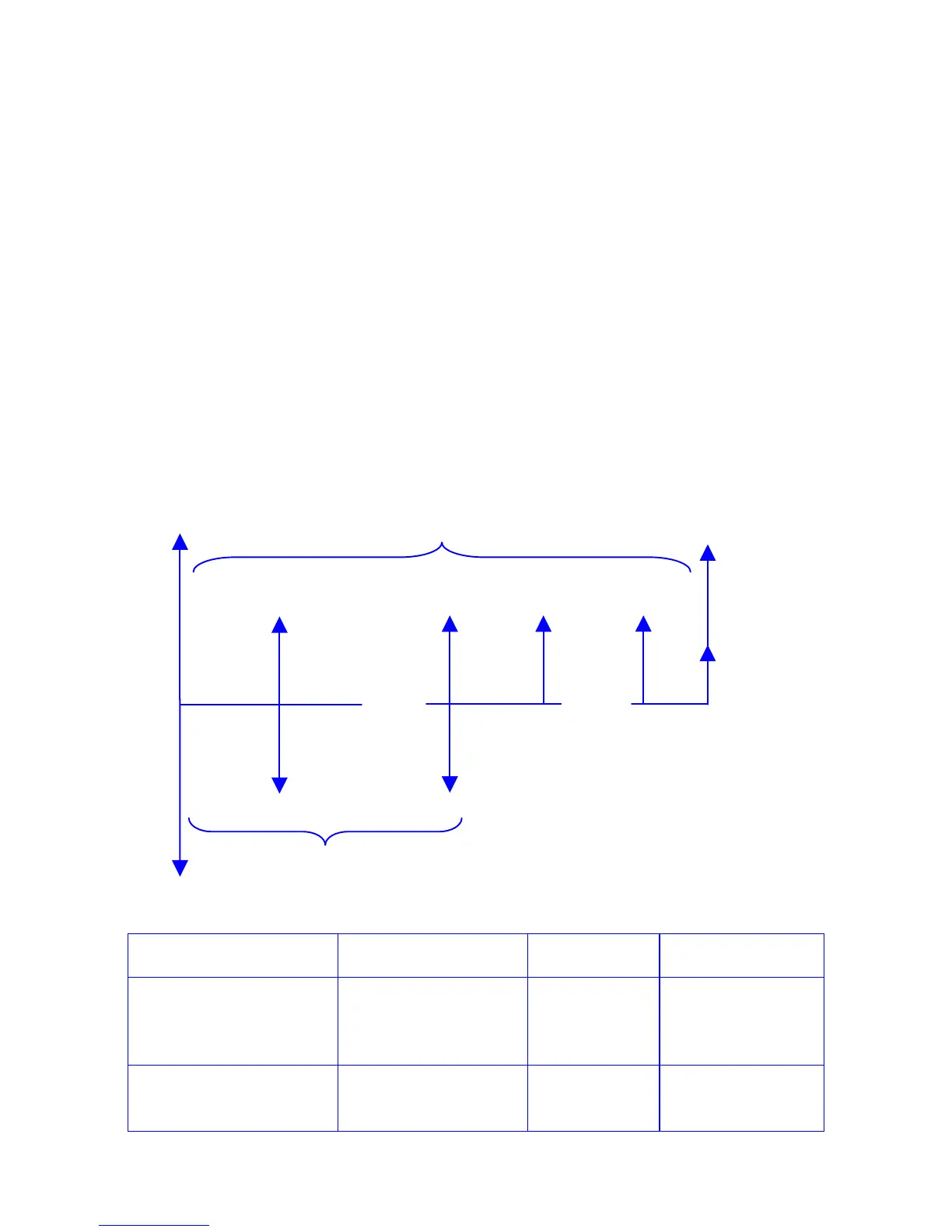

Example 2: A customer has an existing mortgage with a balance of $125,010, a

remaining term of 200 months, and a $1051.61 monthly payment. He wishes to obtain a

$200,000, 9 ½% wrap-around with 240 monthly payments of $1681.71 and a balloon

payment at the end of the 240th month of $129,963.35. If you, as a lender, accept the

proposal, what is your rate of return?

12c platinum / 12C

RPN Keystrokes

12c platinum

ALG Keystrokes

Display Comments

g gÂ

fCLEARG fCLEARG

200000Þ\ 200000Þ

125010+gJ +125010gJ

-74,990.00

Net investment.

1051.61Þ\ 1051.61Þ

1681.71+ +1681.71gK

630.10

Net cash flow

received by lender.

$125010

$ -200000

240 mos.

200 mos.

$ 129963.35

$1681.71 $1681.71 $1681.71

$ -1051.61

$ -1051.61

... ...

Loading...

Loading...