Securities and Options 69

Example 2: Determine the yield of this security; settlement date June 25, 2002; maturity

date September 10, 2002; price $99.45; redemption value $101.33. Assume 360 day basis.

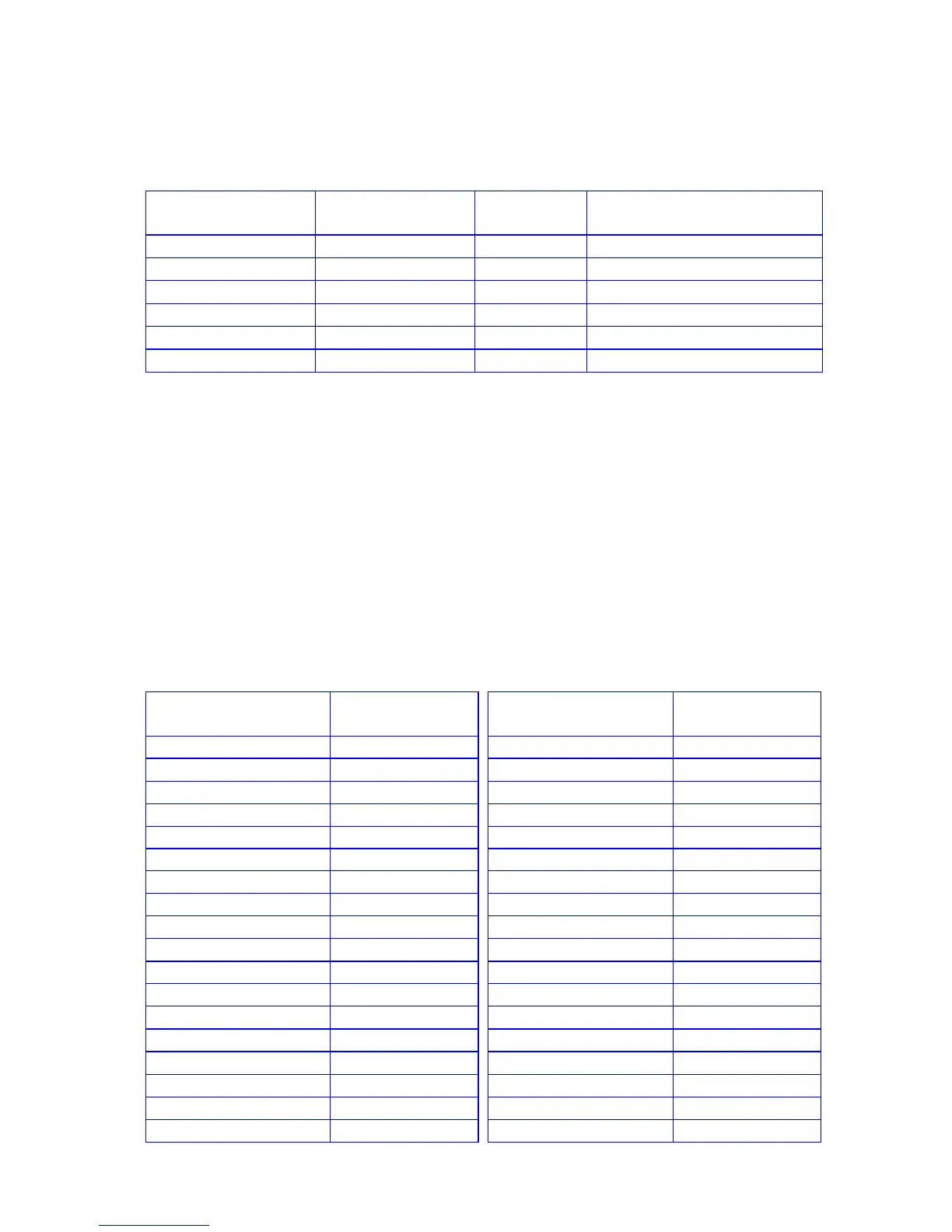

12c platinum / 12C

RPN Keystrokes

12c platinum

ALG Keystrokes

Display Comments

6.252002?1 6.252002?1

6.25

Settlement date.

9.102002?2 9.102002?2

9.10

Maturity date.

360?3 360?3

360.00

360 day basis.

101.33?4 101.33?4

101.33

Redemption value per $100.

99.45?5 99.45?5

99.45

Price.

g(015t g(016t

8.84

Yield.

Black-Scholes Formula for Valuing European

Options

This program implements the Black-Scholes formula which has been used extensively in

option markets worldwide since its publication in the early 1970’s. The five inputs are

simply keyed into the five financial variables and then t displays the call option value,

and ~ shows the put option value. The option values produced are accurate to at least

the nearest cent for asset and strike prices under $100.

