Lending 25

Example 1: A $60,000 land loan at 10% interest calls for equal semi-annual principal

payments over a 6-year maturity. What is the loan reduction schedule for the first year?

(Constant payment to principal is $5000 semi-annually). What is the fourth year's

schedule (skip 4 payments)?

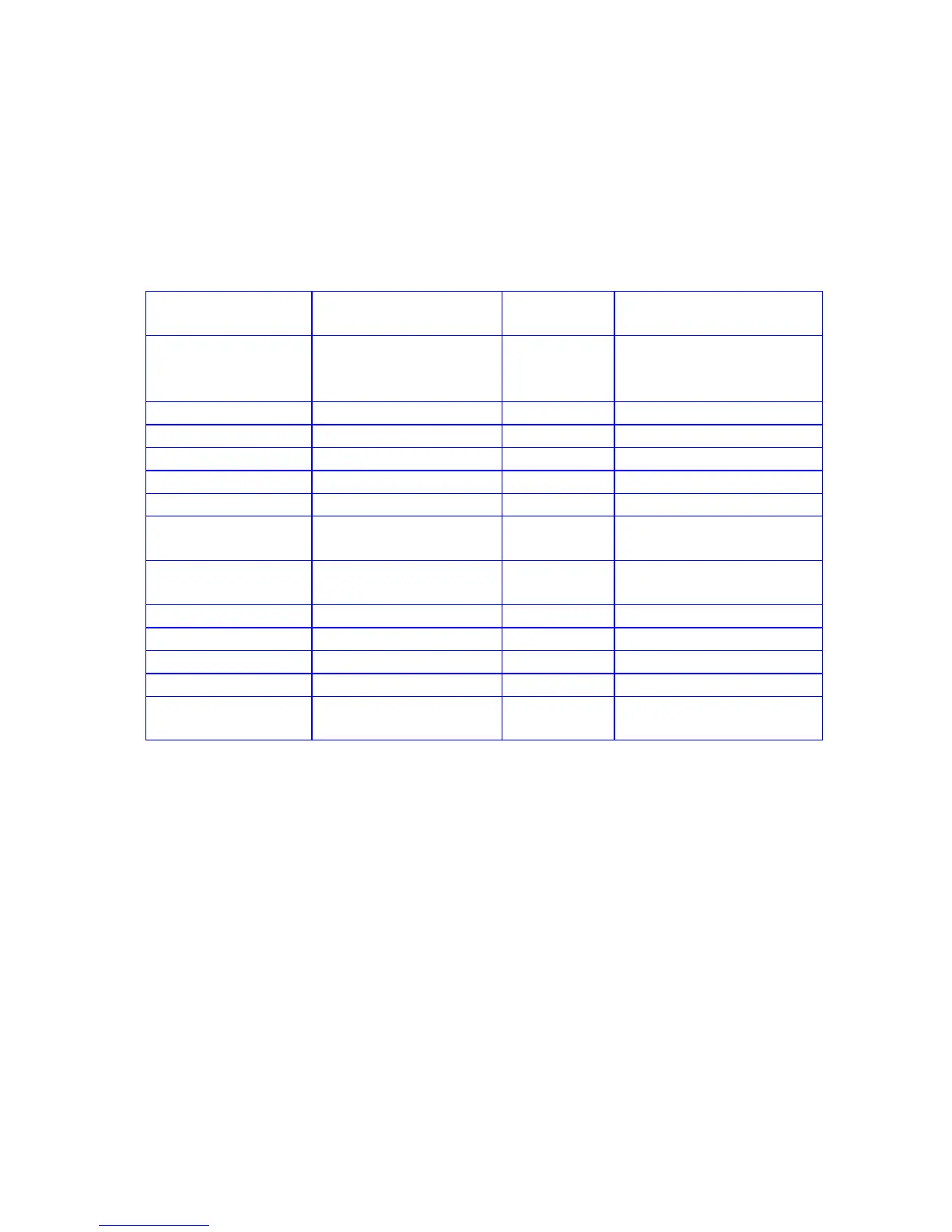

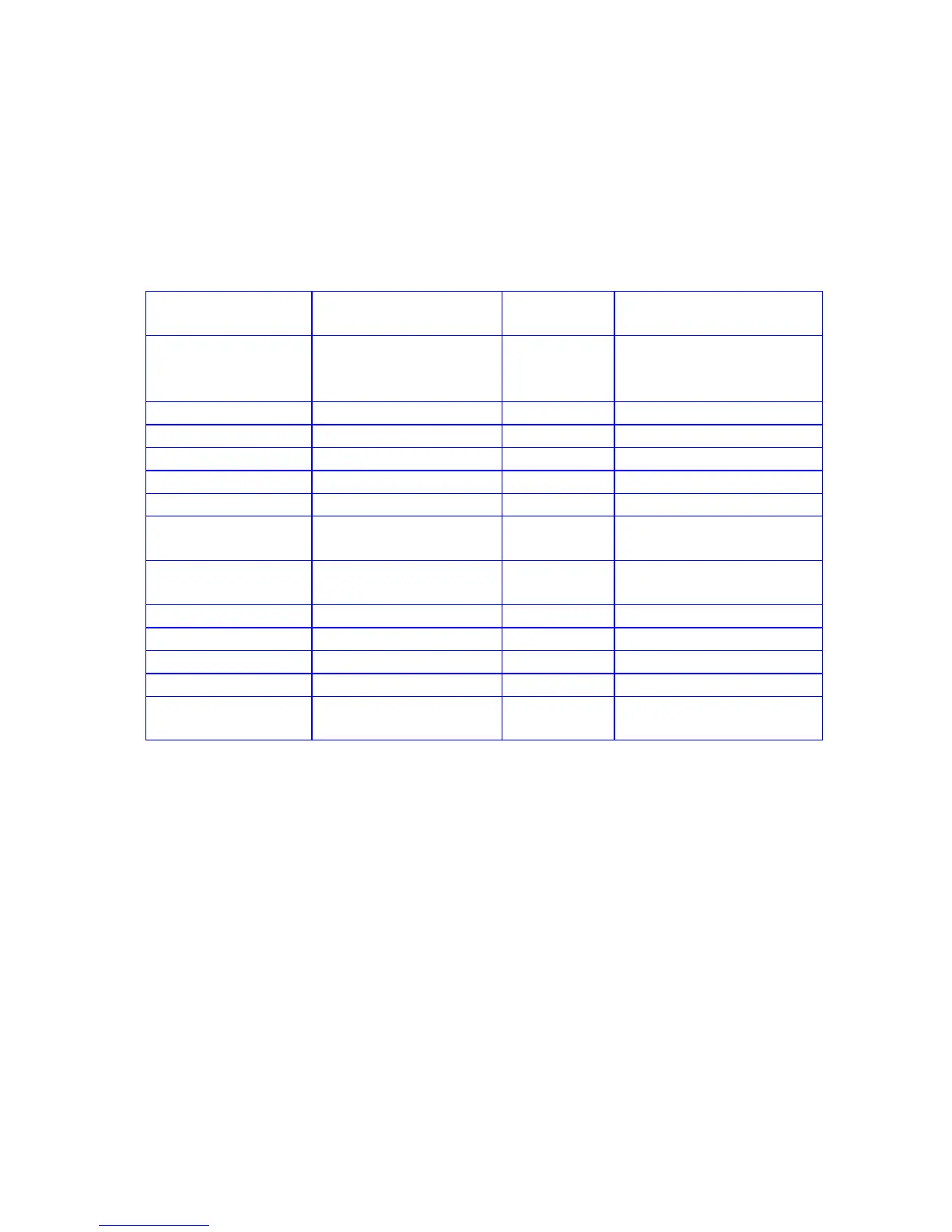

12c platinum / 12C

RPN Keystrokes

12c platinum

ALG Keystrokes

Display Comments

5000?0 5000?0

10\2z\ 60000?1

\\

10z2³?2

5.00

Semi-annual interest rate.

60000~b :1§:2b+

3,000.00

First payment's interest.

:0+ :0?-1³

8,000.00

Total first payment.

O:0- :1

55,000.00

Remaining balance.

~b

§:2b+

2,750.00

Second payment's interest.

:0+ :0?-1³

7,750.00

Total second payment.

O:0- :1

50,000.00

Remaining balance after

the first year.

4:0§- 4§:0³?-1

~b

:1§:2b+

1,500.00

Seventh payment's interest.

:0+ :0?-1³

6,500.00

Total seventh payment.

O:0- :1

25,000.00

Remaining balance.

~b

§:2b+

1,250.00

Eighth payment's interest.

:0+ :0?-1³

6,250.00

Total eighth payment.

O:0- :1

20,000.00

Remaining balance after

fourth year.

Add-On Interest Rate Converted to APR

An add-on interest rate determines what portion of the principal will be added on for

repayment of a loan. This sum is then divided by the number of months in a loan to

determine the monthly payment. For example, a 10% add-on rate for 36 months on $3000

means add one-tenth of $3000 for 3 years (300 x 3) - usually called the "finance charge" -

for a total of $3900. The monthly payment is $3900/36.

This keystroke procedure converts an add-on interest rate to a annual percentage rate

when the add-on rate and number of months are known.

Loading...

Loading...