Personal Finance 127

Stock Portfolio Evaluation and Analysis

This program evaluates a portfolio of stocks given the current market price per share and

the annual dividend. The user inputs the initial purchase price of a stock, the number of

shares, the beta coefficient

*

, the annual dividend, and the current market price for a

portfolio of any size.

The program returns the percent change in value of each stock and the valuation and beta

coefficient

*

of the entire portfolio. Output includes the original portfolio value, the new

portfolio value, the percent change in the value and the annual dividend and yield as a

percent of the current market value. The overall beta coefficient of the portfolio is also

calculated.

Note:

The beta coefficient analysis is optional. Key in 1.00 if beta is not to be analyzed.

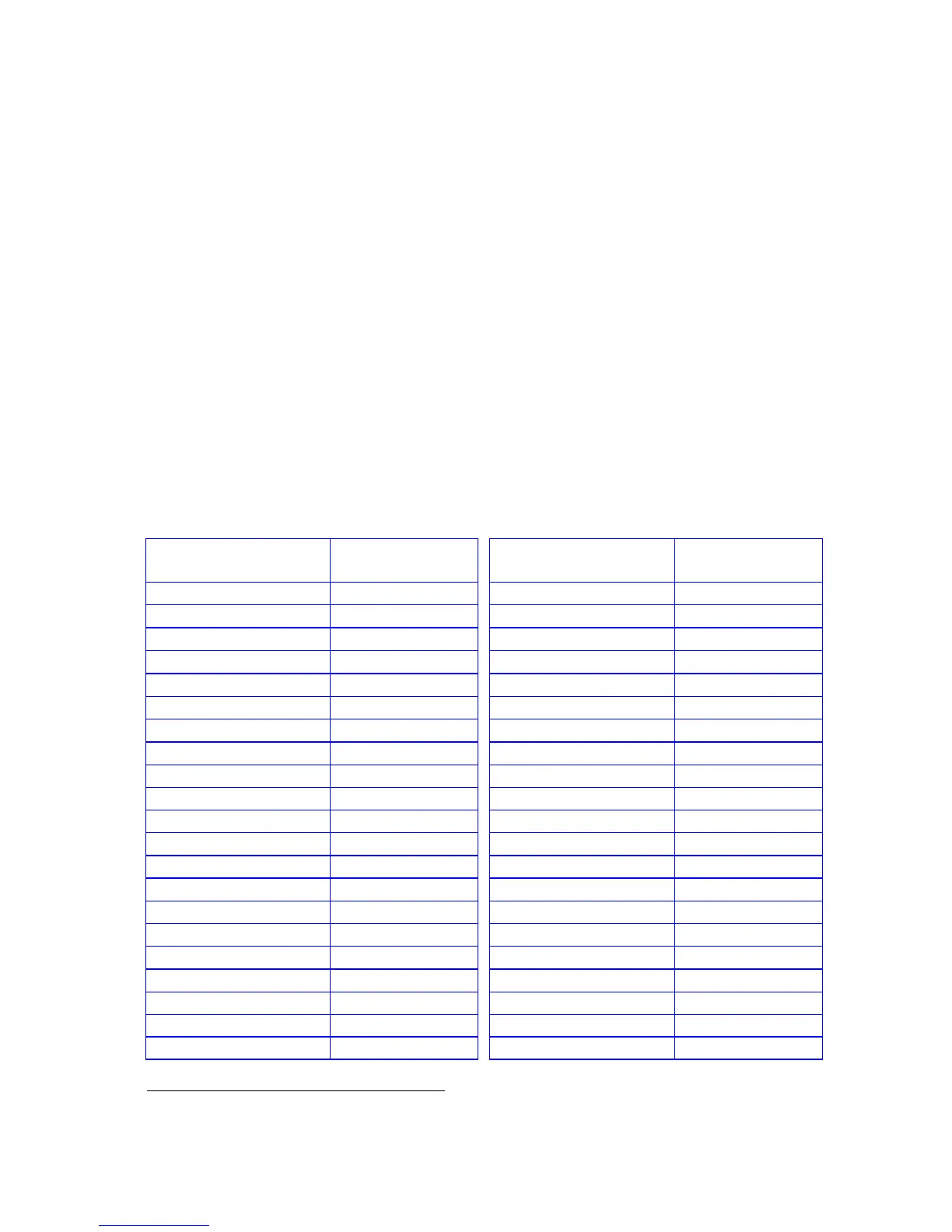

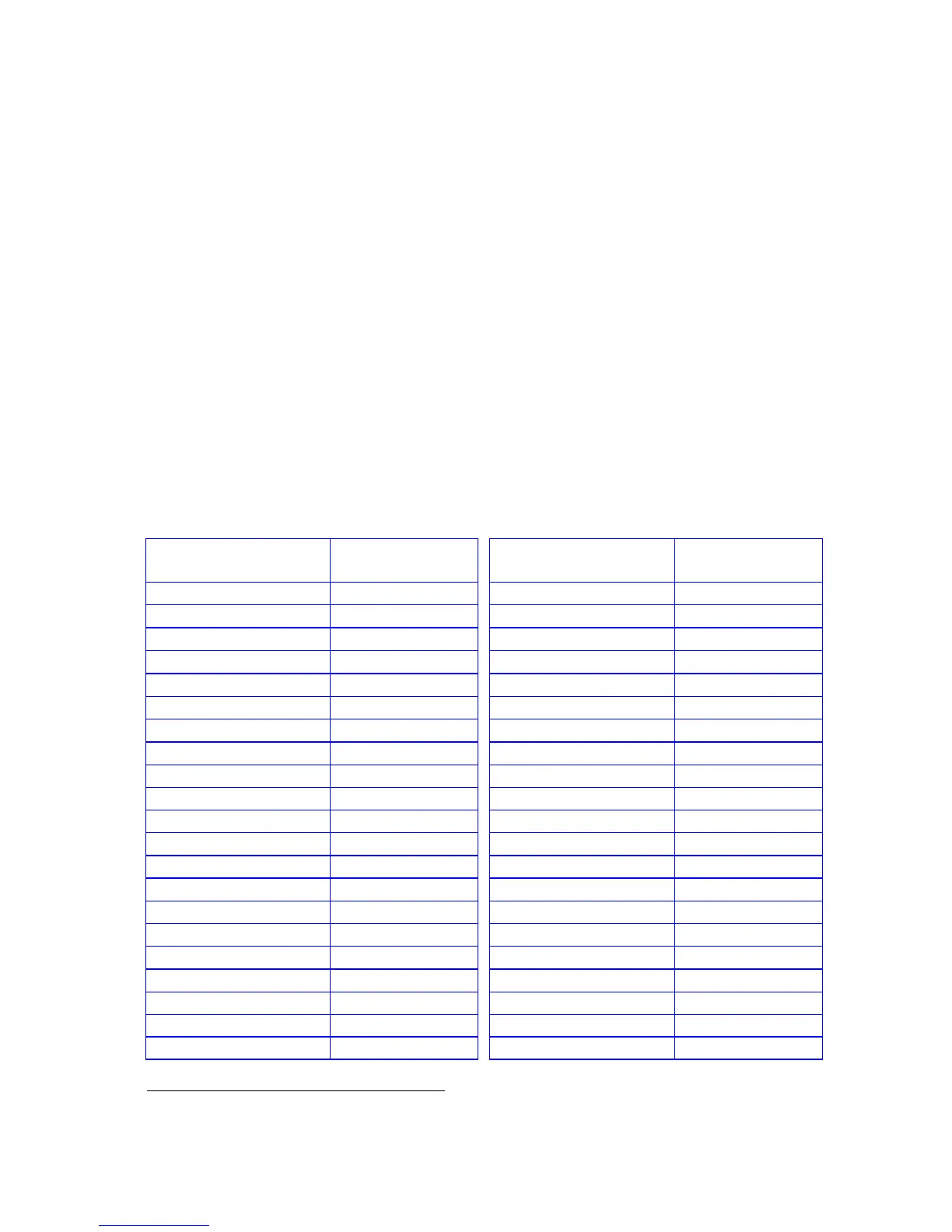

12c platinum / 12C

RPN KEYSTROKES

DISPLAY

12c platinum

ALG KEYSTROKES

DISPLAY

fs

fs

fCLEARÎ

000,

fCLEARÎ

000,

:4

001, 45 4

?6

001, 44 6

gm

002, 43 35

:4

002, 45 4

g(021

003,43,33,021

gm

003, 43 35

?-4

004,44 30 4

g(026

004,43,33,026

§

005, 20

?-4

005,44 30 4

:7

006, 45 7

d

006, 33

§

007, 20

§

007, 20

?+0

008,44 40 0

:7

008, 45 7

~

009, 34

³

009, 36

:7

010, 45 7

?+0

010,44 40 0

§

011, 20

~

011, 34

?+1

012,44 40 1

§

012, 20

d

013, 33

:7

013, 45 7

§

014, 20

³

014, 36

?+3

015,44 40 3

?+1

015,44 40 1

:5

016, 45 5

d

016, 33

gF

017, 43 40

§

017, 20

à

018, 24

~

018, 34

t

019, 31

³

019, 36

*

The beta coefficient is a measure of a stock variability (risk) compared to the market in general.

Beta values for individual stocks can be acquired from brokers, investment publications or the local

business library.

Loading...

Loading...