Reference: Hutchins, 2003, Black-Scholes takes over the HP12C, HPCC (www.hpcc.org)

DataFile,V22,N3 pp13-21.

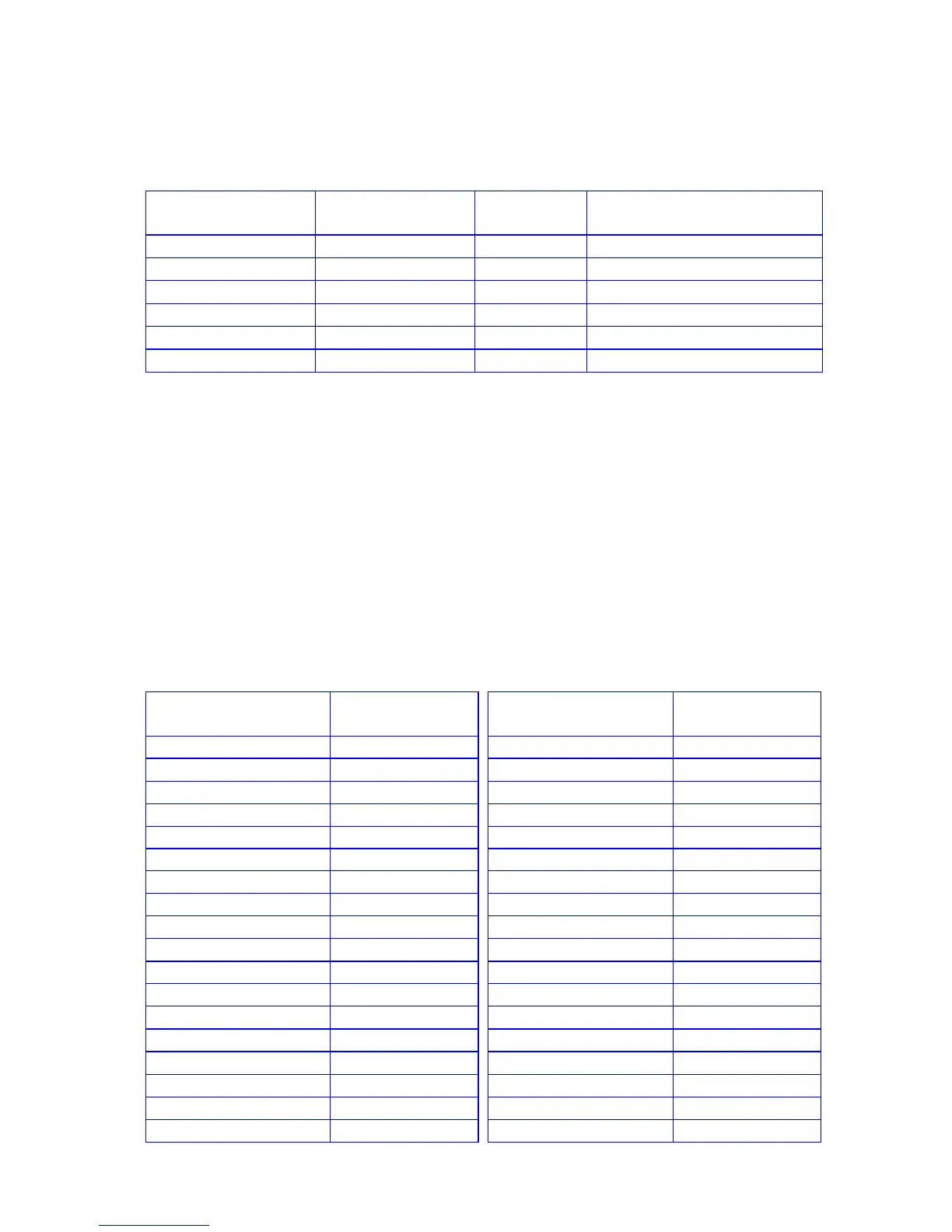

12c platinum / 12C

RPN KEYSTROKES

DISPLAY

12c platinum

ALG KEYSTROKES

DISPLAY

fs

fs

fCLEARÎ

000,

fCLEARÎ

000,

:n

001, 45 11

:n

001, 45 11

:¼

002, 45 12

§

002, 20

b

003, 25

:¼

003, 45 12

Þ

004, 16

b

004, 25

g>

005, 43 22

³

005, 36

:M

006, 45 15

Þ

006, 16

§

007, 20

g>

007, 43 22

?4

008, 44 4

§

008, 20

~

009, 34

:M

009, 45 15

gr

010, 43 21

³

010, 36

:P

011, 45 14

?4

011, 44 4

b

012, 25

:n

012, 45 11

?3

013, 44 3

gr

013, 43 21

:$

014, 45 13

§

014, 20

:4

015, 45 4

:P

015, 45 14

z

016, 10

b

016, 25

Loading...

Loading...