14 Real Estate

2. Calculate the Outstanding Balance of the Mortgage at the end of the Income

Projection Period and subtract it from Proceeds of Resale. The result is Net Cash

Proceeds of Resale.

Thus:

Cash Proceeds of Resale = Sales Price - Transaction Costs.

Net Cash Proceeds of Resale = Cash Proceeds of Resale - Outstanding Mortgage Balance.

Example: The apartment property in the preceding example is expected to be resold in 10

years. The anticipated resale price is $800,000. The transaction costs are expected to be

7% of the resale price. The mortgage is the same as that indicated in the preceding

example.

• What will the Mortgage Balance be in 10 years?

• What are the Cash Proceeds of Resale and Net Cash Proceeds of Resale?

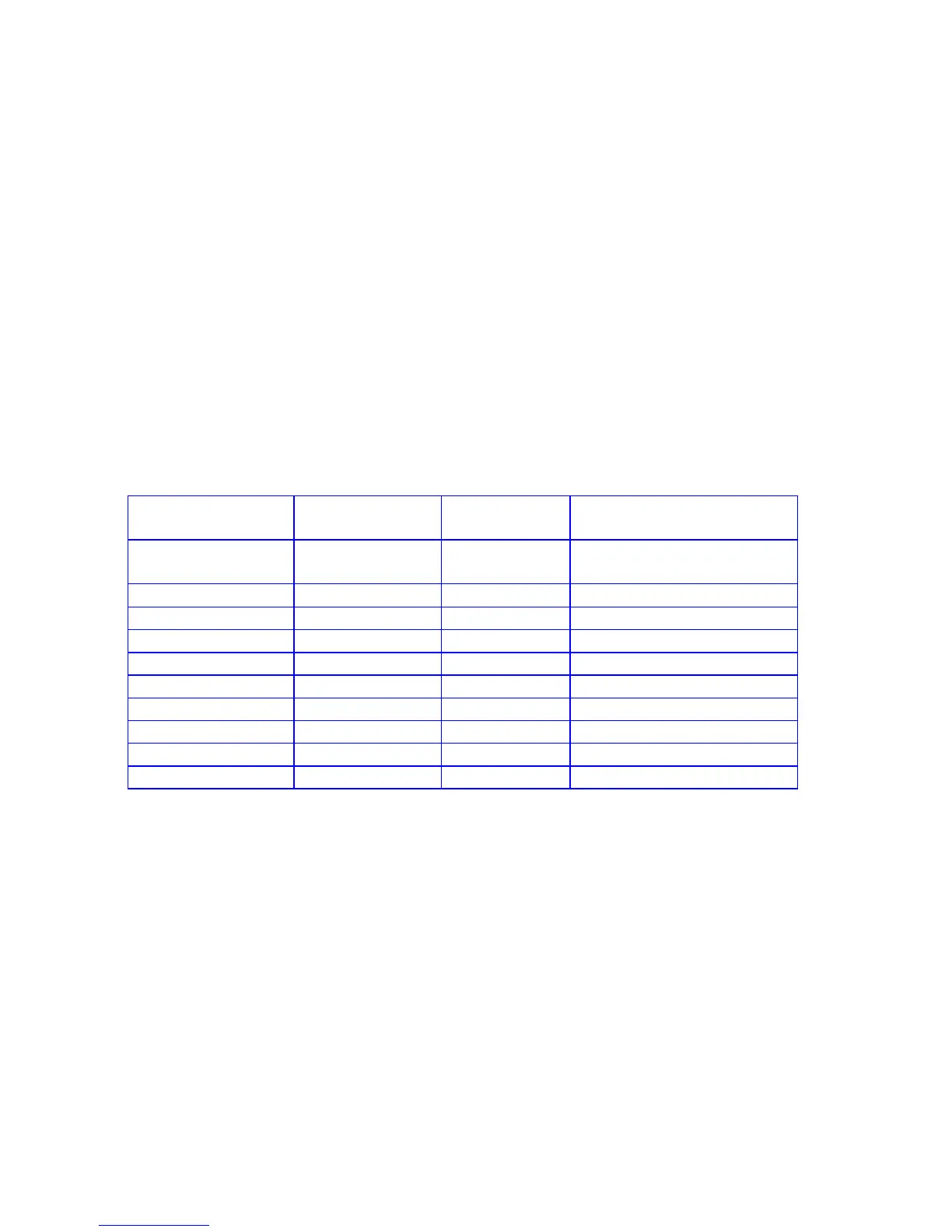

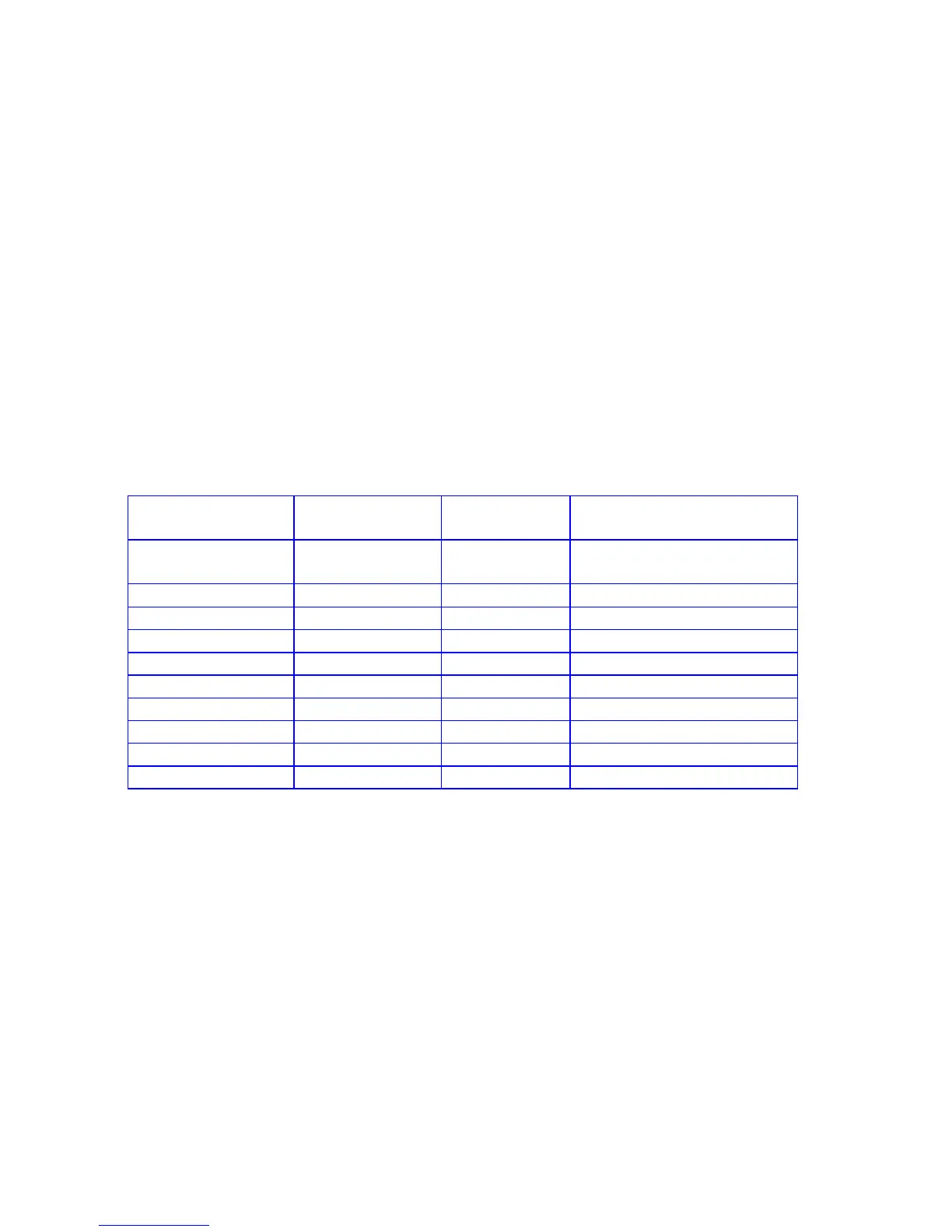

12c platinum / 12C

RPN Keystrokes

12c platinum

ALG Keystrokes

Display Comments

g gÂ

fCLEARG fCLEARG

20gA 20gA

240.00

Mortgage term.

11.5gC 11.5gC

0.96

Mortgage rate.

700000$ 700000$

Property value.

P P

-7,465.01

Monthly payment.

10gA 10gA

120.00

Projection period.

M MM

-530,956.57

Mortgage balance in 10 years.

800000\ 800000-

Estimated resale.

7b- 7b+

744,000.00

Cash Proceeds of Resale.

+ ~³

213,043.43

Net Cash Proceeds of Resale.

After-Tax Cash Flows

The After-Tax Cash Flow (ATCF) is found for the each year by deducting the Income

Tax Liability for that year from the Cash Throw Off.

Where Taxable Income = Net Operating Income - interest - depreciation,

Tax Liability = Taxable Income x Marginal Tax Rate,

and After Tax Cash Flow = Cash Throw Off - Tax Liability.

The After-Tax Cash Flow for the initial and successive years may be calculated by the

following HP 12C Platinum program. This program calculates the Net Operating Income

using the Potential Gross Income, operational cost and vacancy rate. The Net Operating

Loading...

Loading...